2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Other statutory information<br />

Results and dividends<br />

The profit on ordinary activities after taxation of the Group for<br />

the year ended 31 December <strong>2011</strong> amounted to $689.0 million<br />

(2010: $89.5 million).<br />

An interim dividend of Stg 4p (2010: Stg 2p) per ordinary share<br />

was paid on 3 November <strong>2011</strong>. The Directors recommend a final<br />

dividend of Stg 8p (2010: Stg 4p) per ordinary share which, if<br />

approved at the 2012 AGM, will be paid on 24 May 2012 to<br />

shareholders whose names are on the Register of Members on<br />

20 April 2012.<br />

Subsequent events<br />

Since the balance sheet date, <strong>Tullow</strong> has continued to progress<br />

its exploration, development and business growth strategies.<br />

In February 2012, <strong>Tullow</strong> signed two new Production Sharing<br />

Agreements (PSAs) with the Government of Uganda. The new<br />

PSAs cover the EA-1 and Kanywataba licences in the Lake<br />

Albert Rift Basin. <strong>Tullow</strong> has also been awarded the Kingfisher<br />

production licence.<br />

In February 2012, <strong>Tullow</strong> completed the farm-down of one-third<br />

of its Uganda interests to both Total and CNOOC for a total<br />

consideration of $2.9 billion paving the new way for full<br />

development of the Lake Albert Rift Basin oil and gas resources.<br />

In February 2012, the Group announced the Jupiter-1<br />

exploration well in Block SL-07B-11 offshore Sierra Leone<br />

had successfully encountered hydrocarbons. This has been<br />

confirmed by the results of drilling, wireline logs and<br />

samples of reservoir fluids.<br />

Share capital<br />

As at 13 March 2012, the Company had an allotted and fully<br />

paid up share capital of 905,004,587 ordinary shares of 10 pence<br />

each with an aggregate nominal value of £90,500,458.70.<br />

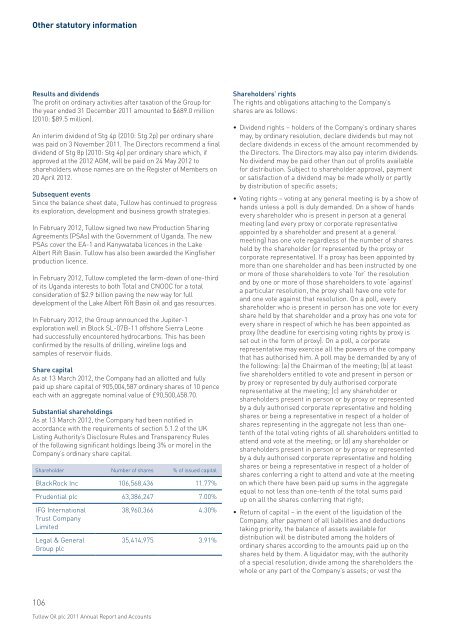

Substantial shareholdings<br />

As at 13 March 2012, the Company had been notified in<br />

accordance with the requirements of section 5.1.2 of the UK<br />

Listing Authority’s Disclosure Rules and Transparency Rules<br />

of the following significant holdings (being 3% or more) in the<br />

Company’s ordinary share capital.<br />

Shareholder Number of shares % of issued capital<br />

BlackRock Inc 106,568,436 11.77%<br />

Prudential <strong>plc</strong> 63,386,247 7.00%<br />

IFG International<br />

Trust Company<br />

Limited<br />

Legal & General<br />

Group <strong>plc</strong><br />

38,960,366 4.30%<br />

35,414,975 3.91%<br />

Shareholders’ rights<br />

The rights and obligations attaching to the Company’s<br />

shares are as follows:<br />

Dividend rights – holders of the Company’s ordinary shares<br />

may, by ordinary resolution, declare dividends but may not<br />

declare dividends in excess of the amount recommended by<br />

the Directors. The Directors may also pay interim dividends.<br />

No dividend may be paid other than out of profits available<br />

for distribution. Subject to shareholder approval, payment<br />

or satisfaction of a dividend may be made wholly or partly<br />

by distribution of specific assets;<br />

Voting rights – voting at any general meeting is by a show of<br />

hands unless a poll is duly demanded. On a show of hands<br />

every shareholder who is present in person at a general<br />

meeting (and every proxy or corporate representative<br />

appointed by a shareholder and present at a general<br />

meeting) has one vote regardless of the number of shares<br />

held by the shareholder (or represented by the proxy or<br />

corporate representative). If a proxy has been appointed by<br />

more than one shareholder and has been instructed by one<br />

or more of those shareholders to vote ‘for’ the resolution<br />

and by one or more of those shareholders to vote ‘against’<br />

a particular resolution, the proxy shall have one vote for<br />

and one vote against that resolution. On a poll, every<br />

shareholder who is present in person has one vote for every<br />

share held by that shareholder and a proxy has one vote for<br />

every share in respect of which he has been appointed as<br />

proxy (the deadline for exercising voting rights by proxy is<br />

set out in the form of proxy). On a poll, a corporate<br />

representative may exercise all the powers of the company<br />

that has authorised him. A poll may be demanded by any of<br />

the following: (a) the Chairman of the meeting; (b) at least<br />

five shareholders entitled to vote and present in person or<br />

by proxy or represented by duly authorised corporate<br />

representative at the meeting; (c) any shareholder or<br />

shareholders present in person or by proxy or represented<br />

by a duly authorised corporate representative and holding<br />

shares or being a representative in respect of a holder of<br />

shares representing in the aggregate not less than onetenth<br />

of the total voting rights of all shareholders entitled to<br />

attend and vote at the meeting; or (d) any shareholder or<br />

shareholders present in person or by proxy or represented<br />

by a duly authorised corporate representative and holding<br />

shares or being a representative in respect of a holder of<br />

shares conferring a right to attend and vote at the meeting<br />

on which there have been paid up sums in the aggregate<br />

equal to not less than one-tenth of the total sums paid<br />

up on all the shares conferring that right;<br />

Return of capital – in the event of the liquidation of the<br />

Company, after payment of all liabilities and deductions<br />

taking priority, the balance of assets available for<br />

distribution will be distributed among the holders of<br />

ordinary shares according to the amounts paid up on the<br />

shares held by them. A liquidator may, with the authority<br />

of a special resolution, divide among the shareholders the<br />

whole or any part of the Company’s assets; or vest the<br />

106<br />

<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts