Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ties had a positive influence of SEK 500 m. (–775) on the year’s earnings.<br />

For a currency calculation concerning Latin American operations, see Note 26.<br />

<strong>Scania</strong>’s policy is to hedge its currency flows during a period of time equivalent<br />

to the projected orderbook until the date of payment. This normally means a hedging<br />

period of 3 to 4 months. However, the hedging period is allowed to vary between<br />

0 and 12 months. <strong>Scania</strong>’s net assets abroad amounted to SEK 11,397 m. at the<br />

end of <strong>2002</strong> (see Note 25). The net assets of foreign subsidiaries are not hedged<br />

under normal circumstances. To the extent a subsidiary has significant monetary<br />

assets in local currency, however, it may be hedged. As of 31 December <strong>2002</strong>,<br />

SEK 566 m. (892) was hedged at <strong>Scania</strong> Group level, which was equivalent to<br />

5 (10) percent of net assets abroad.<br />

In order to hedge monetary operating assets in Latin America, <strong>Scania</strong> has<br />

taken out loans in local currencies. On December 31, <strong>2002</strong>, these loans totalled<br />

SEK 459 m. (1,714).<br />

Other risks<br />

Residual value exposure<br />

A portion of <strong>Scania</strong>’s sales occur with guaranteed residual value or repurchase<br />

guarantee. During <strong>2002</strong>, the volume of such transactions was more than 4,400<br />

vehicles. The value of all obligations at year-end was SEK 6,077 m. (7,413). In the<br />

case of this type of obligations, revenue and profit recognition occurs successively<br />

over the period of the obligation. Residual value and repurchase obligations are<br />

regulated by company policies and are regularly monitored both at the subsidiary<br />

and Group level.<br />

Insurance<br />

Most of <strong>Scania</strong>’s insurance coverage is obtained in the international insurance<br />

market, at a cost of SEK 61 m. (55) in <strong>2002</strong>.<br />

Number of employees<br />

The total number of employees declined to 28,230 at the close of <strong>2002</strong>, compared<br />

to 28,541 at year-end 2001. The net effect of divestments/acquisitions of businesses<br />

resulted in a decrease of about 900 persons. Excluding divestments/acquisitions,<br />

the number of employees in European industrial operations rose by about 600.<br />

In the sales and service organisation the number of employees increased by almost<br />

300. In Latin American operations, the number of employees declined by more<br />

than 300.<br />

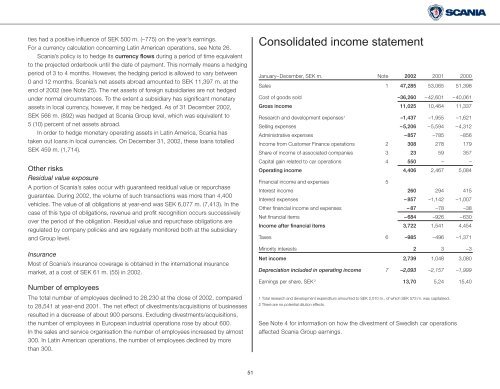

Consolidated income statement<br />

January–December, SEK m. Note <strong>2002</strong> 2001 2000<br />

Sales 1 47,285 53,065 51,398<br />

Cost of goods sold –36,260 –42,601 –40,061<br />

Gross income 11,025 10,464 11,337<br />

Research and development expenses 1 –1,437 –1,955 –1,621<br />

Selling expenses –5,206 –5,594 –4,312<br />

Administrative expenses –857 –785 –856<br />

Income from Customer Finance operations 2 308 278 179<br />

Share of income of associated companies 3 23 59 357<br />

Capital gain related to car operations 4 550 – –<br />

Operating income 4,406 2,467 5,084<br />

Financial income and expenses 5<br />

Interest income 260 294 415<br />

Interest expenses – 857 –1,142 –1,007<br />

Other financial income and expenses –87 –78 –38<br />

Net financial items –684 –926 –630<br />

Income after financial items 3,722 1,541 4,454<br />

Taxes 6 –985 –496 –1,371<br />

Minority interests 2 3 –3<br />

Net income 2,739 1,048 3,080<br />

Depreciation included in operating income 7 –2,093 –2,157 –1,999<br />

Earnings per share, SEK 2 13,70 5,24 15,40<br />

1 Total research and development expenditure amounted to SEK 2,010 m., of which SEK 573 m. was capitalised.<br />

2 There are no potential dilution effects.<br />

See Note 4 for information on how the divestment of Swedish car operations<br />

affected <strong>Scania</strong> Group earnings.<br />

51