bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

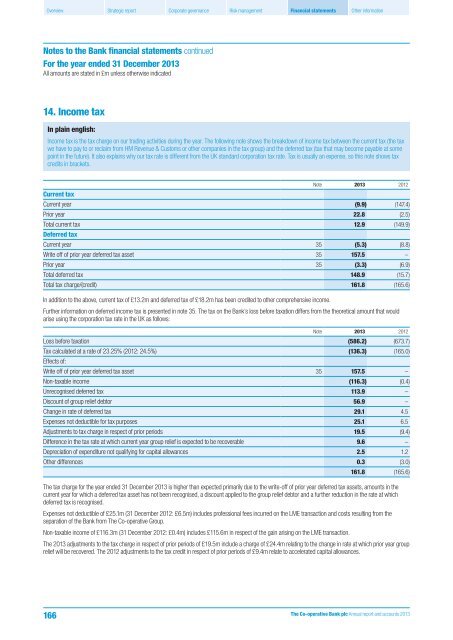

14. Income tax<br />

In plain english:<br />

Income tax is the tax charge on our trading activities during the year. The following note shows the breakdown of income tax between the current tax (the tax<br />

we have to pay to or reclaim from HM Revenue & Customs or other companies in the tax group) <strong>and</strong> the deferred tax (tax that may become payable at some<br />

point in the future). It also explains why our tax rate is different from the UK st<strong>and</strong>ard corporation tax rate. Tax is usually an expense, so this note shows tax<br />

credits in brackets.<br />

Note 2013 2012<br />

Current tax<br />

Current year (9.9) (147.4)<br />

Prior year 22.8 (2.5)<br />

Total current tax 12.9 (149.9)<br />

Deferred tax<br />

Current year 35 (5.3) (8.8)<br />

Write off of prior year deferred tax asset 35 157.5 –<br />

Prior year 35 (3.3) (6.9)<br />

Total deferred tax 148.9 (15.7)<br />

Total tax charge/(credit) 161.8 (165.6)<br />

In addition to the above, current tax of £13.2m <strong>and</strong> deferred tax of £18.2m has been credited to other comprehensive income.<br />

Further information on deferred income tax is presented in note 35. The tax on the Bank’s loss before taxation differs from the theoretical amount that would<br />

arise using the corporation tax rate in the UK as follows:<br />

Note 2013 2012<br />

Loss before taxation (586.2) (673.7)<br />

Tax calculated at a rate of 23.25% (2012: 24.5%) (136.3) (165.0)<br />

Effects of:<br />

Write off of prior year deferred tax asset 35 157.5 –<br />

Non-taxable income (116.3) (0.4)<br />

Unrecognised deferred tax 113.9 –<br />

Discount of group relief debtor 56.9 –<br />

Change in rate of deferred tax 29.1 4.5<br />

Expenses not deductible for tax purposes 25.1 6.5<br />

Adjustments to tax charge in respect of prior periods 19.5 (9.4)<br />

Difference in the tax rate at which current year group relief is expected to be recoverable 9.6 –<br />

Depreciation of expenditure not qualifying for capital allowances 2.5 1.2<br />

Other differences 0.3 (3.0)<br />

161.8 (165.6)<br />

The tax charge for the year ended 31 December 2013 is higher than expected primarily due to the write-off of prior year deferred tax assets, amounts in the<br />

current year for which a deferred tax asset has not been recognised, a discount applied to the group relief debtor <strong>and</strong> a further reduction in the rate at which<br />

deferred tax is recognised.<br />

Expenses not deductible of £25.1m (31 December 2012: £6.5m) includes professional fees incurred on the LME transaction <strong>and</strong> costs resulting from the<br />

separation of the Bank from The Co-operative Group.<br />

Non-taxable income of £116.3m (31 December 2012: £0.4m) includes £115.6m in respect of the gain arising on the LME transaction.<br />

The 2013 adjustments to the tax charge in respect of prior periods of £19.5m include a charge of £24.4m relating to the change in rate at which prior year group<br />

relief will be recovered. The 2012 adjustments to the tax credit in respect of prior periods of £9.4m relate to accelerated capital allowances.<br />

166<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013