2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

2011 Annual Report PDF - Tullow Oil plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Group financial statements continued<br />

Year ended 31 December <strong>2011</strong><br />

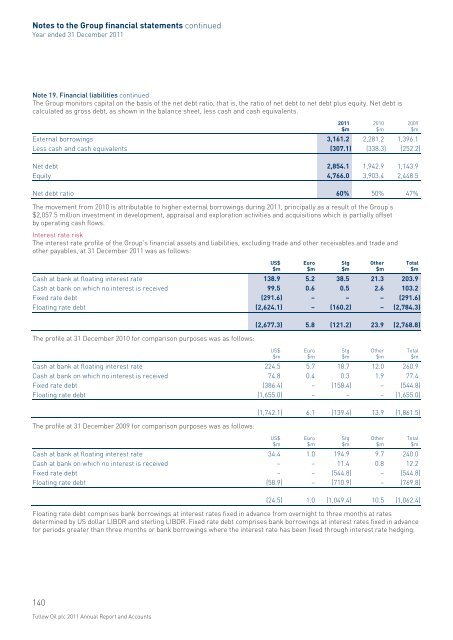

Note 19. Financial liabilities continued<br />

The Group monitors capital on the basis of the net debt ratio, that is, the ratio of net debt to net debt plus equity. Net debt is<br />

calculated as gross debt, as shown in the balance sheet, less cash and cash equivalents.<br />

External borrowings 3,161.2 2,281.2 1,396.1<br />

Less cash and cash equivalents (307.1) (338.3) (252.2)<br />

<strong>2011</strong><br />

$m<br />

2010<br />

$m<br />

2009<br />

$m<br />

Net debt 2,854.1 1,942.9 1,143.9<br />

Equity 4,766.0 3,903.4 2,448.5<br />

Net debt ratio 60% 50% 47%<br />

The movement from 2010 is attributable to higher external borrowings during <strong>2011</strong>, principally as a result of the Group’s<br />

$2,057.5 million investment in development, appraisal and exploration activities and acquisitions which is partially offset<br />

by operating cash flows.<br />

Interest rate risk<br />

The interest rate profile of the Group’s financial assets and liabilities, excluding trade and other receivables and trade and<br />

other payables, at 31 December <strong>2011</strong> was as follows:<br />

Cash at bank at floating interest rate 138.9 5.2 38.5 21.3 203.9<br />

Cash at bank on which no interest is received 99.5 0.6 0.5 2.6 103.2<br />

Fixed rate debt (291.6) – – – (291.6)<br />

Floating rate debt (2,624.1) – (160.2) – (2,784.3)<br />

US$<br />

$m<br />

Euro<br />

$m<br />

Stg<br />

$m<br />

Other<br />

$m<br />

Total<br />

$m<br />

The profile at 31 December 2010 for comparison purposes was as follows:<br />

(2,677.3) 5.8 (121.2) 23.9 (2,768.8)<br />

Cash at bank at floating interest rate 224.5 5.7 18.7 12.0 260.9<br />

Cash at bank on which no interest is received 74.8 0.4 0.3 1.9 77.4<br />

Fixed rate debt (386.4) – (158.4) – (544.8)<br />

Floating rate debt (1,655.0) – – – (1,655.0)<br />

US$<br />

$m<br />

Euro<br />

$m<br />

Stg<br />

$m<br />

Other<br />

$m<br />

Total<br />

$m<br />

The profile at 31 December 2009 for comparison purposes was as follows:<br />

(1,742.1) 6.1 (139.4) 13.9 (1,861.5)<br />

Cash at bank at floating interest rate 34.4 1.0 194.9 9.7 240.0<br />

Cash at bank on which no interest is received – – 11.4 0.8 12.2<br />

Fixed rate debt – – (544.8) – (544.8)<br />

Floating rate debt (58.9) – (710.9) – (769.8)<br />

US$<br />

$m<br />

Euro<br />

$m<br />

Stg<br />

$m<br />

Other<br />

$m<br />

Total<br />

$m<br />

(24.5) 1.0 (1,049.4) 10.5 (1,062.4)<br />

Floating rate debt comprises bank borrowings at interest rates fixed in advance from overnight to three months at rates<br />

determined by US dollar LIBOR and sterling LIBOR. Fixed rate debt comprises bank borrowings at interest rates fixed in advance<br />

for periods greater than three months or bank borrowings where the interest rate has been fixed through interest rate hedging.<br />

140<br />

<strong>Tullow</strong> <strong>Oil</strong> <strong>plc</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts