Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

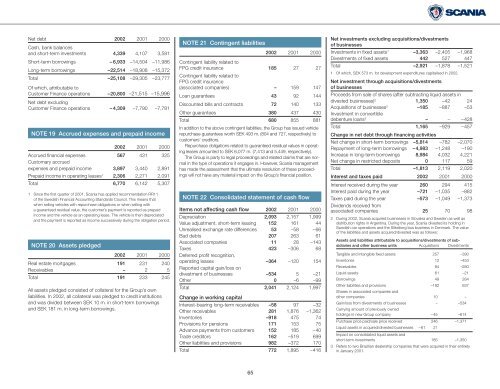

Net debt <strong>2002</strong> 2001 2000<br />

Cash, bank balances<br />

and short-term investments 4,339 4,107 3,581<br />

Short-term borrowings – 6,933 –14,504 –11,986<br />

Long-term borrowings –22,514 –18,908 –15,372<br />

Total –25,108 –29,305 –23,777<br />

Of which, attributable to<br />

Customer Finance operations –20,800 –21,515 –15,996<br />

Net debt excluding<br />

Customer Finance operations – 4,309 –7,790 –7,781<br />

NOTE 19 Accrued expenses and prepaid income<br />

<strong>2002</strong> 2001 2000<br />

Accrued financial expenses 567 431 325<br />

Customary accrued<br />

expenses and prepaid income 3,897 3,440 2,891<br />

Prepaid income in operating leases 1 2,306 2,271 2,091<br />

Total 6,770 6,142 5,307<br />

1 Since the first quarter of 2001, <strong>Scania</strong> has applied recommendation RR11<br />

of the Swedish Financial Accounting Standards Council. This means that<br />

when selling vehicles with repurchase obligations or when selling with<br />

a guaranteed residual value, the customer’s payment is <strong>report</strong>ed as prepaid<br />

income and the vehicle as an operating lease. The vehicle is then depreciated<br />

and the payment is <strong>report</strong>ed as income successively during the obligation period.<br />

NOTE 20 Assets pledged<br />

<strong>2002</strong> 2001 2000<br />

Real estate mortgages 191 231 240<br />

Receivables – 2 5<br />

Total 191 233 245<br />

All assets pledged consisted of collateral for the Group’s own<br />

liabilities. In <strong>2002</strong>, all collateral was pledged to credit institutions<br />

and was divided between SEK 10 m. in short-term borrowings<br />

and SEK 181 m. in long-term borrowings.<br />

NOTE 21 Contingent liabilities<br />

<strong>2002</strong> 2001 2000<br />

Contingent liability related to<br />

FPG credit insurance 185 27 27<br />

Contingent liability related to<br />

FPG credit insurance<br />

(associated companies) – 159 147<br />

Loan guarantees 43 92 144<br />

Discounted bills and contracts 72 140 133<br />

Other guarantees 380 437 430<br />

Total 680 855 881<br />

In addition to the above contingent liabilities, the Group has issued vehicle<br />

repurchase guarantees worth SEK 493 m. (804 and 727, respectively) to<br />

customers’ creditors.<br />

Repurchase obligations related to guaranteed residual values in operating<br />

leases amounted to SEK 6,077 m. (7,413 and 5,449, respectively).<br />

The Group is party to legal proceedings and related claims that are normal<br />

in the type of operations it engages in. However, <strong>Scania</strong> management<br />

has made the assessment that the ultimate resolution of these proceedings<br />

will not have any material impact on the Group’s financial position.<br />

NOTE 22 Consolidated statement of cash flow<br />

Items not affecting cash flow <strong>2002</strong> 2001 2000<br />

Depreciation 2,093 2,157 1,999<br />

Value adjustment, short-term leasing 152 161 44<br />

Unrealised exchange rate differences 53 –58 –66<br />

Bad debts 207 263 61<br />

Associated companies 11 28 –143<br />

Taxes 423 –306 68<br />

Deferred profit recognition,<br />

operating leases –364 –120 154<br />

Reported capital gain/loss on<br />

divestment of businesses –534 5 –21<br />

Other 0 –6 –99<br />

Total 2,041 2,124 1,997<br />

Change in working capital<br />

Interest-bearing long-term receivables –58 97 –32<br />

Other receivables 281 1,876 –1,362<br />

Inventories –918 475 74<br />

Provisions for pensions 171 153 75<br />

Advance payments from customers 152 185 –40<br />

Trade creditors 162 –519 699<br />

Other liabilities and provisions 982 –372 170<br />

Total 772 1,895 –416<br />

Net investments excluding acquisitions/divestments<br />

of businesses<br />

Investments in fixed assets 1 –3,363 –2,405 –1,968<br />

Divestments of fixed assets 442 527 447<br />

Total –2,921 –1,878 –1,521<br />

1 Of which, SEK 573 m. for development expenditures capitalised in <strong>2002</strong>.<br />

Net investment through acquisitions/divestments<br />

of businesses<br />

Proceeds from sale of shares (after subtracting liquid assets in<br />

divested businesses) 2 1,350 –42 24<br />

Acquisitions of businesses 2 –185 –887 –53<br />

Investment in convertible<br />

debenture loans 3 – – –428<br />

Total 1,165 –929 –457<br />

Change in net debt through financing activities<br />

Net change in short-term borrowings –5,814 –782 –2,070<br />

Repayment of long-term borrowings –4,983 –1,248 –190<br />

Increase in long-term borrowings 8,984 4,032 4,221<br />

Net change in restricted deposits 0 117 59<br />

Total –1,813 2,119 2,020<br />

Interest and taxes paid <strong>2002</strong> 2001 2000<br />

Interest received during the year 260 294 415<br />

Interest paid during the year –721 –1,035 –882<br />

Taxes paid during the year –573 –1,049 –1,373<br />

Dividends received from<br />

associated companies 25 70 98<br />

2 During <strong>2002</strong>, <strong>Scania</strong> acquired businesses in Slovakia and Sweden as well as<br />

distribution rights in Argentina. During the year, <strong>Scania</strong> divested its holding in<br />

Swedish car operations and the Silkeborg bus business in Denmark. The value<br />

of the liabilities and assets acquired/divested was as follows:<br />

Assets and liabilities attributable to acquisitions/divestments of subsidiaries<br />

and other business units Acquisitions Divestments<br />

Tangible and intangible fixed assets 257 –390<br />

Inventories 12 –453<br />

Receivables 84 –280<br />

Liquid assets 61 –21<br />

Borrowings 49 284<br />

Other liabilities and provisions –182 637<br />

Shares in associated companies and<br />

other companies 10 –<br />

Gain/loss from divestments of businesses – –534<br />

Carrying amount of previously owned<br />

holdings in new Group company –45 –614<br />

Purchase price paid/sale price received 246 –1,371<br />

Liquid assets in acquired/divested businesses –61 21<br />

Impact on consolidated liquid assets and<br />

short-term investments 185 –1,350<br />

3 Refers to two Brazilian dealership companies that were acquired in their entirety<br />

in January 2001.<br />

65