bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

41. Fair values of financial assets <strong>and</strong> liabilities continued<br />

Covered Bond Limited Liability Partnerships<br />

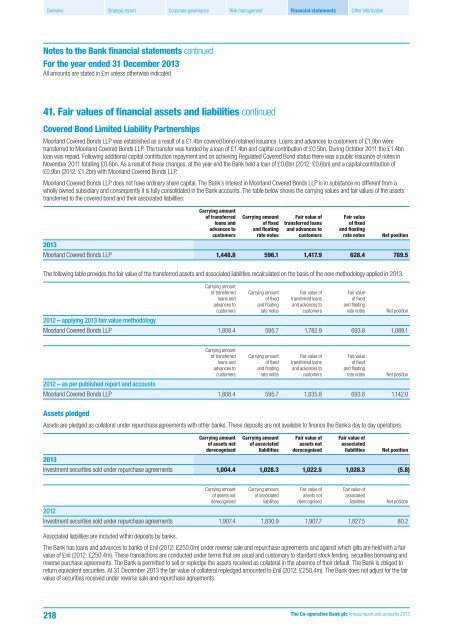

Moorl<strong>and</strong> Covered Bonds LLP was established as a result of a £1.4bn covered bond retained issuance. Loans <strong>and</strong> advances to customers of £1.9bn were<br />

transferred to Moorl<strong>and</strong> Covered Bonds LLP. The transfer was funded by a loan of £1.4bn <strong>and</strong> capital contribution of £0.5bn. During October 2011 the £1.4bn<br />

loan was repaid. Following additional capital contribution repayment <strong>and</strong> on achieving Regulated Covered Bond status there was a public issuance of notes in<br />

November 2011 totalling £0.6bn. As a result of these changes, at the year end the Bank held a loan of £0.6bn (2012: £0.6bn) <strong>and</strong> a capital contribution of<br />

£0.9bn (2012: £1.2bn) with Moorl<strong>and</strong> Covered Bonds LLP.<br />

Moorl<strong>and</strong> Covered Bonds LLP does not have ordinary share capital. The Bank’s interest in Moorl<strong>and</strong> Covered Bonds LLP is in substance no different from a<br />

wholly owned subsidiary <strong>and</strong> consequently it is fully consolidated in the Bank accounts. The table below shows the carrying values <strong>and</strong> fair values of the assets<br />

transferred to the covered bond <strong>and</strong> their associated liabilities:<br />

Carrying amount<br />

of transferred<br />

loans <strong>and</strong><br />

advances to<br />

customers<br />

Carrying amount<br />

of fixed<br />

<strong>and</strong> floating<br />

rate notes<br />

Fair value of<br />

transferred loans<br />

<strong>and</strong> advances to<br />

customers<br />

Fair value<br />

of fixed<br />

<strong>and</strong> floating<br />

rate notes<br />

Net position<br />

2013<br />

Moorl<strong>and</strong> Covered Bonds LLP 1,448.8 596.1 1,417.9 628.4 789.5<br />

The following table provides the fair value of the transferred assets <strong>and</strong> associated liabilities recalculated on the basis of the new methodology applied in 2013.<br />

Carrying amount<br />

of transferred<br />

loans <strong>and</strong><br />

advances to<br />

customers<br />

Carrying amount<br />

of fixed<br />

<strong>and</strong> floating<br />

rate notes<br />

Fair value of<br />

transferred loans<br />

<strong>and</strong> advances to<br />

customers<br />

Fair value<br />

of fixed<br />

<strong>and</strong> floating<br />

rate notes<br />

Net position<br />

2012 – applying 2013 fair value methodology<br />

Moorl<strong>and</strong> Covered Bonds LLP 1,808.4 595.7 1,782.9 693.8 1,089.1<br />

Carrying amount<br />

of transferred<br />

loans <strong>and</strong><br />

advances to<br />

customers<br />

Carrying amount<br />

of fixed<br />

<strong>and</strong> floating<br />

rate notes<br />

Fair value of<br />

transferred loans<br />

<strong>and</strong> advances to<br />

customers<br />

Fair value<br />

of fixed<br />

<strong>and</strong> floating<br />

rate notes<br />

Net position<br />

2012 – as per published report <strong>and</strong> accounts<br />

Moorl<strong>and</strong> Covered Bonds LLP 1,808.4 595.7 1,835.8 693.8 1,142.0<br />

Assets pledged<br />

Assets are pledged as collateral under repurchase agreements with other <strong>bank</strong>s. These deposits are not available to finance the Bank’s day to day operations.<br />

Carrying amount<br />

of assets not<br />

derecognised<br />

Carrying amount<br />

of associated<br />

liabilities<br />

Fair value of<br />

assets not<br />

derecognised<br />

Fair value of<br />

associated<br />

liabilities<br />

Net position<br />

2013<br />

Investment securities sold under repurchase agreements 1,004.4 1,028.3 1,022.5 1,028.3 (5.8)<br />

Carrying amount<br />

of assets not<br />

derecognised<br />

Carrying amount<br />

of associated<br />

liabilities<br />

Fair value of<br />

assets not<br />

derecognised<br />

Fair value of<br />

associated<br />

liabilities<br />

Net position<br />

2012<br />

Investment securities sold under repurchase agreements 1,907.4 1,830.9 1,907.7 1,827.5 80.2<br />

Associated liabilities are included within deposits by <strong>bank</strong>s.<br />

The Bank has loans <strong>and</strong> advances to <strong>bank</strong>s of £nil (2012: £250.0m) under reverse sale <strong>and</strong> repurchase agreements <strong>and</strong> against which gilts are held with a fair<br />

value of £nil (2012: £250.4m). These transactions are conducted under terms that are usual <strong>and</strong> customary to st<strong>and</strong>ard stock lending, securities borrowing <strong>and</strong><br />

reverse purchase agreements. The Bank is permitted to sell or repledge the assets received as collateral in the absence of their default. The Bank is obliged to<br />

return equivalent securities. At 31 December 2013 the fair value of collateral repledged amounted to £nil (2012: £250.4m). The Bank does not adjust for the fair<br />

value of securities received under reverse sale <strong>and</strong> repurchase agreements.<br />

218<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013