2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors’ remuneration report continued<br />

Summary of Executive Director remuneration policy and structure<br />

Component Objective(s) Details<br />

Salary<br />

Pension &<br />

Benefits<br />

<strong>Annual</strong> Bonus<br />

Deferred Bonus<br />

PSP<br />

Share ownership<br />

guidelines<br />

Support recruitment<br />

and retention<br />

Provide competitive benefit<br />

and pension provision<br />

Reinforce the delivery<br />

of key short-term<br />

operational objectives<br />

Ensure the release of<br />

significant bonuses is<br />

spread over multiple years<br />

Reinforce the delivery<br />

of absolute and relative<br />

returns to shareholders<br />

Provide alignment with<br />

shareholders<br />

Provide alignment with<br />

shareholders<br />

Adjustments are effective 1 January<br />

Targeted around the median of the relevant market<br />

Executive Directors receive a pension benefit of 25% of salary<br />

Other benefits include health and medical insurance<br />

Opportunity of up to 200% of salary for Executive Directors<br />

Payout is based on the Remuneration Committee’s assessment of<br />

performance using a balanced scorecard comprising Relative TSR,<br />

Health & Safety, Operational & Financial and Project Milestones<br />

Any bonus earned in excess of 75% of salary is paid in shares<br />

and deferred for three years<br />

<strong>Annual</strong> awards of conditional shares, fixed by number of shares<br />

for the <strong>2011</strong>, 2012 and 2013 cycles<br />

Shares vest on <strong>Tullow</strong>’s three-year TSR outperformance of oil and gas<br />

sector peers (70% of award) and FTSE 100 companies (30% of award)<br />

Full vesting requires <strong>Tullow</strong> to outperform the benchmark by 20% p.a.<br />

Vesting is also dependent on the Remuneration Committee’s<br />

assessment of underlying performance<br />

Executive Directors are required to retain at least 50% of the post-tax<br />

shares that vest under the PSP and Deferred Bonus until they have<br />

built up a shareholding worth at least 400% of base salary<br />

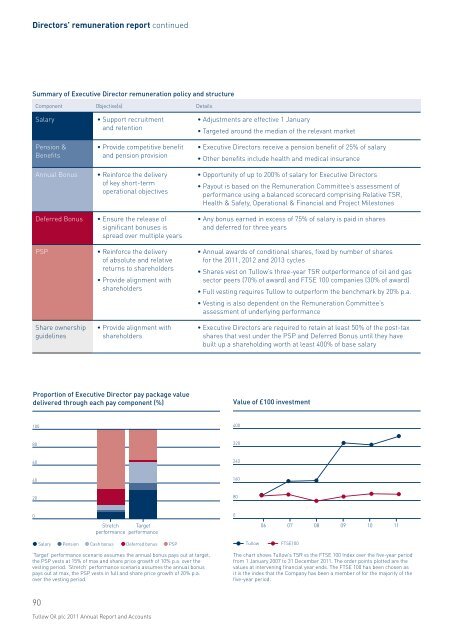

Proportion of Executive Director pay package value<br />

delivered through each pay component (%)<br />

Value of £100 investment<br />

100<br />

400<br />

80<br />

320<br />

60<br />

240<br />

40<br />

160<br />

20<br />

80<br />

0<br />

Stretch Target<br />

performance performance<br />

0<br />

06 07 08 09 10 11<br />

Salary Pension Cash bonus Deferred bonus PSP<br />

<strong>Tullow</strong><br />

FTSE100<br />

‘Target’ performance scenario assumes the annual bonus pays out at target,<br />

the PSP vests at 15% of max and share price growth of 10% p.a. over the<br />

vesting period. ‘Stretch’ performance scenario assumes the annual bonus<br />

pays out at max, the PSP vests in full and share price growth of 20% p.a.<br />

over the vesting period.<br />

The chart shows <strong>Tullow</strong>’s TSR vs the FTSE 100 Index over the five-year period<br />

from 1 January 2007 to 31 December <strong>2011</strong>. The order points plotted are the<br />

values at intervening financial year ends. The FTSE 100 has been chosen as<br />

it is the index that the Company has been a member of for the majority of the<br />

five-year period.<br />

90<br />

<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts