bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

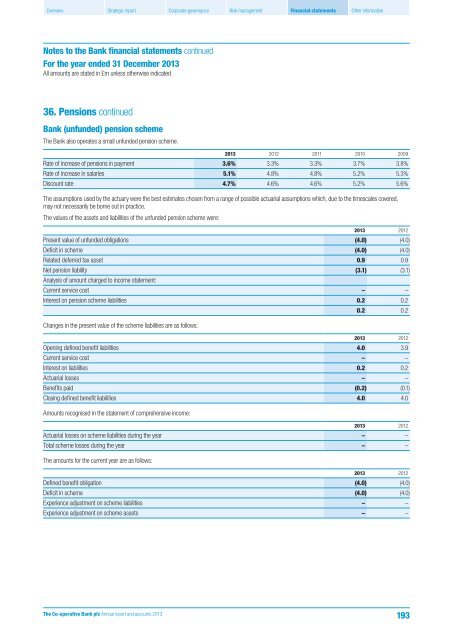

36. Pensions continued<br />

Bank (unfunded) pension scheme<br />

The Bank also operates a small unfunded pension scheme.<br />

2013 2012 2011 2010 2009<br />

Rate of increase of pensions in payment 3.6% 3.3% 3.3% 3.7% 3.8%<br />

Rate of increase in salaries 5.1% 4.8% 4.8% 5.2% 5.3%<br />

Discount rate 4.7% 4.6% 4.6% 5.2% 5.6%<br />

The assumptions used by the actuary were the best estimates chosen from a range of possible actuarial assumptions which, due to the timescales covered,<br />

may not necessarily be borne out in practice.<br />

The values of the assets <strong>and</strong> liabilities of the unfunded pension scheme were:<br />

2013 2012<br />

Present value of unfunded obligations (4.0) (4.0)<br />

Deficit in scheme (4.0) (4.0)<br />

Related deferred tax asset 0.9 0.9<br />

Net pension liability (3.1) (3.1)<br />

Analysis of amount charged to income statement:<br />

Current service cost – –<br />

Interest on pension scheme liabilities 0.2 0.2<br />

0.2 0.2<br />

Changes in the present value of the scheme liabilities are as follows:<br />

2013 2012<br />

Opening defined benefit liabilities 4.0 3.9<br />

Current service cost – –<br />

Interest on liabilities 0.2 0.2<br />

Actuarial losses – –<br />

Benefits paid (0.2) (0.1)<br />

Closing defined benefit liabilities 4.0 4.0<br />

Amounts recognised in the statement of comprehensive income:<br />

2013 2012<br />

Actuarial losses on scheme liabilities during the year – –<br />

Total scheme losses during the year – –<br />

The amounts for the current year are as follows:<br />

2013 2012<br />

Defined benefit obligation (4.0) (4.0)<br />

Deficit in scheme (4.0) (4.0)<br />

Experience adjustment on scheme liabilities – –<br />

Experience adjustment on scheme assets – –<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

193