bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

20. Derivative financial instruments<br />

In plain english:<br />

A derivative is a financial instrument used to manage risk. Its value changes over time in response to underlying variables such as interest rates or exchange<br />

rates. These contracts are for a fixed period. Our derivatives include a variety of financial contracts, many of which are designed to help customers manage<br />

their interest rate <strong>and</strong> currency risks. We also use derivatives ourselves, to manage our own interest rate <strong>and</strong> foreign currency risk.<br />

The value of the derivative contracts that you can see in our balance sheet is determined by fluctuations in the underlying item. The derivative will appear as<br />

an asset if we have benefitted from the contract by the balance sheet date <strong>and</strong> as a liability if we have not benefitted.<br />

As you can imagine, the value of these derivatives is very volatile as market conditions change on a daily basis.<br />

The Bank has entered, as principal, into various derivatives either as a trading activity, which includes proprietary transactions <strong>and</strong> customer facilitation, or as a<br />

hedging activity for the management of interest rate risk, equity risk <strong>and</strong> foreign exchange rate risk. Positive <strong>and</strong> negative fair values have not been netted as the<br />

Bank does not have a legal right of offset.<br />

Derivatives held for trading purposes<br />

The trading transactions are wholly interest rate related contracts including swaps, caps <strong>and</strong> floors, forward rate agreements <strong>and</strong> exchange traded futures.<br />

Trading transactions include derivatives where the Bank enters into a transaction to accommodate a customer together with the corresponding hedge<br />

transaction. The Bank no longer holds derivatives for trading purposes.<br />

Non-trading derivatives<br />

Non-trading transactions comprise derivatives held for hedging purposes to manage the asset <strong>and</strong> liability positions of the Bank. Derivatives used to manage<br />

interest rate related positions include swaps, caps <strong>and</strong> floors, forward rate agreements <strong>and</strong> exchange traded futures. The foreign exchange rate positions are<br />

managed using forward currency transactions <strong>and</strong> swaps. Equity risk is managed using equity swaps.<br />

During the year the Bank has entered into fair value hedges to mitigate price movements due to interest rate sensitivities.<br />

2013<br />

Fair value<br />

2012<br />

Fair value<br />

Assets Liabilities Assets Liabilities<br />

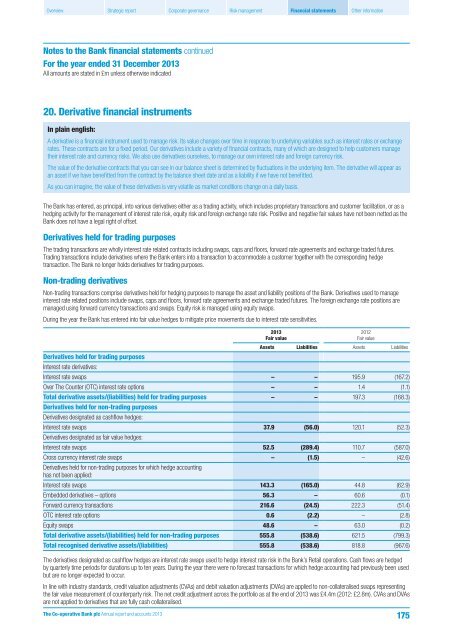

Derivatives held for trading purposes<br />

Interest rate derivatives:<br />

Interest rate swaps – – 195.9 (167.2)<br />

Over The Counter (OTC) interest rate options – – 1.4 (1.1)<br />

Total derivative assets/(liabilities) held for trading purposes – – 197.3 (168.3)<br />

Derivatives held for non-trading purposes<br />

Derivatives designated as cashflow hedges:<br />

Interest rate swaps 37.9 (56.0) 120.1 (52.3)<br />

Derivatives designated as fair value hedges:<br />

Interest rate swaps 52.5 (289.4) 110.7 (587.0)<br />

Cross currency interest rate swaps – (1.5) – (42.6)<br />

Derivatives held for non-trading purposes for which hedge accounting<br />

has not been applied:<br />

Interest rate swaps 143.3 (165.0) 44.8 (62.9)<br />

Embedded derivatives – options 56.3 – 60.6 (0.1)<br />

Forward currency transactions 216.6 (24.5) 222.3 (51.4)<br />

OTC interest rate options 0.6 (2.2) – (2.8)<br />

Equity swaps 48.6 – 63.0 (0.2)<br />

Total derivative assets/(liabilities) held for non-trading purposes 555.8 (538.6) 621.5 (799.3)<br />

Total recognised derivative assets/(liabilities) 555.8 (538.6) 818.8 (967.6)<br />

The derivatives designated as cashflow hedges are interest rate swaps used to hedge interest rate risk in the Bank’s Retail operations. Cash flows are hedged<br />

by quarterly time periods for durations up to ten years. During the year there were no forecast transactions for which hedge accounting had previously been used<br />

but are no longer expected to occur.<br />

In line with industry st<strong>and</strong>ards, credit valuation adjustments (CVAs) <strong>and</strong> debit valuation adjustments (DVAs) are applied to non-collateralised swaps representing<br />

the fair value measurement of counterparty risk. The net credit adjustment across the portfolio as at the end of 2013 was £4.4m (2012: £2.8m). CVAs <strong>and</strong> DVAs<br />

are not applied to derivatives that are fully cash collateralised.<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

175