2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Group financial statements continued<br />

Year ended 31 December <strong>2011</strong><br />

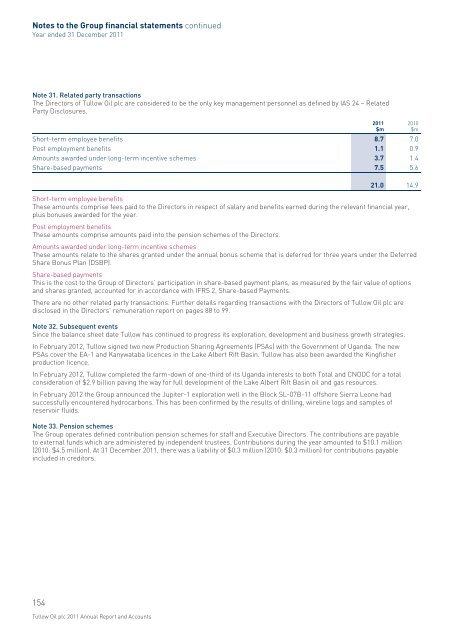

Note 31. Related party transactions<br />

The Directors of <strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> are considered to be the only key management personnel as defined by IAS 24 – Related<br />

Party Disclosures.<br />

Short-term employee benefits 8.7 7.0<br />

Post employment benefits 1.1 0.9<br />

Amounts awarded under long-term incentive schemes 3.7 1.4<br />

Share-based payments 7.5 5.6<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

21.0 14.9<br />

Short-term employee benefits<br />

These amounts comprise fees paid to the Directors in respect of salary and benefits earned during the relevant financial year,<br />

plus bonuses awarded for the year.<br />

Post employment benefits<br />

These amounts comprise amounts paid into the pension schemes of the Directors.<br />

Amounts awarded under long-term incentive schemes<br />

These amounts relate to the shares granted under the annual bonus scheme that is deferred for three years under the Deferred<br />

Share Bonus Plan (DSBP).<br />

Share-based payments<br />

This is the cost to the Group of Directors’ participation in share-based payment plans, as measured by the fair value of options<br />

and shares granted, accounted for in accordance with IFRS 2, Share-based Payments.<br />

There are no other related party transactions. Further details regarding transactions with the Directors of <strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> are<br />

disclosed in the Directors’ remuneration report on pages 88 to 99.<br />

Note 32. Subsequent events<br />

Since the balance sheet date <strong>Tullow</strong> has continued to progress its exploration, development and business growth strategies.<br />

In February 2012, <strong>Tullow</strong> signed two new Production Sharing Agreements (PSAs) with the Government of Uganda. The new<br />

PSAs cover the EA-1 and Kanywataba licences in the Lake Albert Rift Basin. <strong>Tullow</strong> has also been awarded the Kingfisher<br />

production licence.<br />

In February 2012, <strong>Tullow</strong> completed the farm-down of one-third of its Uganda interests to both Total and CNOOC for a total<br />

consideration of $2.9 billion paving the way for full development of the Lake Albert Rift Basin oil and gas resources.<br />

In February 2012 the Group announced the Jupiter-1 exploration well in the Block SL-07B-11 offshore Sierra Leone had<br />

successfully encountered hydrocarbons. This has been confirmed by the results of drilling, wireline logs and samples of<br />

reservoir fluids.<br />

Note 33. Pension schemes<br />

The Group operates defined contribution pension schemes for staff and Executive Directors. The contributions are payable<br />

to external funds which are administered by independent trustees. Contributions during the year amounted to $10.1 million<br />

(2010: $4.5 million). At 31 December <strong>2011</strong>, there was a liability of $0.3 million (2010: $0.3 million) for contributions payable<br />

included in creditors.<br />

154<br />

<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts