2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Group financial statements continued<br />

Year ended 31 December <strong>2011</strong><br />

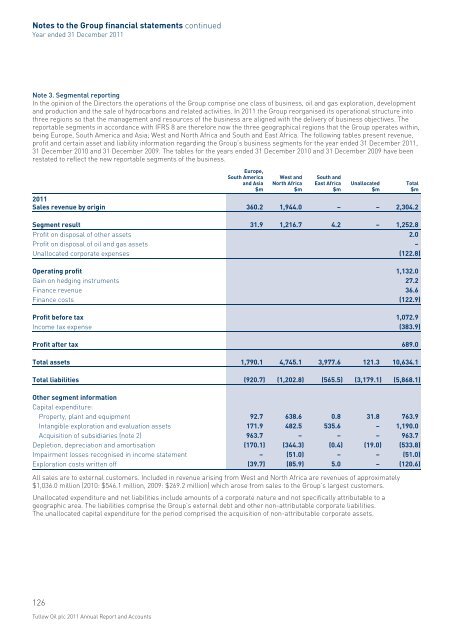

Note 3. Segmental reporting<br />

In the opinion of the Directors the operations of the Group comprise one class of business, oil and gas exploration, development<br />

and production and the sale of hydrocarbons and related activities. In <strong>2011</strong> the Group reorganised its operational structure into<br />

three regions so that the management and resources of the business are aligned with the delivery of business objectives. The<br />

reportable segments in accordance with IFRS 8 are therefore now the three geographical regions that the Group operates within,<br />

being Europe, South America and Asia; West and North Africa and South and East Africa. The following tables present revenue,<br />

profit and certain asset and liability information regarding the Group’s business segments for the year ended 31 December <strong>2011</strong>,<br />

31 December 2010 and 31 December 2009. The tables for the years ended 31 December 2010 and 31 December 2009 have been<br />

restated to reflect the new reportable segments of the business.<br />

Europe,<br />

South America<br />

and Asia<br />

$m<br />

West and<br />

North Africa<br />

$m<br />

South and<br />

East Africa<br />

$m<br />

Unallocated<br />

$m<br />

<strong>2011</strong><br />

Sales revenue by origin 360.2 1,944.0 – – 2,304.2<br />

Total<br />

$m<br />

Segment result 31.9 1,216.7 4.2 – 1,252.8<br />

Profit on disposal of other assets 2.0<br />

Profit on disposal of oil and gas assets –<br />

Unallocated corporate expenses (122.8)<br />

Operating profit 1,132.0<br />

Gain on hedging instruments 27.2<br />

Finance revenue 36.6<br />

Finance costs (122.9)<br />

Profit before tax 1,072.9<br />

Income tax expense (383.9)<br />

Profit after tax 689.0<br />

Total assets 1,790.1 4,745.1 3,977.6 121.3 10,634.1<br />

Total liabilities (920.7) (1,202.8) (565.5) (3,179.1) (5,868.1)<br />

Other segment information<br />

Capital expenditure:<br />

Property, plant and equipment 92.7 638.6 0.8 31.8 763.9<br />

Intangible exploration and evaluation assets 171.9 482.5 535.6 – 1,190.0<br />

Acquisition of subsidiaries (note 2) 963.7 – – – 963.7<br />

Depletion, depreciation and amortisation (170.1) (344.3) (0.4) (19.0) (533.8)<br />

Impairment losses recognised in income statement – (51.0) – – (51.0)<br />

Exploration costs written off (39.7) (85.9) 5.0 – (120.6)<br />

All sales are to external customers. Included in revenue arising from West and North Africa are revenues of approximately<br />

$1,036.0 million (2010: $546.1 million, 2009: $269.2 million) which arose from sales to the Group’s largest customers.<br />

Unallocated expenditure and net liabilities include amounts of a corporate nature and not specifically attributable to a<br />

geographic area. The liabilities comprise the Group’s external debt and other non-attributable corporate liabilities.<br />

The unallocated capital expenditure for the period comprised the acquisition of non-attributable corporate assets.<br />

126<br />

<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts