Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

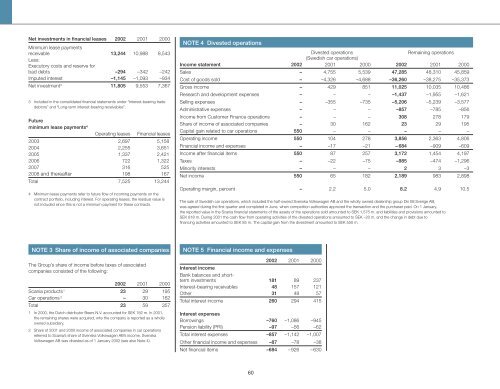

Net investments in financial leases <strong>2002</strong> 2001 2000<br />

Minimum lease payments<br />

receivable 13,244 10,988 8,543<br />

Less:<br />

Executory costs and reserve for<br />

bad debts –294 –342 –242<br />

Imputed interest –1,145 –1,093 –934<br />

Net investment 3 11,805 9,553 7,367<br />

3 Included in the consolidated financial statements under “Interest-bearing trade<br />

debtors” and “Long-term interest-bearing receivables”.<br />

Future<br />

minimum lease payments 4 Operating leases Financial leases<br />

2003 2,697 5,158<br />

2004 2,255 3,651<br />

2005 1,337 2,421<br />

2006 722 1,322<br />

2007 316 525<br />

2008 and thereafter 198 167<br />

Total 7,525 13,244<br />

4 Minimum lease payments refer to future flow of incoming payments on the<br />

contract portfolio, including interest. For operating leases, the residual value is<br />

not included since this is not a minimum payment for these contracts.<br />

NOTE 4 Divested operations<br />

Divested operations<br />

Remaining operations<br />

(Swedish car operations)<br />

Income statement <strong>2002</strong> 2001 2000 <strong>2002</strong> 2001 2000<br />

Sales – 4,755 5,539 47,285 48,310 45,859<br />

Cost of goods sold – –4,326 –4,688 –36,260 –38,275 –35,373<br />

Gross income – 429 851 11,025 10,035 10,486<br />

Research and development expenses – – – –1,437 –1,955 –1,621<br />

Selling expenses – –355 –735 –5,206 –5,239 –3,577<br />

Administrative expenses – – – –857 –785 –856<br />

Income from Customer Finance operations – – – 308 278 179<br />

Share of income of associated companies – 30 162 23 29 195<br />

Capital gain related to car operations 550 – – – – –<br />

Operating income 550 104 278 3,856 2,363 4,806<br />

Financial income and expenses – –17 –21 – 684 –909 –609<br />

Income after financial items 550 87 257 3,172 1,454 4,197<br />

Taxes – –22 –75 –985 –474 –1,296<br />

Minority interests – – – 2 3 –3<br />

Net income 550 65 182 2,189 983 2,898<br />

Operating margin, percent – 2.2 5.0 8.2 4.9 10.5<br />

The sale of Swedish car operations, which included the half-owned Svenska Volkswagen AB and the wholly owned dealership group Din Bil Sverige AB,<br />

was agreed during the first quarter and completed in June, when competition authorities approved the transaction and the purchaser paid. On 1 January,<br />

the <strong>report</strong>ed value in the <strong>Scania</strong> financial statements of the assets of the operations sold amounted to SEK 1,575 m. and liabilities and provisions amounted to<br />

SEK 818 m. During 2001 the cash flow from operating activities of the divested operations amounted to SEK –20 m. and the change in debt due to<br />

financing activities amounted to SEK 85 m. The capital gain from the divestment amounted to SEK 550 m.<br />

NOTE 3 Share of income of associated companies<br />

The Group’s share of income before taxes of associated<br />

companies consisted of the following:<br />

<strong>2002</strong> 2001 2000<br />

<strong>Scania</strong> products 1 23 29 195<br />

Car operations 2 – 30 162<br />

Total 23 59 357<br />

1 In 2000, the Dutch distributor Beers N.V. accounted for SEK 182 m. In 2001,<br />

the remaining shares were acquired, why the company is <strong>report</strong>ed as a wholly<br />

owned subsidiary.<br />

2 Share of 2001 and 2000 income of associated companies in car operations<br />

referred to <strong>Scania</strong>’s share of Svenska Volkswagen AB’s income. Svenska<br />

Volkswagen AB was divested as of 1 January <strong>2002</strong> (see also Note 4).<br />

NOTE 5 Financial income and expenses<br />

<strong>2002</strong> 2001 2000<br />

Interest income<br />

Bank balances and shortterm<br />

investments 181 89 237<br />

Interest-bearing receivables 48 157 121<br />

Other 31 48 57<br />

Total interest income 260 294 415<br />

Interest expenses<br />

Borrowings –760 –1,086 –945<br />

Pension liability (PRI) –97 –56 –62<br />

Total interest expenses –857 –1,142 –1,007<br />

Other financial income and expenses –87 –78 –38<br />

Net financial items –684 –926 –630<br />

60