2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5<br />

The Group’s profit before taxation will continue to be subject to jurisdictions where the effective rate of taxation differs from that<br />

in the UK. Furthermore, unsuccessful exploration expenditure is often incurred in jurisdictions where the Group has no taxable<br />

profits, such that no related tax benefit arises. Accordingly, the Group’s tax charge will continue to depend on the jurisdictions<br />

in which pre-tax profits and exploration costs written off arise.<br />

The Group has tax losses of $1,082.3 million (2010: $840.1 million) that are available indefinitely for offset against future taxable<br />

profits in the companies in which the losses arose. Deferred tax assets have not been recognised in respect of these losses as<br />

they may not be used to offset taxable profits elsewhere in the Group.<br />

The Group has recognised $117.5 million in deferred tax assets in relation to taxable losses (2010: $175.1 million).<br />

No deferred tax liability is recognised on temporary differences of $253.0 million (2010: $485.6 million) relating to unremitted<br />

earnings of overseas subsidiaries as the Group is able to control the timing of the reversal of these temporary differences and<br />

it is probable that they will not reverse in the foreseeable future.<br />

FINANCIAL STATEMENTS<br />

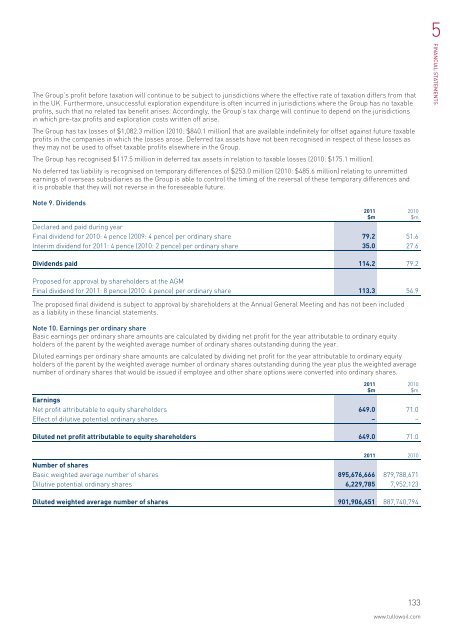

Note 9. Dividends<br />

Declared and paid during year<br />

Final dividend for 2010: 4 pence (2009: 4 pence) per ordinary share 79.2 51.6<br />

Interim dividend for <strong>2011</strong>: 4 pence (2010: 2 pence) per ordinary share 35.0 27.6<br />

Dividends paid 114.2 79.2<br />

Proposed for approval by shareholders at the AGM<br />

Final dividend for <strong>2011</strong>: 8 pence (2010: 4 pence) per ordinary share 113.3 54.9<br />

The proposed final dividend is subject to approval by shareholders at the <strong>Annual</strong> General Meeting and has not been included<br />

as a liability in these financial statements.<br />

Note 10. Earnings per ordinary share<br />

Basic earnings per ordinary share amounts are calculated by dividing net profit for the year attributable to ordinary equity<br />

holders of the parent by the weighted average number of ordinary shares outstanding during the year.<br />

Diluted earnings per ordinary share amounts are calculated by dividing net profit for the year attributable to ordinary equity<br />

holders of the parent by the weighted average number of ordinary shares outstanding during the year plus the weighted average<br />

number of ordinary shares that would be issued if employee and other share options were converted into ordinary shares.<br />

Earnings<br />

Net profit attributable to equity shareholders 649.0 71.0<br />

Effect of dilutive potential ordinary shares – –<br />

<strong>2011</strong><br />

$m<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

2010<br />

$m<br />

Diluted net profit attributable to equity shareholders 649.0 71.0<br />

<strong>2011</strong> 2010<br />

Number of shares<br />

Basic weighted average number of shares 895,676,666 879,788,671<br />

Dilutive potential ordinary shares 6,229,785 7,952,123<br />

Diluted weighted average number of shares 901,906,451 887,740,794<br />

133<br />

www.tullowoil.com