bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

41. Fair values of financial assets <strong>and</strong> liabilities continued<br />

Transferred assets include securitised gilts <strong>and</strong> loans <strong>and</strong> advances to customers that have not been derecognised by the seller. The associated liabilities include<br />

the fixed <strong>and</strong> floating rate notes, <strong>bank</strong> loans <strong>and</strong> intercompany loans that specifically relate to the funding for the assets securitised.<br />

The difference between the fair value <strong>and</strong> carrying value of the mortgages that have been securitised within Leek 17, 18 <strong>and</strong> 19 is significantly higher than the<br />

fair value to carrying value difference for the associated liabilities. This is because it is expected that the notes will be repaid at par at the call date of the Leek<br />

liabilities whereas most of the mortgages will continue to be held on the Bank’s balance sheet for a significant period after the notes have repaid <strong>and</strong> these<br />

mortgages have an interest rate which is below the equivalent market rate at the balance sheet date for loans of a similar nature.<br />

The securitisation vehicles receive cash daily in relation to the transferred loans <strong>and</strong> advances <strong>and</strong> semi-annually for the transferred gilts. These amounts are<br />

held within loans <strong>and</strong> advances to <strong>bank</strong>s until the associated liabilities’ payments are due. Payments are made quarterly for all associated liabilities except for the<br />

variable funding notes associated with the transferred gilts, which are paid semi-annually. The amounts held within loans <strong>and</strong> advances to <strong>bank</strong>s are not included<br />

in the table above but will be used in part to cover the repayments made on the associated liabilities.<br />

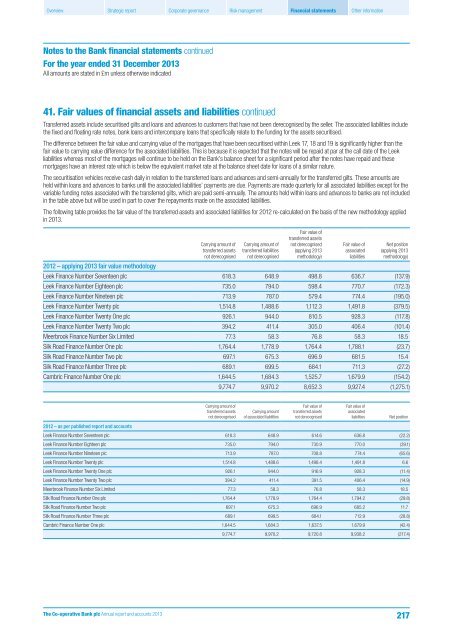

The following table provides the fair value of the transferred assets <strong>and</strong> associated liabilities for 2012 re-calculated on the basis of the new methodology applied<br />

in 2013.<br />

Carrying amount of<br />

transferred assets<br />

not derecognised<br />

Carrying amount of<br />

transferred liabilities<br />

not derecognised<br />

Fair value of<br />

transferred assets<br />

not derecognised<br />

(applying 2013<br />

methodology)<br />

Fair value of<br />

associated<br />

liabilities<br />

Net position<br />

(applying 2013<br />

methodology)<br />

2012 – applying 2013 fair value methodology<br />

Leek Finance Number Seventeen plc 618.3 648.9 498.8 636.7 (137.9)<br />

Leek Finance Number Eighteen plc 735.0 794.0 598.4 770.7 (172.3)<br />

Leek Finance Number Nineteen plc 713.9 787.0 579.4 774.4 (195.0)<br />

Leek Finance Number Twenty plc 1,514.8 1,488.6 1,112.3 1,491.8 (379.5)<br />

Leek Finance Number Twenty One plc 926.1 944.0 810.5 928.3 (117.8)<br />

Leek Finance Number Twenty Two plc 394.2 411.4 305.0 406.4 (101.4)<br />

Meerbrook Finance Number Six Limited 77.3 58.3 76.8 58.3 18.5<br />

Silk Road Finance Number One plc 1,764.4 1,778.9 1,764.4 1,788.1 (23.7)<br />

Silk Road Finance Number Two plc 697.1 675.3 696.9 681.5 15.4<br />

Silk Road Finance Number Three plc 689.1 699.5 684.1 711.3 (27.2)<br />

Cambric Finance Number One plc 1,644.5 1,684.3 1,525.7 1,679.9 (154.2)<br />

9,774.7 9,970.2 8,652.3 9,927.4 (1,275.1)<br />

Carrying amount of<br />

transferred assets<br />

not derecognised<br />

Carrying amount<br />

of associated liabilities<br />

Fair value of<br />

transferred assets<br />

not derecognised<br />

Fair value of<br />

associated<br />

liabilities<br />

Net position<br />

2012 – as per published report <strong>and</strong> accounts<br />

Leek Finance Number Seventeen plc 618.3 648.9 614.6 636.8 (22.2)<br />

Leek Finance Number Eighteen plc 735.0 794.0 730.9 770.0 (39.1)<br />

Leek Finance Number Nineteen plc 713.9 787.0 708.8 774.4 (65.6)<br />

Leek Finance Number Twenty plc 1,514.8 1,488.6 1,498.4 1,491.8 6.6<br />

Leek Finance Number Twenty One plc 926.1 944.0 916.9 928.3 (11.4)<br />

Leek Finance Number Twenty Two plc 394.2 411.4 391.5 406.4 (14.9)<br />

Meerbrook Finance Number Six Limited 77.3 58.3 76.8 58.3 18.5<br />

Silk Road Finance Number One plc 1,764.4 1,778.9 1,764.4 1,794.2 (29.8)<br />

Silk Road Finance Number Two plc 697.1 675.3 696.9 685.2 11.7<br />

Silk Road Finance Number Three plc 689.1 699.5 684.1 712.9 (28.8)<br />

Cambric Finance Number One plc 1,644.5 1,684.3 1,637.5 1,679.9 (42.4)<br />

9,774.7 9,970.2 9,720.8 9,938.2 (217.4)<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

217