bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Directors’ Remuneration report continued<br />

Pillar 3 disclosures<br />

As part of its responsibilities, the Bank Remuneration Committee also oversees remuneration for individuals who are included on the Bank’s register of<br />

‘Code Staff’. As noted within this Directors’ Remuneration Report, a new remuneration policy is being developed for Directors. In addition <strong>and</strong> as part of the<br />

same exercise, a new remuneration policy will be developed <strong>and</strong> adopted for Code Staff.<br />

It is intended that the new remuneration policy will be based on linking pay to performance <strong>and</strong> ensuring that any remuneration arrangements are consistent<br />

with the Bank’s risk appetite. Any variable remuneration arrangements in place will incorporate performance conditions that support the Bank’s strategy <strong>and</strong><br />

also comply with the provisions of the PRA Remuneration Code.<br />

The current policy operated for Code Staff is based on the following:<br />

• Code Staff are defined as those staff having a material impact on the Bank’s risk profile, including a person who performs a significant influence function for<br />

the Bank, a senior manager <strong>and</strong> a risk taker.<br />

• Decisions on remuneration for Code Staff are made by the Committee. Advice is taken from the Risk function in making remuneration decisions. The design<br />

of the component parts of remuneration is as set out for the Executive Directors above.<br />

• For Code Staff, performance related pay is risk adjusted through the use of underpins to the incentive arrangements, together with the use of deferrals,<br />

clawback <strong>and</strong> malus adjustments in accordance with the PRA Remuneration Code, as set out for the Executive Directors above.<br />

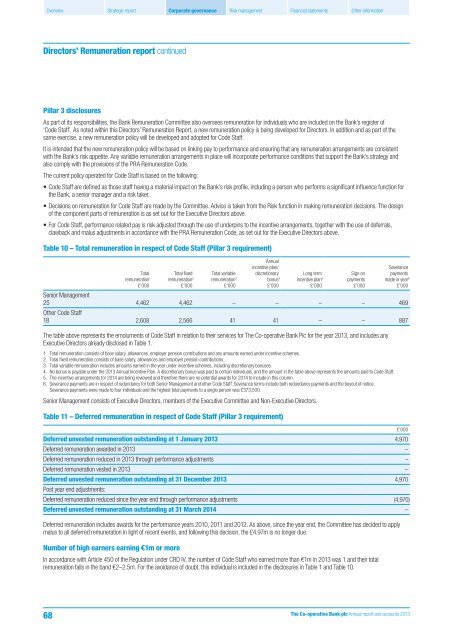

Table 10 – Total remuneration in respect of Code Staff (Pillar 3 requirement)<br />

Total<br />

remuneration 1<br />

£’000<br />

Total fixed<br />

remuneration 2<br />

£’000<br />

Total variable<br />

remuneration 3<br />

£’000<br />

Annual<br />

incentive plan/<br />

discretionary<br />

bonus 4<br />

£’000<br />

Long term<br />

incentive plan 5<br />

£’000<br />

Sign on<br />

payments<br />

£’000<br />

Severance<br />

payments<br />

made in year 6<br />

£’000<br />

Senior Management<br />

25 4,462 4,462 – – – – 469<br />

Other Code Staff<br />

18 2,608 2,566 41 41 – – 887<br />

The table above represents the emoluments of Code Staff in relation to their services for The Co-operative Bank Plc for the year 2013, <strong>and</strong> includes any<br />

Executive Directors already disclosed in Table 1.<br />

1. Total remuneration consists of base salary, allowances, employer pension contributions <strong>and</strong> any amounts earned under incentive schemes.<br />

2. Total fixed remuneration consists of base salary, allowances <strong>and</strong> employer pension contributions.<br />

3. Total variable remuneration includes amounts earned in the year under incentive schemes, including discretionary bonuses.<br />

4. No bonus is payable under the 2013 Annual Incentive Plan. A discretionary bonus was paid to certain individuals, <strong>and</strong> the amount in the table above represents the amounts paid to Code Staff.<br />

5. The incentive arrangements for 2014 are being reviewed <strong>and</strong> therefore there are no potential awards for 2014 to include in this column.<br />

6. Severance payments are in respect of redundancy for both Senior Management <strong>and</strong> other Code Staff. Severance terms include both redundancy payments <strong>and</strong> the buyout of notice.<br />

Severance payments were made to four individuals <strong>and</strong> the highest total payments to a single person was £373,500.<br />

Senior Management consists of Executive Directors, members of the Executive Committee <strong>and</strong> Non-Executive Directors.<br />

Table 11 – Deferred remuneration in respect of Code Staff (Pillar 3 requirement)<br />

£’000<br />

Deferred unvested remuneration outst<strong>and</strong>ing at 1 January 2013 4,970<br />

Deferred remuneration awarded in 2013 –<br />

Deferred remuneration reduced in 2013 through performance adjustments –<br />

Deferred remuneration vested in 2013 –<br />

Deferred unvested remuneration outst<strong>and</strong>ing at 31 December 2013 4,970<br />

Post year end adjustments:<br />

Deferred remuneration reduced since the year end through performance adjustments (4,970)<br />

Deferred unvested remuneration outst<strong>and</strong>ing at 31 March 2014 –<br />

Deferred remuneration includes awards for the performance years 2010, 2011 <strong>and</strong> 2012. As above, since the year end, the Committee has decided to apply<br />

malus to all deferred remuneration in light of recent events, <strong>and</strong> following this decision, the £4.97m is no longer due.<br />

Number of high earners earning €1m or more<br />

In accordance with Article 450 of the Regulation under CRD IV, the number of Code Staff who earned more than €1m in 2013 was 1 <strong>and</strong> their total<br />

remuneration falls in the b<strong>and</strong> €2–2.5m. For the avoidance of doubt, this individual is included in the disclosures in Table 1 <strong>and</strong> Table 10.<br />

68<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013