2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5<br />

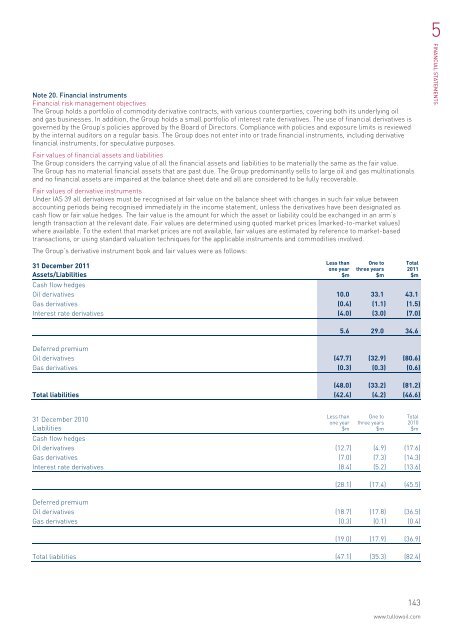

Note 20. Financial instruments<br />

Financial risk management objectives<br />

The Group holds a portfolio of commodity derivative contracts, with various counterparties, covering both its underlying oil<br />

and gas businesses. In addition, the Group holds a small portfolio of interest rate derivatives. The use of financial derivatives is<br />

governed by the Group’s policies approved by the Board of Directors. Compliance with policies and exposure limits is reviewed<br />

by the internal auditors on a regular basis. The Group does not enter into or trade financial instruments, including derivative<br />

financial instruments, for speculative purposes.<br />

Fair values of financial assets and liabilities<br />

The Group considers the carrying value of all the financial assets and liabilities to be materially the same as the fair value.<br />

The Group has no material financial assets that are past due. The Group predominantly sells to large oil and gas multinationals<br />

and no financial assets are impaired at the balance sheet date and all are considered to be fully recoverable.<br />

Fair values of derivative instruments<br />

Under IAS 39 all derivatives must be recognised at fair value on the balance sheet with changes in such fair value between<br />

accounting periods being recognised immediately in the income statement, unless the derivatives have been designated as<br />

cash flow or fair value hedges. The fair value is the amount for which the asset or liability could be exchanged in an arm’s<br />

length transaction at the relevant date. Fair values are determined using quoted market prices (marked-to-market values)<br />

where available. To the extent that market prices are not available, fair values are estimated by reference to market-based<br />

transactions, or using standard valuation techniques for the applicable instruments and commodities involved.<br />

The Group’s derivative instrument book and fair values were as follows:<br />

FINANCIAL STATEMENTS<br />

31 December <strong>2011</strong><br />

Assets/Liabilities<br />

Less than<br />

one year<br />

$m<br />

One to<br />

three years<br />

$m<br />

Cash flow hedges<br />

<strong>Oil</strong> derivatives 10.0 33.1 43.1<br />

Gas derivatives (0.4) (1.1) (1.5)<br />

Interest rate derivatives (4.0) (3.0) (7.0)<br />

Total<br />

<strong>2011</strong><br />

$m<br />

5.6 29.0 34.6<br />

Deferred premium<br />

<strong>Oil</strong> derivatives (47.7) (32.9) (80.6)<br />

Gas derivatives (0.3) (0.3) (0.6)<br />

(48.0) (33.2) (81.2)<br />

Total liabilities (42.4) (4.2) (46.6)<br />

31 December 2010<br />

Liabilities<br />

Less than<br />

one year<br />

$m<br />

One to<br />

three years<br />

$m<br />

Cash flow hedges<br />

<strong>Oil</strong> derivatives (12.7) (4.9) (17.6)<br />

Gas derivatives (7.0) (7.3) (14.3)<br />

Interest rate derivatives (8.4) (5.2) (13.6)<br />

Total<br />

2010<br />

$m<br />

(28.1) (17.4) (45.5)<br />

Deferred premium<br />

<strong>Oil</strong> derivatives (18.7) (17.8) (36.5)<br />

Gas derivatives (0.3) (0.1) (0.4)<br />

(19.0) (17.9) (36.9)<br />

Total liabilities (47.1) (35.3) (82.4)<br />

143<br />

www.tullowoil.com