Best Practices in PPP Financing Latin America - e-Institute - World ...

Best Practices in PPP Financing Latin America - e-Institute - World ...

Best Practices in PPP Financing Latin America - e-Institute - World ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Best</strong> practices <strong>in</strong> Public-Private Partnerships f<strong>in</strong>anc<strong>in</strong>g <strong>in</strong> Lat<strong>in</strong> <strong>America</strong><br />

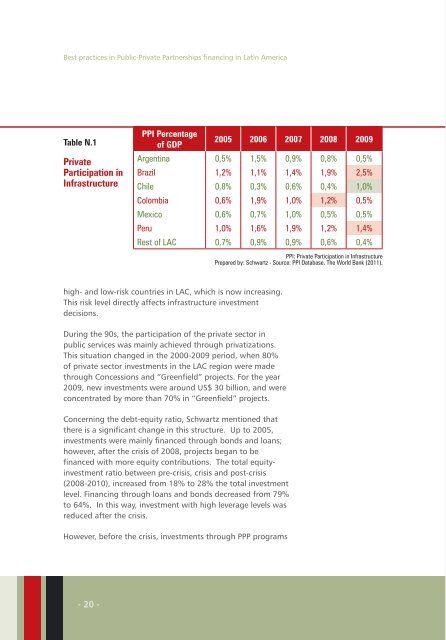

Table N.1<br />

Private<br />

Participation <strong>in</strong><br />

Infrastructure<br />

PPI Percentage<br />

of GDP<br />

2005 2006 2007 2008 2009<br />

Argent<strong>in</strong>a 0,5% 1,5% 0,9% 0,8% 0,5%<br />

Brazil 1,2% 1,1% 1,4% 1,9% 2,5%<br />

Chile 0,8% 0,3% 0,6% 0,4% 1,0%<br />

Colombia 0,6% 1,9% 1,0% 1,2% 0,5%<br />

Mexico 0,6% 0,7% 1,0% 0,5% 0,5%<br />

Peru 1,0% 1,6% 1,9% 1,2% 1,4%<br />

Rest of LAC 0,7% 0,9% 0,9% 0,6% 0,4%<br />

PPI: Private Participation <strong>in</strong> Infrastructure<br />

Prepared by: Schwartz - Source: PPI Database, The <strong>World</strong> Bank (2011).<br />

high- and low-risk countries <strong>in</strong> LAC, which is now <strong>in</strong>creas<strong>in</strong>g.<br />

This risk level directly affects <strong>in</strong>frastructure <strong>in</strong>vestment<br />

decisions.<br />

Dur<strong>in</strong>g the 90s, the participation of the private sector <strong>in</strong><br />

public services was ma<strong>in</strong>ly achieved through privatizations.<br />

This situation changed <strong>in</strong> the 2000-2009 period, when 80%<br />

of private sector <strong>in</strong>vestments <strong>in</strong> the LAC region were made<br />

through Concessions and “Greenfield” projects. For the year<br />

2009, new <strong>in</strong>vestments were around US$ 30 billion, and were<br />

concentrated by more than 70% <strong>in</strong> “Greenfield” projects.<br />

Concern<strong>in</strong>g the debt-equity ratio, Schwartz mentioned that<br />

there is a significant change <strong>in</strong> this structure. Up to 2005,<br />

<strong>in</strong>vestments were ma<strong>in</strong>ly f<strong>in</strong>anced through bonds and loans;<br />

however, after the crisis of 2008, projects began to be<br />

f<strong>in</strong>anced with more equity contributions. The total equity<strong>in</strong>vestment<br />

ratio between pre-crisis, crisis and post-crisis<br />

(2008-2010), <strong>in</strong>creased from 18% to 28% the total <strong>in</strong>vestment<br />

level. F<strong>in</strong>anc<strong>in</strong>g through loans and bonds decreased from 79%<br />

to 64%. In this way, <strong>in</strong>vestment with high leverage levels was<br />

reduced after the crisis.<br />

However, before the crisis, <strong>in</strong>vestments through <strong>PPP</strong> programs<br />

- 20 -