2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Group financial statements continued<br />

Year ended 31 December <strong>2011</strong><br />

Note 6. Bank loans continued<br />

The Company is exposed to floating rate interest rate risk as entities in the Group borrow funds at floating interest rates.<br />

The Group hedges its floating rate interest rate exposure on an ongoing basis through the use of interest rate derivatives,<br />

namely interest rate swaps, interest rate collars and interest rate caps. The mark-to-market position of the Group’s interest<br />

rate portfolio as at 31 December <strong>2011</strong> was $7.2 million out of the money (2010: $13.6 million out of the money). The interest rate<br />

hedges are included in the fixed rate debt in the above table.<br />

The carrying amounts of the Company’s foreign currency denominated monetary assets and monetary liabilities at the reporting<br />

date are net liabilities of $163.8 million (2010: net liabilities of $164.0 million).<br />

Foreign currency sensitivity analysis<br />

The Company is mainly exposed to fluctuations in the US dollar. The Company measures its market risk exposure by running<br />

various sensitivity analyses including 20% favourable and adverse changes in the key variables. The sensitivity analyses include<br />

only outstanding foreign currency denominated monetary items and adjust their translation at the period end for a 20% change<br />

in foreign currency rates.<br />

As at 31 December <strong>2011</strong>, a 20% increase in foreign exchange rates against the US dollar would have resulted in a decrease in<br />

foreign currency denominated liabilities of $27.3 million (2010: $27.3 million) and a 20% decrease in foreign exchange rates<br />

against the US dollar would have resulted in an increase in foreign currency denominated liabilities and equity of $32.8 million<br />

(2010: $32.8 million).<br />

Note 7. Loans from subsidiary undertakings<br />

Amounts falling due after more than one year<br />

Loans from subsidiary companies 1.1 1.1<br />

The amounts due from subsidiaries do not accrue interest. All loans from subsidiary companies are not due to be repaid within<br />

five years.<br />

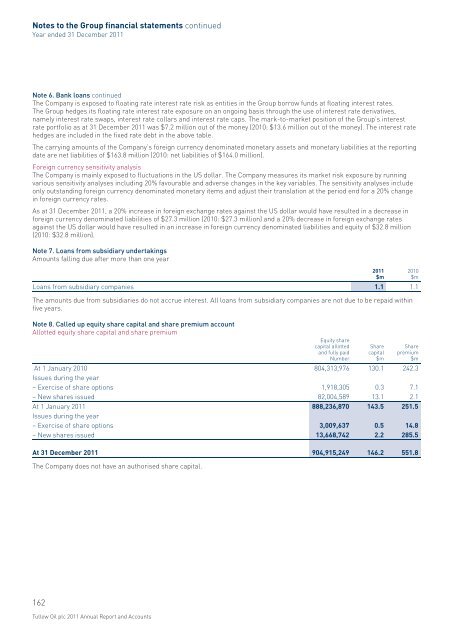

Note 8. Called up equity share capital and share premium account<br />

Allotted equity share capital and share premium<br />

Equity share<br />

capital allotted<br />

and fully paid<br />

Number<br />

<strong>2011</strong><br />

$m<br />

Share<br />

capital<br />

$m<br />

2010<br />

$m<br />

Share<br />

premium<br />

$m<br />

At 1 January 2010 804,313,976 130.1 242.3<br />

Issues during the year<br />

– Exercise of share options 1,918,305 0.3 7.1<br />

– New shares issued 82,004,589 13.1 2.1<br />

At 1 January <strong>2011</strong> 888,236,870 143.5 251.5<br />

Issues during the year<br />

– Exercise of share options 3,009,637 0.5 14.8<br />

– New shares issued 13,668,742 2.2 285.5<br />

At 31 December <strong>2011</strong> 904,915,249 146.2 551.8<br />

The Company does not have an authorised share capital.<br />

162<br />

<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts