2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Capital market relationships<br />

<strong>Tullow</strong> places great emphasis on achieving top quartile and best<br />

practice performance in investor relations and capital market<br />

communications. A total of 26 corporate updates were<br />

announced during the year in addition to the six annual<br />

programme announcements for Results, Operational Updates<br />

and Trading Statements and Interim Management Statements.<br />

In <strong>2011</strong>, Senior Management and Investor Relations met with<br />

over 370 institutions in the UK, Europe and North America and<br />

presented at 15 investor conferences and 18 sales force<br />

briefings. This amounted to almost 50 investor days, split over<br />

22 cities in 13 countries.<br />

<strong>2011</strong> TSR amounted to 12% (2010: down 3%). This compares<br />

with a 2% decline in the FTSE 100 TSR performance in <strong>2011</strong>.<br />

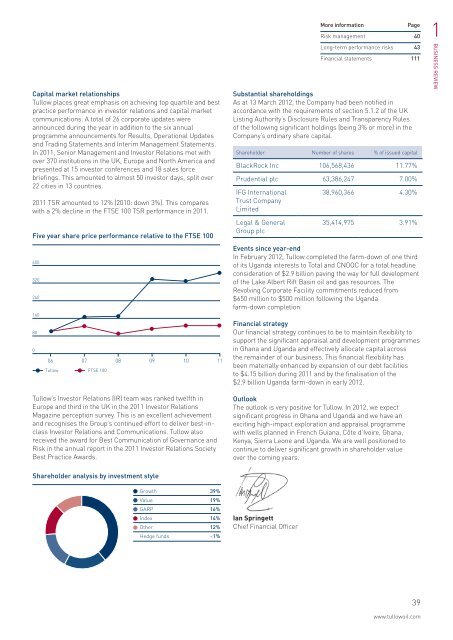

Five year share price performance relative to the FTSE 100<br />

400<br />

320<br />

240<br />

160<br />

80<br />

0<br />

06 07 08 09 10<br />

11<br />

<strong>Tullow</strong> FTSE 100<br />

<strong>Tullow</strong>’s Investor Relations (IR) team was ranked twelfth in<br />

Europe and third in the UK in the <strong>2011</strong> Investor Relations<br />

Magazine perception survey. This is an excellent achievement<br />

and recognises the Group’s continued effort to deliver best-inclass<br />

Investor Relations and Communications. <strong>Tullow</strong> also<br />

received the award for Best Communication of Governance and<br />

Risk in the annual report in the <strong>2011</strong> Investor Relations Society<br />

Best Practice Awards.<br />

Substantial shareholdings<br />

As at 13 March 2012, the Company had been notified in<br />

accordance with the requirements of section 5.1.2 of the UK<br />

Listing Authority’s Disclosure Rules and Transparency Rules<br />

of the following significant holdings (being 3% or more) in the<br />

Company’s ordinary share capital.<br />

Shareholder Number of shares % of issued capital<br />

BlackRock Inc 106,568,436 11.77%<br />

Prudential <strong>plc</strong> 63,386,247 7.00%<br />

IFG International<br />

Trust Company<br />

Limited<br />

Legal & General<br />

Group <strong>plc</strong><br />

More information<br />

Page<br />

Risk management 40<br />

Long-term performance risks 43<br />

Financial statements 111<br />

38,960,366 4.30%<br />

35,414,975 3.91%<br />

Events since year-end<br />

In February 2012, <strong>Tullow</strong> completed the farm-down of one third<br />

of its Uganda interests to Total and CNOOC for a total headline<br />

consideration of $2.9 billion paving the way for full development<br />

of the Lake Albert Rift Basin oil and gas resources. The<br />

Revolving Corporate Facility commitments reduced from<br />

$650 million to $500 million following the Uganda<br />

farm-down completion.<br />

Financial strategy<br />

Our financial strategy continues to be to maintain flexibility to<br />

support the significant appraisal and development programmes<br />

in Ghana and Uganda and effectively allocate capital across<br />

the remainder of our business. This financial flexibility has<br />

been materially enhanced by expansion of our debt facilities<br />

to $4.15 billion during <strong>2011</strong> and by the finalisation of the<br />

$2.9 billion Uganda farm-down in early 2012.<br />

Outlook<br />

The outlook is very positive for <strong>Tullow</strong>. In 2012, we expect<br />

significant progress in Ghana and Uganda and we have an<br />

exciting high-impact exploration and appraisal programme<br />

with wells planned in French Guiana, Côte d’Ivoire, Ghana,<br />

Kenya, Sierra Leone and Uganda. We are well positioned to<br />

continue to deliver significant growth in shareholder value<br />

over the coming years.<br />

1<br />

BUSINESS REVIEW<br />

Shareholder analysis by investment style<br />

Growth 39%<br />

Value 19%<br />

GARP 16%<br />

Index 14%<br />

Other 12%<br />

Hedge funds