bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Capital management continued<br />

For the year ended 31 December 2013<br />

All the amounts are stated in £m unless otherwise indicated<br />

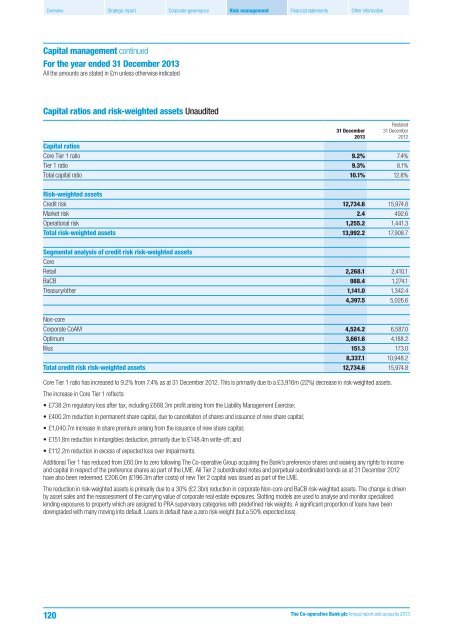

Capital ratios <strong>and</strong> risk-weighted assets Unaudited<br />

31 December<br />

2013<br />

Restated<br />

31 December<br />

2012<br />

Capital ratios<br />

Core Tier 1 ratio 9.2% 7.4%<br />

Tier 1 ratio 9.3% 8.1%<br />

Total capital ratio 10.1% 12.8%<br />

Risk-weighted assets<br />

Credit risk 12,734.6 15,974.8<br />

Market risk 2.4 492.6<br />

Operational risk 1,255.2 1,441.3<br />

Total risk-weighted assets 13,992.2 17,908.7<br />

Segmental analysis of credit risk risk-weighted assets<br />

Core<br />

Retail 2,268.1 2,410.1<br />

BaCB 988.4 1,274.1<br />

Treasury/other 1,141.0 1,342.4<br />

4,397.5 5,026.6<br />

Non-core<br />

Corporate CoAM 4,524.2 6,587.0<br />

Optimum 3,661.6 4,188.2<br />

Illius 151.3 173.0<br />

8,337.1 10,948.2<br />

Total credit risk risk-weighted assets 12,734.6 15,974.8<br />

Core Tier 1 ratio has increased to 9.2% from 7.4% as at 31 December 2012. This is primarily due to a £3,916m (22%) decrease in risk-weighted assets.<br />

The increase in Core Tier 1 reflects:<br />

• £738.2m regulatory loss after tax, including £688.3m profit arising from the Liability Management Exercise;<br />

• £400.2m reduction in permanent share capital, due to cancellation of shares <strong>and</strong> issuance of new share capital;<br />

• £1,040.7m increase in share premium arising from the issuance of new share capital;<br />

• £151.8m reduction in intangibles deduction, primarily due to £148.4m write-off; <strong>and</strong><br />

• £112.2m reduction in excess of expected loss over impairments.<br />

Additional Tier 1 has reduced from £60.0m to zero following The Co-operative Group acquiring the Bank’s preference shares <strong>and</strong> waiving any rights to income<br />

<strong>and</strong> capital in respect of the preference shares as part of the LME. All Tier 2 subordinated notes <strong>and</strong> perpetual subordinated bonds as at 31 December 2012<br />

have also been redeemed. £206.0m (£196.3m after costs) of new Tier 2 capital was issued as part of the LME.<br />

The reduction in risk-weighted assets is primarily due to a 30% (£2.3bn) reduction in corporate Non-core <strong>and</strong> BaCB risk-weighted assets. The change is driven<br />

by asset sales <strong>and</strong> the reassessment of the carrying value of corporate real estate exposures. Slotting models are used to analyse <strong>and</strong> monitor specialised<br />

lending exposures to property which are assigned to PRA supervisory categories with predefined risk weights. A significant proportion of loans have been<br />

downgraded with many moving into default. Loans in default have a zero risk-weight (but a 50% expected loss).<br />

120<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013