bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Company financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

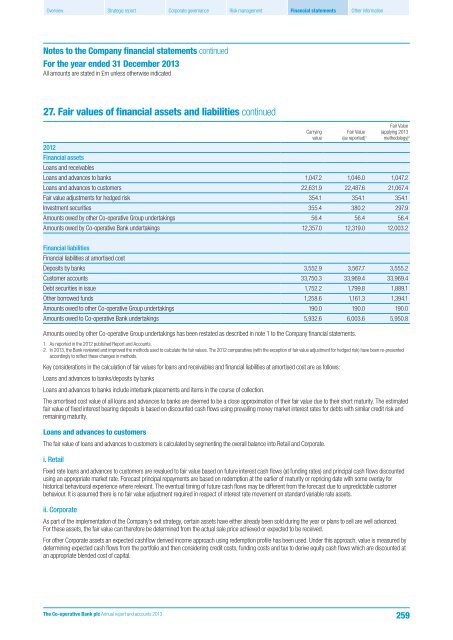

27. Fair values of financial assets <strong>and</strong> liabilities continued<br />

Carrying<br />

value<br />

Fair Value<br />

(as reported) 1<br />

Fair Value<br />

(applying 2013<br />

methodology) 2<br />

2012<br />

Financial assets<br />

Loans <strong>and</strong> receivables<br />

Loans <strong>and</strong> advances to <strong>bank</strong>s 1,047.2 1,046.0 1,047.2<br />

Loans <strong>and</strong> advances to customers 22,631.9 22,487.6 21,067.4<br />

Fair value adjustments for hedged risk 354.1 354.1 354.1<br />

Investment securities 355.4 380.2 297.9<br />

Amounts owed by other Co-operative Group undertakings 56.4 56.4 56.4<br />

Amounts owed by Co-operative Bank undertakings 12,357.0 12,319.0 12,003.2<br />

Financial liabilities<br />

Financial liabilities at amortised cost<br />

Deposits by <strong>bank</strong>s 3,552.9 3,567.7 3,555.2<br />

Customer accounts 33,750.3 33,969.4 33,969.4<br />

Debt securities in issue 1,752.2 1,799.8 1,889.1<br />

Other borrowed funds 1,258.6 1,161.3 1,394.1<br />

Amounts owed to other Co-operative Group undertakings 190.0 190.0 190.0<br />

Amounts owed to Co-operative Bank undertakings 5,932.6 6,003.6 5,950.8<br />

Amounts owed by other Co-operative Group undertakings has been restated as described in note 1 to the Company financial statements.<br />

1. As reported in the 2012 published Report <strong>and</strong> Accounts.<br />

2. In 2013, the Bank reviewed <strong>and</strong> improved the methods used to calculate the fair values. The 2012 comparatives (with the exception of fair value adjustment for hedged risk) have been re-presented<br />

accordingly to reflect these changes in methods.<br />

Key considerations in the calculation of fair values for loans <strong>and</strong> receivables <strong>and</strong> financial liabilities at amortised cost are as follows:<br />

Loans <strong>and</strong> advances to <strong>bank</strong>s/deposits by <strong>bank</strong>s<br />

Loans <strong>and</strong> advances to <strong>bank</strong>s include inter<strong>bank</strong> placements <strong>and</strong> items in the course of collection.<br />

The amortised cost value of all loans <strong>and</strong> advances to <strong>bank</strong>s are deemed to be a close approximation of their fair value due to their short maturity. The estimated<br />

fair value of fixed interest bearing deposits is based on discounted cash flows using prevailing money market interest rates for debts with similar credit risk <strong>and</strong><br />

remaining maturity.<br />

Loans <strong>and</strong> advances to customers<br />

The fair value of loans <strong>and</strong> advances to customers is calculated by segmenting the overall balance into Retail <strong>and</strong> Corporate.<br />

i. Retail<br />

Fixed rate loans <strong>and</strong> advances to customers are revalued to fair value based on future interest cash flows (at funding rates) <strong>and</strong> principal cash flows discounted<br />

using an appropriate market rate. Forecast principal repayments are based on redemption at the earlier of maturity or repricing date with some overlay for<br />

historical behavioural experience where relevant. The eventual timing of future cash flows may be different from the forecast due to unpredictable customer<br />

behaviour. It is assumed there is no fair value adjustment required in respect of interest rate movement on st<strong>and</strong>ard variable rate assets.<br />

ii. Corporate<br />

As part of the implementation of the Company’s exit strategy, certain assets have either already been sold during the year or plans to sell are well advanced.<br />

For these assets, the fair value can therefore be determined from the actual sale price achieved or expected to be received.<br />

For other Corporate assets an expected cashflow derived income approach using redemption profile has been used. Under this approach, value is measured by<br />

determining expected cash flows from the portfolio <strong>and</strong> then considering credit costs, funding costs <strong>and</strong> tax to derive equity cash flows which are discounted at<br />

an appropriate blended cost of capital.<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

259