bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

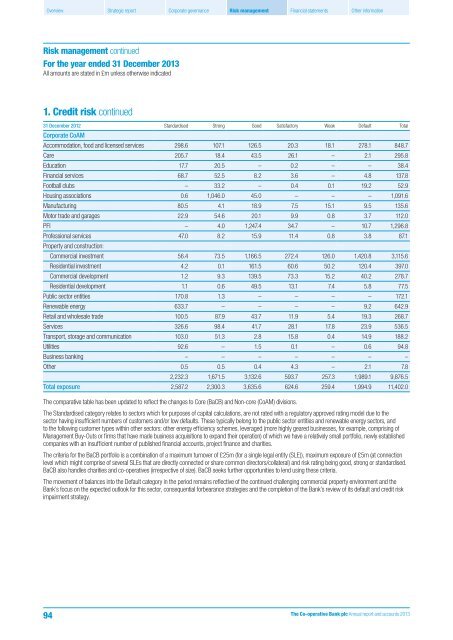

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Risk management continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

1. Credit risk continued<br />

31 December 2012 St<strong>and</strong>ardised Strong Good Satisfactory Weak Default Total<br />

Corporate CoAM<br />

Accommodation, food <strong>and</strong> licensed services 298.6 107.1 126.5 20.3 18.1 278.1 848.7<br />

Care 205.7 18.4 43.5 26.1 – 2.1 295.8<br />

Education 17.7 20.5 – 0.2 – – 38.4<br />

Financial services 68.7 52.5 8.2 3.6 – 4.8 137.8<br />

Football clubs – 33.2 – 0.4 0.1 19.2 52.9<br />

Housing associations 0.6 1,046.0 45.0 – – – 1,091.6<br />

Manufacturing 80.5 4.1 18.9 7.5 15.1 9.5 135.6<br />

Motor trade <strong>and</strong> garages 22.9 54.6 20.1 9.9 0.8 3.7 112.0<br />

PFI – 4.0 1,247.4 34.7 – 10.7 1,296.8<br />

Professional services 47.0 8.2 15.9 11.4 0.8 3.8 87.1<br />

Property <strong>and</strong> construction:<br />

Commercial investment 56.4 73.5 1,166.5 272.4 126.0 1,420.8 3,115.6<br />

Residential investment 4.2 0.1 161.5 60.6 50.2 120.4 397.0<br />

Commercial development 1.2 9.3 139.5 73.3 15.2 40.2 278.7<br />

Residential development 1.1 0.6 49.5 13.1 7.4 5.8 77.5<br />

Public sector entities 170.8 1.3 – – – – 172.1<br />

Renewable energy 633.7 – – – – 9.2 642.9<br />

Retail <strong>and</strong> wholesale trade 100.5 87.9 43.7 11.9 5.4 19.3 268.7<br />

Services 326.6 98.4 41.7 28.1 17.8 23.9 536.5<br />

Transport, storage <strong>and</strong> communication 103.0 51.3 2.8 15.8 0.4 14.9 188.2<br />

Utilities 92.6 – 1.5 0.1 – 0.6 94.8<br />

Business <strong>bank</strong>ing – – – – – – –<br />

Other 0.5 0.5 0.4 4.3 – 2.1 7.8<br />

2,232.3 1,671.5 3,132.6 593.7 257.3 1,989.1 9,876.5<br />

Total exposure 2,587.2 2,300.3 3,635.6 624.6 259.4 1,994.9 11,402.0<br />

The comparative table has been updated to reflect the changes to Core (BaCB) <strong>and</strong> Non-core (CoAM) divisions.<br />

The St<strong>and</strong>ardised category relates to sectors which for purposes of capital calculations, are not rated with a regulatory approved rating model due to the<br />

sector having insufficient numbers of customers <strong>and</strong>/or low defaults. These typically belong to the public sector entities <strong>and</strong> renewable energy sectors, <strong>and</strong><br />

to the following customer types within other sectors: other energy efficiency schemes, leveraged (more highly geared businesses, for example, comprising of<br />

Management Buy-Outs or firms that have made business acquisitions to exp<strong>and</strong> their operation) of which we have a relatively small portfolio, newly established<br />

companies with an insufficient number of published financial accounts, project finance <strong>and</strong> charities.<br />

The criteria for the BaCB portfolio is a combination of a maximum turnover of £25m (for a single legal entity (SLE)), maximum exposure of £5m (at connection<br />

level which might comprise of several SLEs that are directly connected or share common directors/collateral) <strong>and</strong> risk rating being good, strong or st<strong>and</strong>ardised.<br />

BaCB also h<strong>and</strong>les charities <strong>and</strong> co-operatives (irrespective of size). BaCB seeks further opportunities to lend using these criteria.<br />

The movement of balances into the Default category in the period remains reflective of the continued challenging commercial property environment <strong>and</strong> the<br />

Bank’s focus on the expected outlook for this sector, consequential forbearance strategies <strong>and</strong> the completion of the Bank’s review of its default <strong>and</strong> credit risk<br />

impairment strategy.<br />

94<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013