bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Company financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

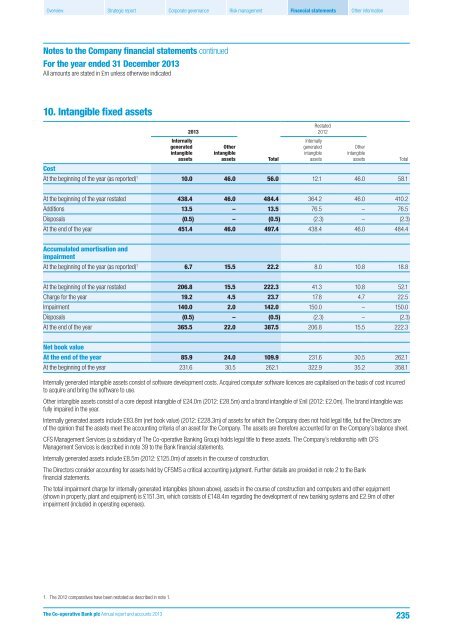

10. Intangible fixed assets<br />

2013<br />

Internally<br />

generated<br />

intangible<br />

assets<br />

Other<br />

intangible<br />

assets<br />

Total<br />

Restated<br />

2012<br />

Internally<br />

generated<br />

intangible<br />

assets<br />

Other<br />

intangible<br />

assets<br />

Cost<br />

At the beginning of the year (as reported) 1 10.0 46.0 56.0 12.1 46.0 58.1<br />

Total<br />

At the beginning of the year restated 438.4 46.0 484.4 364.2 46.0 410.2<br />

Additions 13.5 – 13.5 76.5 – 76.5<br />

Disposals (0.5) – (0.5) (2.3) – (2.3)<br />

At the end of the year 451.4 46.0 497.4 438.4 46.0 484.4<br />

Accumulated amortisation <strong>and</strong><br />

impairment<br />

At the beginning of the year (as reported) 1 6.7 15.5 22.2 8.0 10.8 18.8<br />

At the beginning of the year restated 206.8 15.5 222.3 41.3 10.8 52.1<br />

Charge for the year 19.2 4.5 23.7 17.8 4.7 22.5<br />

Impairment 140.0 2.0 142.0 150.0 – 150.0<br />

Disposals (0.5) – (0.5) (2.3) – (2.3)<br />

At the end of the year 365.5 22.0 387.5 206.8 15.5 222.3<br />

Net book value<br />

At the end of the year 85.9 24.0 109.9 231.6 30.5 262.1<br />

At the beginning of the year 231.6 30.5 262.1 322.9 35.2 358.1<br />

Internally generated intangible assets consist of software development costs. Acquired computer software licences are capitalised on the basis of cost incurred<br />

to acquire <strong>and</strong> bring the software to use.<br />

Other intangible assets consist of a core deposit intangible of £24.0m (2012: £28.5m) <strong>and</strong> a br<strong>and</strong> intangible of £nil (2012: £2.0m). The br<strong>and</strong> intangible was<br />

fully impaired in the year.<br />

Internally generated assets include £83.8m (net book value) (2012: £228.3m) of assets for which the Company does not hold legal title, but the Directors are<br />

of the opinion that the assets meet the accounting criteria of an asset for the Company. The assets are therefore accounted for on the Company’s balance sheet.<br />

CFS Management Services (a subsidiary of The Co-operative Banking Group) holds legal title to these assets. The Company’s relationship with CFS<br />

Management Services is described in note 39 to the Bank financial statements.<br />

Internally generated assets include £8.5m (2012: £125.0m) of assets in the course of construction.<br />

The Directors consider accounting for assets held by CFSMS a critical accounting judgment. Further details are provided in note 2 to the Bank<br />

financial statements.<br />

The total impairment charge for internally generated intangibles (shown above), assets in the course of construction <strong>and</strong> computers <strong>and</strong> other equipment<br />

(shown in property, plant <strong>and</strong> equipment) is £151.3m, which consists of £148.4m regarding the development of new <strong>bank</strong>ing systems <strong>and</strong> £2.9m of other<br />

impairment (included in operating expenses).<br />

1. The 2012 comparatives have been restated as described in note 1.<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

235