bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

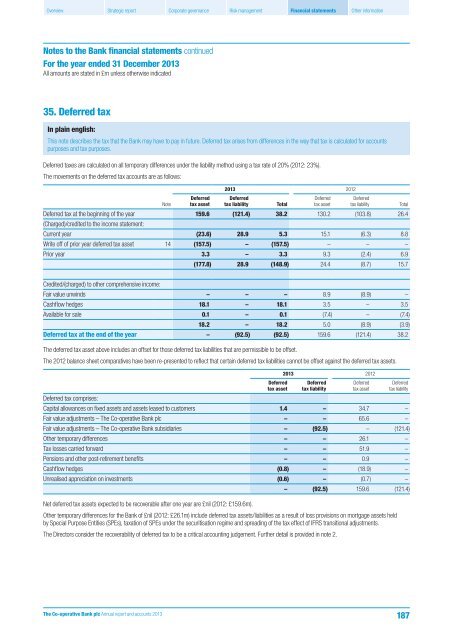

35. Deferred tax<br />

In plain english:<br />

This note describes the tax that the Bank may have to pay in future. Deferred tax arises from differences in the way that tax is calculated for accounts<br />

purposes <strong>and</strong> tax purposes.<br />

Deferred taxes are calculated on all temporary differences under the liability method using a tax rate of 20% (2012: 23%).<br />

The movements on the deferred tax accounts are as follows:<br />

2013 2012<br />

Note<br />

Deferred<br />

tax asset<br />

Deferred<br />

tax liability<br />

Total<br />

Deferred<br />

tax asset<br />

Deferred<br />

tax liability<br />

Total<br />

Deferred tax at the beginning of the year 159.6 (121.4) 38.2 130.2 (103.8) 26.4<br />

(Charged)/credited to the income statement:<br />

Current year (23.6) 28.9 5.3 15.1 (6.3) 8.8<br />

Write off of prior year deferred tax asset 14 (157.5) – (157.5) – – –<br />

Prior year 3.3 – 3.3 9.3 (2.4) 6.9<br />

(177.8) 28.9 (148.9) 24.4 (8.7) 15.7<br />

Credited/(charged) to other comprehensive income:<br />

Fair value unwinds – – – 8.9 (8.9) –<br />

Cashflow hedges 18.1 – 18.1 3.5 – 3.5<br />

Available for sale 0.1 – 0.1 (7.4) – (7.4)<br />

18.2 – 18.2 5.0 (8.9) (3.9)<br />

Deferred tax at the end of the year – (92.5) (92.5) 159.6 (121.4) 38.2<br />

The deferred tax asset above includes an offset for those deferred tax liabilities that are permissible to be offset.<br />

The 2012 balance sheet comparatives have been re-presented to reflect that certain deferred tax liabilities cannot be offset against the deferred tax assets.<br />

Deferred<br />

tax asset<br />

2013 2012<br />

Deferred<br />

tax liability<br />

Deferred<br />

tax asset<br />

Deferred<br />

tax liability<br />

Deferred tax comprises:<br />

Capital allowances on fixed assets <strong>and</strong> assets leased to customers 1.4 – 34.7 –<br />

Fair value adjustments – The Co-operative Bank plc – – 65.6 –<br />

Fair value adjustments – The Co-operative Bank subsidiaries – (92.5) – (121.4)<br />

Other temporary differences – – 26.1 –<br />

Tax losses carried forward – – 51.9 –<br />

Pensions <strong>and</strong> other post-retirement benefits – – 0.9 –<br />

Cashflow hedges (0.8) – (18.9) –<br />

Unrealised appreciation on investments (0.6) – (0.7) –<br />

– (92.5) 159.6 (121.4)<br />

Net deferred tax assets expected to be recoverable after one year are £nil (2012: £159.6m).<br />

Other temporary differences for the Bank of £nil (2012: £26.1m) include deferred tax assets/liabilities as a result of loss provisions on mortgage assets held<br />

by Special Purpose Entities (SPEs), taxation of SPEs under the securitisation regime <strong>and</strong> spreading of the tax effect of IFRS transitional adjustments.<br />

The Directors consider the recoverability of deferred tax to be a critical accounting judgement. Further detail is provided in note 2.<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

187