bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

4. Recapitalisation <strong>and</strong> the Liability Management Exercise continued<br />

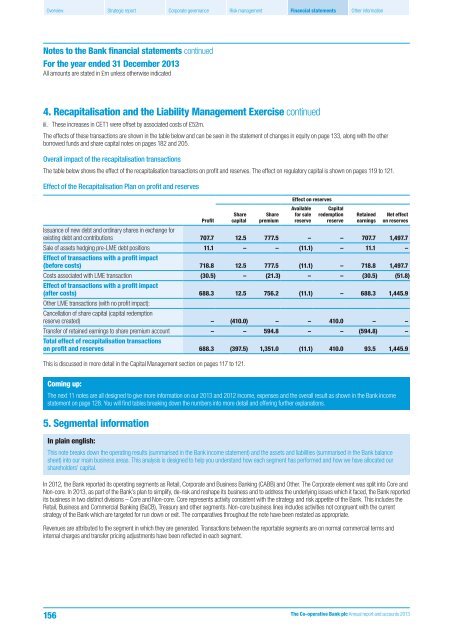

iii. These increases in CET1 were offset by associated costs of £52m.<br />

The effects of these transactions are shown in the table below <strong>and</strong> can be seen in the statement of changes in equity on page 133, along with the other<br />

borrowed funds <strong>and</strong> share capital notes on pages 182 <strong>and</strong> 205.<br />

Overall impact of the recapitalisation transactions<br />

The table below shows the effect of the recapitalisation transactions on profit <strong>and</strong> reserves. The effect on regulatory capital is shown on pages 119 to 121.<br />

Effect of the Recapitalisation Plan on profit <strong>and</strong> reserves<br />

Profit<br />

Share<br />

capital<br />

Share<br />

premium<br />

Effect on reserves<br />

Available<br />

for sale<br />

reserve<br />

Capital<br />

redemption<br />

reserve<br />

Retained<br />

earnings<br />

Net effect<br />

on reserves<br />

Issuance of new debt <strong>and</strong> ordinary shares in exchange for<br />

existing debt <strong>and</strong> contributions 707.7 12.5 777.5 – – 707.7 1,497.7<br />

Sale of assets hedging pre-LME debt positions 11.1 – – (11.1) – 11.1 –<br />

Effect of transactions with a profit impact<br />

(before costs) 718.8 12.5 777.5 (11.1) – 718.8 1,497.7<br />

Costs associated with LME transaction (30.5) – (21.3) – – (30.5) (51.8)<br />

Effect of transactions with a profit impact<br />

(after costs) 688.3 12.5 756.2 (11.1) – 688.3 1,445.9<br />

Other LME transactions (with no profit impact):<br />

Cancellation of share capital (capital redemption<br />

reserve created) – (410.0) – – 410.0 – –<br />

Transfer of retained earnings to share premium account – – 594.8 – – (594.8) –<br />

Total effect of recapitalisation transactions<br />

on profit <strong>and</strong> reserves 688.3 (397.5) 1,351.0 (11.1) 410.0 93.5 1,445.9<br />

This is discussed in more detail in the Capital Management section on pages 117 to 121.<br />

Coming up:<br />

The next 11 notes are all designed to give more information on our 2013 <strong>and</strong> 2012 income, expenses <strong>and</strong> the overall result as shown in the Bank income<br />

statement on page 128. You will find tables breaking down the numbers into more detail <strong>and</strong> offering further explanations.<br />

5. Segmental information<br />

In plain english:<br />

This note breaks down the operating results (summarised in the Bank income statement) <strong>and</strong> the assets <strong>and</strong> liabilities (summarised in the Bank balance<br />

sheet) into our main business areas. This analysis is designed to help you underst<strong>and</strong> how each segment has performed <strong>and</strong> how we have allocated our<br />

shareholders’ capital.<br />

In 2012, the Bank reported its operating segments as Retail, Corporate <strong>and</strong> Business Banking (CABB) <strong>and</strong> Other. The Corporate element was split into Core <strong>and</strong><br />

Non-core. In 2013, as part of the Bank’s plan to simplify, de-risk <strong>and</strong> reshape its business <strong>and</strong> to address the underlying issues which it faced, the Bank reported<br />

its business in two distinct divisions – Core <strong>and</strong> Non-core. Core represents activity consistent with the strategy <strong>and</strong> risk appetite of the Bank. This includes the<br />

Retail, Business <strong>and</strong> Commercial Banking (BaCB), Treasury <strong>and</strong> other segments. Non-core business lines includes activities not congruent with the current<br />

strategy of the Bank which are targeted for run down or exit. The comparatives throughout the note have been restated as appropriate.<br />

Revenues are attributed to the segment in which they are generated. Transactions between the reportable segments are on normal commercial terms <strong>and</strong><br />

internal charges <strong>and</strong> transfer pricing adjustments have been reflected in each segment.<br />

156<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013