Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Scania</strong> AB has 100,000,000 A shares outstanding with voting<br />

rights of one vote per share and 100,000,000 B shares outstanding<br />

with voting rights of 1/10 vote per share. No provisions to restricted<br />

reserves are required.<br />

1 Exchange rate differences for the year arise when foreign net assets are<br />

translated according to the current accounting method. The year’s negative<br />

exchange rate difference of SEK –1,103 m. arose due to the appreciation of<br />

the Swedish krona. About SEK –500 m. of this effect was attributable to<br />

appreciation against USD, SEK –300 m. against Latin American currencies,<br />

mainly the Argentine peso, and about SEK –300 m. against EUR and other<br />

currencies.<br />

2 Transfers from restricted equity are explained mainly by exchange rate<br />

differences above.<br />

NOTE 16 Provisions for pensions and similar<br />

commitments<br />

<strong>2002</strong> 2001 2000<br />

Provisions for FPG/PRI<br />

guaranteed pensions 1,447 1,427 1,350<br />

Provisions for other pensions 454 446 376<br />

Provisions for medical care benefits 144 219 203<br />

Total 2,045 2,092 1,929<br />

The amount under “Provisions for pensions” corresponds to the<br />

actuarial projections of the collectively agreed ITP occupational<br />

pension plan and all voluntary pension obligations.<br />

The Swedish plan for salaried employees is administered by<br />

a Swedish multi-employer pension institution, the Pension Registration<br />

Institute (PRI). The actuarial assumptions are established by<br />

PRI. <strong>Scania</strong>’s pension liability consists of the sum of the discounted<br />

present value of the company’s estimated future pension payments,<br />

based on current salaries. Pensions are guaranteed through<br />

a credit insurance from the mutual insurance company Försäkringsbolaget<br />

Pensionsgaranti (FPG).<br />

“Provisions for pensions” include foreign subsidiaries, whose<br />

pension commitments are <strong>report</strong>ed in accordance with the<br />

principles that apply in each country, provided that they permit<br />

earned pension benefits to be <strong>report</strong>ed as an expense.<br />

For obligations related to medical care benefits, which are<br />

attributable to its operations in Brazil, <strong>Scania</strong> applies SFAS 106,<br />

“Employers’ Accounting for Postretirement Benefits”. This means<br />

that medical care benefits, etc that are earned by the employees<br />

but not utilised until after retirement are expensed as they arise.<br />

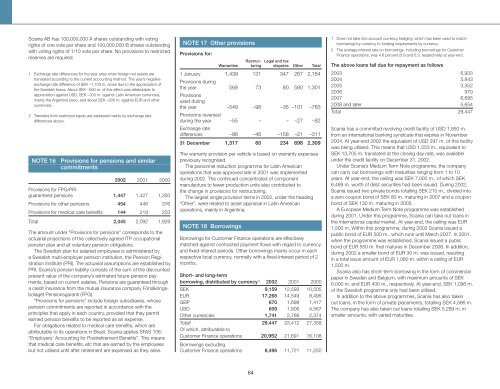

NOTE 17 Other provisions<br />

Provisions for:<br />

Restruc- Legal and tax<br />

Warranties turing disputes Other Total<br />

1 January 1,439 131 347 267 2,184<br />

Provisions during<br />

the year 568 73 80 580 1,301<br />

Provisions<br />

used during<br />

the year –549 –98 –35 –101 –783<br />

Provisions reversed<br />

during the year –55 – – –27 –82<br />

Exchange rate<br />

differences –86 –46 –158 –21 –311<br />

31 December 1,317 60 234 698 2,309<br />

The warranty provision per vehicle is based on warranty expenses<br />

previously recognised.<br />

The personnel reduction programme for Latin American<br />

operations that was approved late in 2001 was implemented<br />

during <strong>2002</strong>. The continued concentrated of component<br />

manufacture to fewer production units also contributed to<br />

the change in provisions for restructuring.<br />

The largest single provision items in <strong>2002</strong>, under the heading<br />

“Other”, were related to asset appraisal in Latin American<br />

operations, mainly in Argentina.<br />

NOTE 18 Borrowings<br />

Borrowings for Customer Finance operations are effectively<br />

matched against contracted payment flows with regard to currency<br />

and fixed-interest periods. Other borrowings mainly occur in each<br />

respective local currency, normally with a fixed-interest period of 2<br />

months.<br />

Short- and long-term<br />

borrowing, distributed by currency 1 <strong>2002</strong> 2001 2000<br />

SEK 9,159 12,593 10,505<br />

EUR 17,268 14,549 8,495<br />

GBP 670 1,698 1,417<br />

USD 609 1,806 4,567<br />

Other currencies 1,741 2,766 2,374<br />

Total 2 29,447 33,412 27,358<br />

Of which, attributable to<br />

Customer Finance operations 20,952 21,691 16,108<br />

Borrowings excluding<br />

Customer Finance operations 8,496 11,721 11,250<br />

1 Does not take into account currency hedging, which has been used to match<br />

borrowings by currency to funding requirements by currency.<br />

2 The average interest rate on borrowings, including borrowings for Customer<br />

Finance operations, was 4.6 percent (5.9 and 6.3, respectively) at year-end.<br />

The above loans fall due for repayment as follows<br />

2003 6,933<br />

2004 5,843<br />

2005 3,352<br />

2006 970<br />

2007 6,695<br />

2008 and later 5,654<br />

Total 29,447<br />

<strong>Scania</strong> has a committed revolving credit facility of USD 1,850 m.<br />

from an international banking syndicate that expires in November<br />

2004. At year-end <strong>2002</strong> the equivalent of USD 297 m. of this facility<br />

was being utilised. This means that USD 1,553 m., equivalent to<br />

SEK 13,705 m. translated at the closing day rate, was available<br />

under the credit facility on December 31, <strong>2002</strong>.<br />

Under <strong>Scania</strong>’s Medium Term Note programme, the company<br />

can carry out borrowings with maturities ranging from 1 to 10<br />

years. At year-end, the ceiling was SEK 7,000 m., of which SEK<br />

6,489 m. worth of debt securities had been issued. During <strong>2002</strong>,<br />

<strong>Scania</strong> issued two private bonds totalling SEK 210 m., divided into<br />

a zero coupon bond of SEK 80 m. maturing in 2007 and a coupon<br />

bond of SEK 130 m. maturing in 2005.<br />

A European Medium Term Note programme was established<br />

during 2001. Under this programme, <strong>Scania</strong> can take out loans in<br />

the international capital market. At year-end, the ceiling was EUR<br />

1,500 m. Within this programme, during <strong>2002</strong> <strong>Scania</strong> issued a<br />

public bond of EUR 500 m., which runs until March 2007. In 2001,<br />

when the programme was established, <strong>Scania</strong> issued a public<br />

bond of EUR 550 m. that matures in December 2008. In addition,<br />

during <strong>2002</strong> a smaller bond of EUR 30 m. was issued, resulting<br />

in a total issue amount of EUR 1,080 m. within a ceiling of EUR<br />

1,500 m.<br />

<strong>Scania</strong> also has short-term borrowing in the form of commercial<br />

paper in Sweden and Belgium, with maximum amounts of SEK<br />

6,000 m. and EUR 400 m., respectively. At year-end, SEK 1,096 m.<br />

of the Swedish programme only had been utilised.<br />

In addition to the above programmes, <strong>Scania</strong> has also taken<br />

out loans, in the form of private placements, totalling SEK 4,586 m.<br />

The company has also taken out loans totalling SEK 5,289 m. in<br />

smaller amounts, with varied maturities.<br />

64