Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

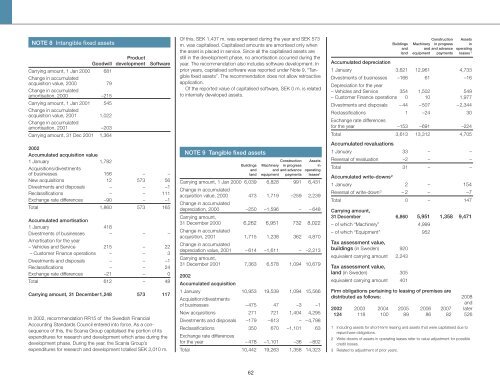

NOTE 8 Intangible fixed assets<br />

Product<br />

Goodwill development<br />

Carrying amount, 1 Jan 2000 681<br />

Change in accumulated<br />

acquisition value, 2000 79<br />

Change in accumulated<br />

amortisation, 2000 –215<br />

Carrying amount, 1 Jan 2001 545<br />

Change in accumulated<br />

acquisition value, 2001 1,022<br />

Change in accumulated<br />

amortisation, 2001 –203<br />

Carrying amount, 31 Dec 2001 1,364<br />

Software<br />

<strong>2002</strong><br />

Accumulated acquisition value<br />

1 January 1,782<br />

Acquisitions/divestments<br />

of businesses 156 – –<br />

New acquisitions 12 573 56<br />

Divestments and disposals – – –1<br />

Reclassifications – – 111<br />

Exchange rate differences –90 – –1<br />

Total 1,860 573 165<br />

Accumulated amortisation<br />

1 January 418<br />

Divestments of businesses – – –<br />

Amortisation for the year<br />

– Vehicles and Service 215 – 22<br />

– Customer Finance operations – – 3<br />

Divestments and disposals – – –1<br />

Reclassifications – – 24<br />

Exchange rate differences –21 – 0<br />

Total 612 – 48<br />

Carrying amount, 31 December1,248 573 117<br />

In <strong>2002</strong>, recommendation RR15 of the Swedish Financial<br />

Accounting Standards Council entered into force. As a consequence<br />

of this, the <strong>Scania</strong> Group capitalised the portion of its<br />

expenditures for research and development which arise during the<br />

development phase. During the year, the <strong>Scania</strong> Group’s<br />

expenditures for research and development totalled SEK 2,010 m.<br />

Of this, SEK 1,437 m. was expensed during the year and SEK 573<br />

m. was capitalised. Capitalised amounts are amortised only when<br />

the asset is placed in service. Since all the capitalised assets are<br />

still in the development phase, no amortisation occurred during the<br />

year. The recommendation also includes software development. In<br />

prior years, capitalised software was <strong>report</strong>ed under Note 9, “Tangible<br />

fixed assets”. The recommendation does not allow retroactive<br />

application.<br />

Of the <strong>report</strong>ed value of capitalised software, SEK 0 m. is related<br />

to internally developed assets.<br />

NOTE 9 Tangible fixed assets<br />

Construction Assets<br />

Buildings Machinery in progress in<br />

and and and advance operating<br />

land equipment payments leases 1<br />

Carrying amount, 1 Jan 2000 6,039 6,828 991 6,431<br />

Change in accumulated<br />

acquisition value, 2000 473 1,719 –259 2,239<br />

Change in accumulated<br />

depreciation, 2000 –250 –1,596 – – 648<br />

Carrying amount,<br />

31 December 2000 6,262 6,951 732 8,022<br />

Change in accumulated<br />

acquisition, 2001 1,715 1,238 362 4,870<br />

Change in accumulated<br />

depreciation value, 2001 – 614 –1,611 – –2,213<br />

Carrying amount,<br />

31 December 2001 7,363 6,578 1,094 10,679<br />

<strong>2002</strong><br />

Accumulated acquisition<br />

1 January 10,953 19,539 1,094 15,566<br />

Acquisition/divestments<br />

of businesses –475 47 –3 –1<br />

New acquisitions 271 721 1,404 4,295<br />

Divestments and disposals –179 –613 – –4,798<br />

Reclassifications 350 670 –1,101 63<br />

Exchange rate differences<br />

for the year – 478 –1,101 –36 –802<br />

Total 10,442 19,263 1,358 14,323<br />

Construction Assets<br />

Buildings Machinery in progress in<br />

and and and advance operating<br />

land equipment payments leases 1<br />

Accumulated depreciation<br />

1 January 3,621 12,961 4,733<br />

Divestments of businesses –166 61 –16<br />

Depreciation for the year<br />

– Vehicles and Service 354 1,502 549<br />

– Customer Finance operations 0 10 1,977<br />

Divestments and disposals – 44 –507 –2,344<br />

Reclassifications 1 –24 30<br />

Exchange rate differences<br />

for the year –153 –691 –224<br />

Total 3,613 13,312 4,705<br />

Accumulated revaluations<br />

1 January 33 – –<br />

Reversal of revaluation –2 – –<br />

Total 31 – –<br />

Accumulated write-downs 2<br />

1 January 2 – 154<br />

Reversal of write-down 3 –2 – –7<br />

Total 0 – 147<br />

Carrying amount,<br />

31 December 6,860 5,951 1,358 9,471<br />

– of which “Machinery” 4,999<br />

– of which “Equipment” 952<br />

Tax assessment value,<br />

buildings (in Sweden) 920<br />

equivalent carrying amount 2,243<br />

Tax assessment value,<br />

land (in Sweden) 305<br />

equivalent carrying amount 401<br />

Firm obligations pertaining to leasing of premises are<br />

distributed as follows: 2008<br />

and<br />

<strong>2002</strong> 2003 2004 2005 2006 2007 later<br />

124 118 100 89 86 82 526<br />

1 Including assets for short-term leasing and assets that were capitalised due to<br />

repurchase obligations.<br />

2 Write-downs of assets in operating leases refer to value adjustment for possible<br />

credit losses.<br />

3 Related to adjustment of prior years.<br />

62