bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Company financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

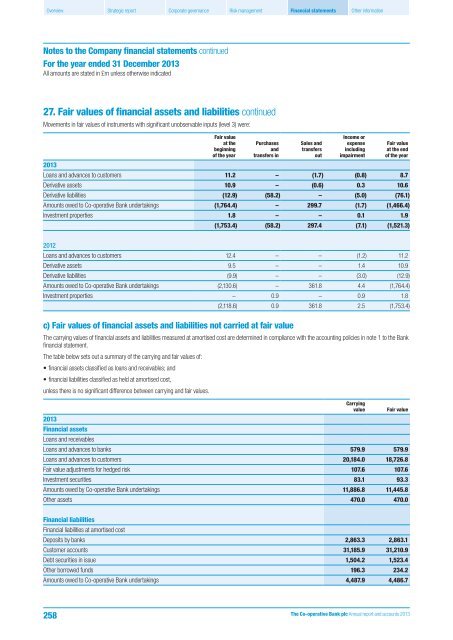

27. Fair values of financial assets <strong>and</strong> liabilities continued<br />

Movements in fair values of instruments with significant unobservable inputs (level 3) were:<br />

Fair value<br />

at the<br />

beginning<br />

of the year<br />

Purchases<br />

<strong>and</strong><br />

transfers in<br />

Sales <strong>and</strong><br />

transfers<br />

out<br />

Income or<br />

expense<br />

including<br />

impairment<br />

Fair value<br />

at the end<br />

of the year<br />

2013<br />

Loans <strong>and</strong> advances to customers 11.2 – (1.7) (0.8) 8.7<br />

Derivative assets 10.9 – (0.6) 0.3 10.6<br />

Derivative liabilities (12.9) (58.2) – (5.0) (76.1)<br />

Amounts owed to Co-operative Bank undertakings (1,764.4) – 299.7 (1.7) (1,466.4)<br />

Investment properties 1.8 – – 0.1 1.9<br />

(1,753.4) (58.2) 297.4 (7.1) (1,521.3)<br />

2012<br />

Loans <strong>and</strong> advances to customers 12.4 – – (1.2) 11.2<br />

Derivative assets 9.5 – – 1.4 10.9<br />

Derivative liabilities (9.9) – – (3.0) (12.9)<br />

Amounts owed to Co-operative Bank undertakings (2,130.6) – 361.8 4.4 (1,764.4)<br />

Investment properties – 0.9 – 0.9 1.8<br />

(2,118.6) 0.9 361.8 2.5 (1,753.4)<br />

c) Fair values of financial assets <strong>and</strong> liabilities not carried at fair value<br />

The carrying values of financial assets <strong>and</strong> liabilities measured at amortised cost are determined in compliance with the accounting policies in note 1 to the Bank<br />

financial statement.<br />

The table below sets out a summary of the carrying <strong>and</strong> fair values of:<br />

• financial assets classified as loans <strong>and</strong> receivables; <strong>and</strong><br />

• financial liabilities classified as held at amortised cost,<br />

unless there is no significant difference between carrying <strong>and</strong> fair values.<br />

Carrying<br />

value Fair value<br />

2013<br />

Financial assets<br />

Loans <strong>and</strong> receivables<br />

Loans <strong>and</strong> advances to <strong>bank</strong>s 579.9 579.9<br />

Loans <strong>and</strong> advances to customers 20,184.0 18,726.8<br />

Fair value adjustments for hedged risk 107.6 107.6<br />

Investment securities 83.1 93.3<br />

Amounts owed by Co-operative Bank undertakings 11,886.8 11,445.8<br />

Other assets 470.0 470.0<br />

Financial liabilities<br />

Financial liabilities at amortised cost<br />

Deposits by <strong>bank</strong>s 2,863.3 2,863.1<br />

Customer accounts 31,185.9 31,210.9<br />

Debt securities in issue 1,504.2 1,523.4<br />

Other borrowed funds 196.3 234.2<br />

Amounts owed to Co-operative Bank undertakings 4,487.9 4,486.7<br />

258<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013