bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

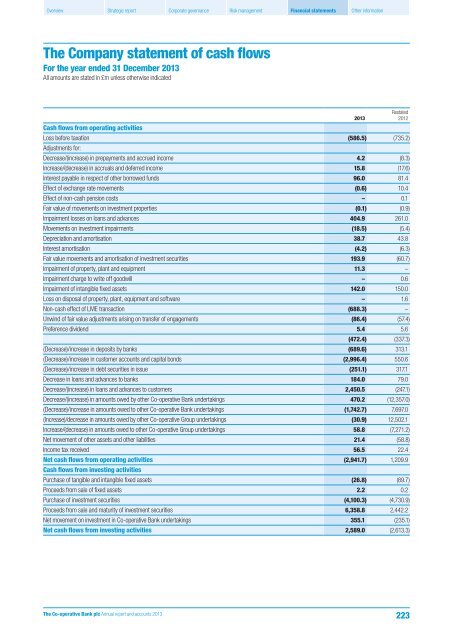

The Company statement of cash flows<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

Cash flows from operating activities<br />

Loss before taxation (586.5) (735.2)<br />

Adjustments for:<br />

Decrease/(increase) in prepayments <strong>and</strong> accrued income 4.2 (8.3)<br />

Increase/(decrease) in accruals <strong>and</strong> deferred income 15.8 (17.6)<br />

Interest payable in respect of other borrowed funds 96.0 81.4<br />

Effect of exchange rate movements (0.6) 10.4<br />

Effect of non-cash pension costs – 0.1<br />

Fair value of movements on investment properties (0.1) (0.9)<br />

Impairment losses on loans <strong>and</strong> advances 404.9 261.0<br />

Movements on investment impairments (18.5) (5.4)<br />

Depreciation <strong>and</strong> amortisation 38.7 43.8<br />

Interest amortisation (4.2) (6.3)<br />

Fair value movements <strong>and</strong> amortisation of investment securities 193.9 (60.7)<br />

Impairment of property, plant <strong>and</strong> equipment 11.3 –<br />

Impairment charge to write off goodwill – 0.6<br />

Impairment of intangible fixed assets 142.0 150.0<br />

Loss on disposal of property, plant, equipment <strong>and</strong> software – 1.6<br />

Non-cash effect of LME transaction (688.3) –<br />

Unwind of fair value adjustments arising on transfer of engagements (86.4) (57.4)<br />

Preference dividend 5.4 5.6<br />

(472.4) (337.3)<br />

(Decrease)/increase in deposits by <strong>bank</strong>s (689.6) 313.1<br />

(Decrease)/increase in customer accounts <strong>and</strong> capital bonds (2,996.4) 550.6<br />

(Decrease)/increase in debt securities in issue (251.1) 317.1<br />

Decrease in loans <strong>and</strong> advances to <strong>bank</strong>s 184.0 79.0<br />

Decrease/(increase) in loans <strong>and</strong> advances to customers 2,450.5 (247.1)<br />

Decrease/(increase) in amounts owed by other Co-operative Bank undertakings 470.2 (12,357.0)<br />

(Decrease)/increase in amounts owed to other Co-operative Bank undertakings (1,742.7) 7,697.0<br />

(Increase)/decrease in amounts owed by other Co-operative Group undertakings (30.9) 12,502.1<br />

Increase/(decrease) in amounts owed to other Co-operative Group undertakings 58.8 (7,271.2)<br />

Net movement of other assets <strong>and</strong> other liabilities 21.4 (58.8)<br />

Income tax received 56.5 22.4<br />

Net cash flows from operating activities (2,941.7) 1,209.9<br />

Cash flows from investing activities<br />

Purchase of tangible <strong>and</strong> intangible fixed assets (26.8) (89.7)<br />

Proceeds from sale of fixed assets 2.2 0.2<br />

Purchase of investment securities (4,100.3) (4,730.9)<br />

Proceeds from sale <strong>and</strong> maturity of investment securities 6,358.8 2,442.2<br />

Net movement on investment in Co-operative Bank undertakings 355.1 (235.1)<br />

Net cash flows from investing activities 2,589.0 (2,613.3)<br />

2013<br />

Restated<br />

2012<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

223