bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Risk management continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

3. Market risk continued<br />

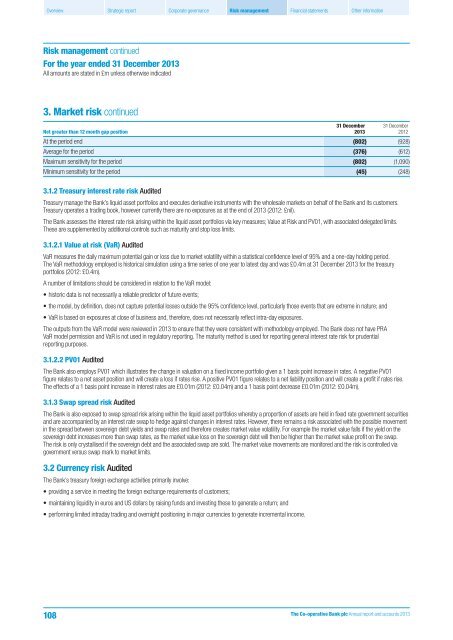

Net greater than 12 month gap position<br />

31 December<br />

2013<br />

31 December<br />

2012<br />

At the period end (802) (928)<br />

Average for the period (376) (612)<br />

Maximum sensitivity for the period (802) (1,090)<br />

Minimum sensitivity for the period (45) (248)<br />

3.1.2 Treasury interest rate risk Audited<br />

Treasury manage the Bank’s liquid asset portfolios <strong>and</strong> executes derivative instruments with the wholesale markets on behalf of the Bank <strong>and</strong> its customers.<br />

Treasury operates a trading book, however currently there are no exposures as at the end of 2013 (2012: £nil).<br />

The Bank assesses the interest rate risk arising within the liquid asset portfolios via key measures; Value at Risk <strong>and</strong> PV01, with associated delegated limits.<br />

These are supplemented by additional controls such as maturity <strong>and</strong> stop loss limits.<br />

3.1.2.1 Value at risk (VaR) Audited<br />

VaR measures the daily maximum potential gain or loss due to market volatility within a statistical confidence level of 95% <strong>and</strong> a one-day holding period.<br />

The VaR methodology employed is historical simulation using a time series of one year to latest day <strong>and</strong> was £0.4m at 31 December 2013 for the treasury<br />

portfolios (2012: £0.4m).<br />

A number of limitations should be considered in relation to the VaR model:<br />

• historic data is not necessarily a reliable predictor of future events;<br />

• the model, by definition, does not capture potential losses outside the 95% confidence level, particularly those events that are extreme in nature; <strong>and</strong><br />

• VaR is based on exposures at close of business <strong>and</strong>, therefore, does not necessarily reflect intra-day exposures.<br />

The outputs from the VaR model were reviewed in 2013 to ensure that they were consistent with methodology employed. The Bank does not have PRA<br />

VaR model permission <strong>and</strong> VaR is not used in regulatory reporting. The maturity method is used for reporting general interest rate risk for prudential<br />

reporting purposes.<br />

3.1.2.2 PV01 Audited<br />

The Bank also employs PV01 which illustrates the change in valuation on a fixed income portfolio given a 1 basis point increase in rates. A negative PV01<br />

figure relates to a net asset position <strong>and</strong> will create a loss if rates rise. A positive PV01 figure relates to a net liability position <strong>and</strong> will create a profit if rates rise.<br />

The effects of a 1 basis point increase in interest rates are £0.01m (2012: £0.04m) <strong>and</strong> a 1 basis point decrease £0.01m (2012: £0.04m).<br />

3.1.3 Swap spread risk Audited<br />

The Bank is also exposed to swap spread risk arising within the liquid asset portfolios whereby a proportion of assets are held in fixed rate government securities<br />

<strong>and</strong> are accompanied by an interest rate swap to hedge against changes in interest rates. However, there remains a risk associated with the possible movement<br />

in the spread between sovereign debt yields <strong>and</strong> swap rates <strong>and</strong> therefore creates market value volatility. For example the market value falls if the yield on the<br />

sovereign debt increases more than swap rates, as the market value loss on the sovereign debt will then be higher than the market value profit on the swap.<br />

The risk is only crystallised if the sovereign debt <strong>and</strong> the associated swap are sold. The market value movements are monitored <strong>and</strong> the risk is controlled via<br />

government versus swap mark to market limits.<br />

3.2 Currency risk Audited<br />

The Bank’s treasury foreign exchange activities primarily involve:<br />

• providing a service in meeting the foreign exchange requirements of customers;<br />

• maintaining liquidity in euros <strong>and</strong> US dollars by raising funds <strong>and</strong> investing these to generate a return; <strong>and</strong><br />

• performing limited intraday trading <strong>and</strong> overnight positioning in major currencies to generate incremental income.<br />

108<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013