bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

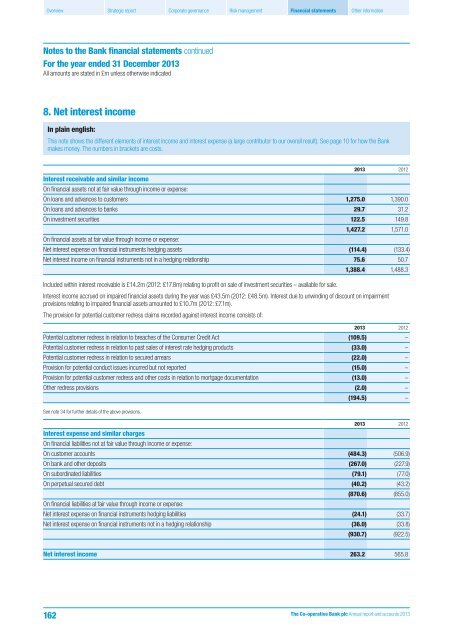

8. Net interest income<br />

In plain english:<br />

This note shows the different elements of interest income <strong>and</strong> interest expense (a large contributor to our overall result). See page 10 for how the Bank<br />

makes money. The numbers in brackets are costs.<br />

2013 2012<br />

Interest receivable <strong>and</strong> similar income<br />

On financial assets not at fair value through income or expense:<br />

On loans <strong>and</strong> advances to customers 1,275.0 1,390.0<br />

On loans <strong>and</strong> advances to <strong>bank</strong>s 29.7 31.2<br />

On investment securities 122.5 149.8<br />

1,427.2 1,571.0<br />

On financial assets at fair value through income or expense:<br />

Net interest expense on financial instruments hedging assets (114.4) (133.4)<br />

Net interest income on financial instruments not in a hedging relationship 75.6 50.7<br />

1,388.4 1,488.3<br />

Included within interest receivable is £14.2m (2012: £17.8m) relating to profit on sale of investment securities – available for sale.<br />

Interest income accrued on impaired financial assets during the year was £43.5m (2012: £48.5m). Interest due to unwinding of discount on impairment<br />

provisions relating to impaired financial assets amounted to £10.7m (2012: £7.1m).<br />

The provision for potential customer redress claims recorded against interest income consists of:<br />

2013 2012<br />

Potential customer redress in relation to breaches of the Consumer Credit Act (109.5) –<br />

Potential customer redress in relation to past sales of interest rate hedging products (33.0) –<br />

Potential customer redress in relation to secured arrears (22.0) –<br />

Provision for potential conduct issues incurred but not reported (15.0) –<br />

Provision for potential customer redress <strong>and</strong> other costs in relation to mortgage documentation (13.0) –<br />

Other redress provisions (2.0) –<br />

(194.5) –<br />

See note 34 for further details of the above provisions.<br />

2013 2012<br />

Interest expense <strong>and</strong> similar charges<br />

On financial liabilities not at fair value through income or expense:<br />

On customer accounts (484.3) (506.9)<br />

On <strong>bank</strong> <strong>and</strong> other deposits (267.0) (227.9)<br />

On subordinated liabilities (79.1) (77.0)<br />

On perpetual secured debt (40.2) (43.2)<br />

(870.6) (855.0)<br />

On financial liabilities at fair value through income or expense:<br />

Net interest expense on financial instruments hedging liabilities (24.1) (33.7)<br />

Net interest expense on financial instruments not in a hedging relationship (36.0) (33.8)<br />

(930.7) (922.5)<br />

Net interest income 263.2 565.8<br />

162<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013