2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5<br />

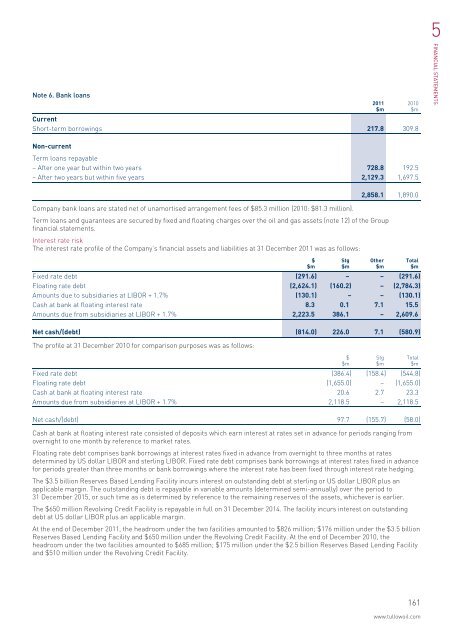

Note 6. Bank loans<br />

Current<br />

Short-term borrowings 217.8 309.8<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

FINANCIAL STATEMENTS<br />

Non-current<br />

Term loans repayable<br />

– After one year but within two years 728.8 192.5<br />

– After two years but within five years 2,129.3 1,697.5<br />

2,858.1 1,890.0<br />

Company bank loans are stated net of unamortised arrangement fees of $85.3 million (2010: $81.3 million).<br />

Term loans and guarantees are secured by fixed and floating charges over the oil and gas assets (note 12) of the Group<br />

financial statements.<br />

Interest rate risk<br />

The interest rate profile of the Company’s financial assets and liabilities at 31 December <strong>2011</strong> was as follows:<br />

Fixed rate debt (291.6) – – (291.6)<br />

Floating rate debt (2,624.1) (160.2) – (2,784.3)<br />

Amounts due to subsidiaries at LIBOR + 1.7% (130.1) – – (130.1)<br />

Cash at bank at floating interest rate 8.3 0.1 7.1 15.5<br />

Amounts due from subsidiaries at LIBOR + 1.7% 2,223.5 386.1 – 2,609.6<br />

$<br />

$m<br />

Stg<br />

$m<br />

Other<br />

$m<br />

Total<br />

$m<br />

Net cash/(debt) (814.0) 226.0 7.1 (580.9)<br />

The profile at 31 December 2010 for comparison purposes was as follows:<br />

Fixed rate debt (386.4) (158.4) (544.8)<br />

Floating rate debt (1,655.0) – (1,655.0)<br />

Cash at bank at floating interest rate 20.6 2.7 23.3<br />

Amounts due from subsidiaries at LIBOR + 1.7% 2,118.5 – 2,118.5<br />

$<br />

$m<br />

Stg<br />

$m<br />

Total<br />

$m<br />

Net cash/(debt) 97.7 (155.7) (58.0)<br />

Cash at bank at floating interest rate consisted of deposits which earn interest at rates set in advance for periods ranging from<br />

overnight to one month by reference to market rates.<br />

Floating rate debt comprises bank borrowings at interest rates fixed in advance from overnight to three months at rates<br />

determined by US dollar LIBOR and sterling LIBOR. Fixed rate debt comprises bank borrowings at interest rates fixed in advance<br />

for periods greater than three months or bank borrowings where the interest rate has been fixed through interest rate hedging.<br />

The $3.5 billion Reserves Based Lending Facility incurs interest on outstanding debt at sterling or US dollar LIBOR plus an<br />

applicable margin. The outstanding debt is repayable in variable amounts (determined semi-annually) over the period to<br />

31 December 2015, or such time as is determined by reference to the remaining reserves of the assets, whichever is earlier.<br />

The $650 million Revolving Credit Facility is repayable in full on 31 December 2014. The facility incurs interest on outstanding<br />

debt at US dollar LIBOR plus an applicable margin.<br />

At the end of December <strong>2011</strong>, the headroom under the two facilities amounted to $826 million; $176 million under the $3.5 billion<br />

Reserves Based Lending Facility and $650 million under the Revolving Credit Facility. At the end of December 2010, the<br />

headroom under the two facilities amounted to $685 million; $175 million under the $2.5 billion Reserves Based Lending Facility<br />

and $510 million under the Revolving Credit Facility.<br />

161<br />

www.tullowoil.com