Best Practices in PPP Financing Latin America - e-Institute - World ...

Best Practices in PPP Financing Latin America - e-Institute - World ...

Best Practices in PPP Financing Latin America - e-Institute - World ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Best</strong> practices <strong>in</strong> Public-Private Partnerships f<strong>in</strong>anc<strong>in</strong>g <strong>in</strong> Lat<strong>in</strong> <strong>America</strong><br />

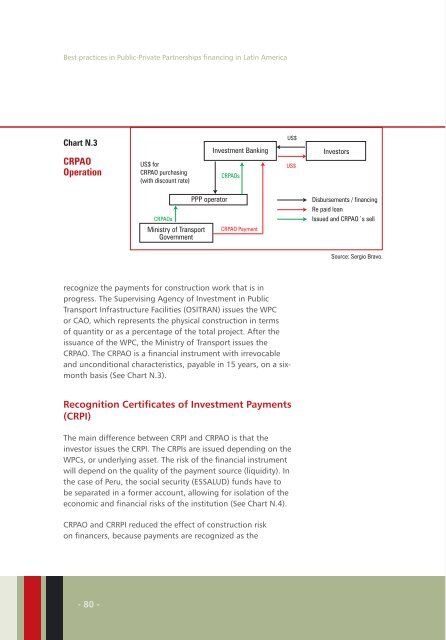

Chart N.3<br />

CRPAO<br />

Operation<br />

US$ for<br />

CRPAO purchas<strong>in</strong>g<br />

(with discount rate)<br />

Investment Bank<strong>in</strong>g<br />

CRPAOs<br />

US$<br />

US$<br />

Investors<br />

CRPAOs<br />

M<strong>in</strong>istry of Transport<br />

Government<br />

<strong>PPP</strong> operator<br />

CRPAO Payment<br />

Disbursements / f<strong>in</strong>anc<strong>in</strong>g<br />

Re paid loan<br />

Issued and CRPAO´s sell<br />

Source: Sergio Bravo.<br />

recognize the payments for construction work that is <strong>in</strong><br />

progress. The Supervis<strong>in</strong>g Agency of Investment <strong>in</strong> Public<br />

Transport Infrastructure Facilities (OSITRAN) issues the WPC<br />

or CAO, which represents the physical construction <strong>in</strong> terms<br />

of quantity or as a percentage of the total project. After the<br />

issuance of the WPC, the M<strong>in</strong>istry of Transport issues the<br />

CRPAO. The CRPAO is a f<strong>in</strong>ancial <strong>in</strong>strument with irrevocable<br />

and unconditional characteristics, payable <strong>in</strong> 15 years, on a sixmonth<br />

basis (See Chart N.3).<br />

Recognition Certificates of Investment Payments<br />

(CRPI)<br />

The ma<strong>in</strong> difference between CRPI and CRPAO is that the<br />

<strong>in</strong>vestor issues the CRPI. The CRPIs are issued depend<strong>in</strong>g on the<br />

WPCs, or underly<strong>in</strong>g asset. The risk of the f<strong>in</strong>ancial <strong>in</strong>strument<br />

will depend on the quality of the payment source (liquidity). In<br />

the case of Peru, the social security (ESSALUD) funds have to<br />

be separated <strong>in</strong> a former account, allow<strong>in</strong>g for isolation of the<br />

economic and f<strong>in</strong>ancial risks of the <strong>in</strong>stitution (See Chart N.4).<br />

CRPAO and CRRPI reduced the effect of construction risk<br />

on f<strong>in</strong>ancers, because payments are recognized as the<br />

- 80 -