2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5<br />

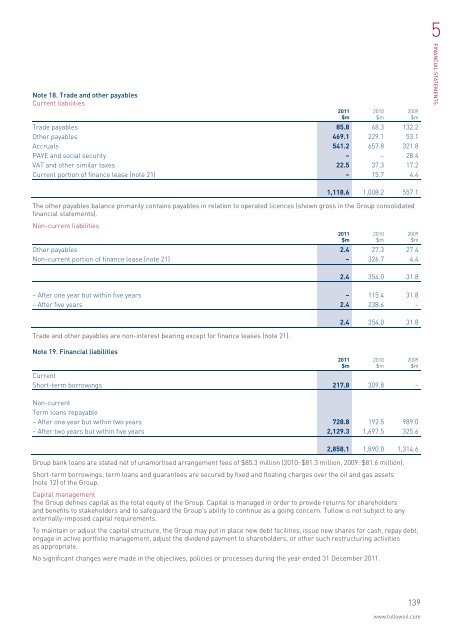

Note 18. Trade and other payables<br />

Current liabilities<br />

Trade payables 85.8 68.3 132.2<br />

Other payables 469.1 229.1 53.1<br />

Accruals 541.2 657.8 321.8<br />

PAYE and social security – – 28.4<br />

VAT and other similar taxes 22.5 37.3 17.2<br />

Current portion of finance lease (note 21) – 15.7 4.4<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

2009<br />

$m<br />

FINANCIAL STATEMENTS<br />

1,118.6 1,008.2 557.1<br />

The other payables balance primarily contains payables in relation to operated licences (shown gross in the Group consolidated<br />

financial statements).<br />

Non-current liabilities<br />

Other payables 2.4 27.3 27.4<br />

Non-current portion of finance lease (note 21) – 326.7 4.4<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

2009<br />

$m<br />

2.4 354.0 31.8<br />

– After one year but within five years – 115.4 31.8<br />

– After five years 2.4 238.6 –<br />

Trade and other payables are non-interest bearing except for finance leases (note 21).<br />

Note 19. Financial liabilities<br />

2.4 354.0 31.8<br />

Current<br />

Short-term borrowings 217.8 309.8 –<br />

Non-current<br />

Term loans repayable<br />

– After one year but within two years 728.8 192.5 989.0<br />

– After two years but within five years 2,129.3 1,697.5 325.6<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

2009<br />

$m<br />

2,858.1 1,890.0 1,314.6<br />

Group bank loans are stated net of unamortised arrangement fees of $85.3 million (2010: $81.3 million, 2009: $81.6 million).<br />

Short-term borrowings, term loans and guarantees are secured by fixed and floating charges over the oil and gas assets<br />

(note 12) of the Group.<br />

Capital management<br />

The Group defines capital as the total equity of the Group. Capital is managed in order to provide returns for shareholders<br />

and benefits to stakeholders and to safeguard the Group’s ability to continue as a going concern. <strong>Tullow</strong> is not subject to any<br />

externally-imposed capital requirements.<br />

To maintain or adjust the capital structure, the Group may put in place new debt facilities, issue new shares for cash, repay debt,<br />

engage in active portfolio management, adjust the dividend payment to shareholders, or other such restructuring activities<br />

as appropriate.<br />

No significant changes were made in the objectives, policies or processes during the year ended 31 December <strong>2011</strong>.<br />

139<br />

www.tullowoil.com