bank-r-and-a

bank-r-and-a

bank-r-and-a

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Risk management continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

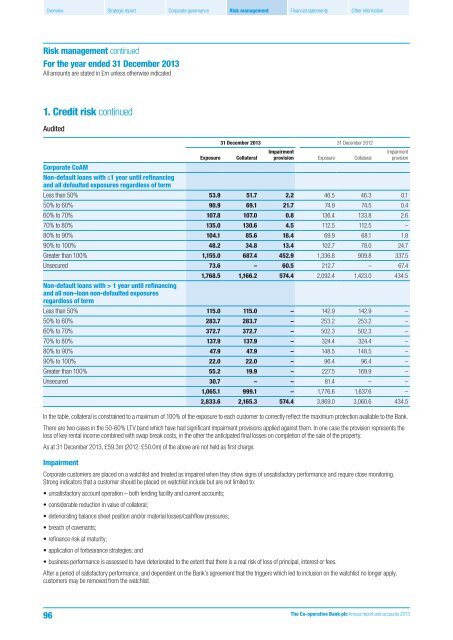

1. Credit risk continued<br />

Audited<br />

31 December 2013 31 December 2012<br />

Exposure Collateral<br />

Impairment<br />

provision Exposure Collateral<br />

Impairment<br />

provision<br />

Corporate CoAM<br />

Non-default loans with ≤1 year until refinancing<br />

<strong>and</strong> all defaulted exposures regardless of term<br />

Less than 50% 53.9 51.7 2.2 46.5 46.3 0.1<br />

50% to 60% 90.9 69.1 21.7 74.9 74.5 0.4<br />

60% to 70% 107.8 107.0 0.8 136.4 133.8 2.6<br />

70% to 80% 135.0 130.6 4.5 112.5 112.5 –<br />

80% to 90% 104.1 85.6 18.4 69.9 68.1 1.8<br />

90% to 100% 48.2 34.8 13.4 102.7 78.0 24.7<br />

Greater than 100% 1,155.0 687.4 452.9 1,336.8 909.8 337.5<br />

Unsecured 73.6 – 60.5 212.7 – 67.4<br />

1,768.5 1,166.2 574.4 2,092.4 1,423.0 434.5<br />

Non-default loans with > 1 year until refinancing<br />

<strong>and</strong> all non–loan non-defaulted exposures<br />

regardless of term<br />

Less than 50% 115.0 115.0 – 142.9 142.9 –<br />

50% to 60% 283.7 283.7 – 253.2 253.2 –<br />

60% to 70% 372.7 372.7 – 502.3 502.3 –<br />

70% to 80% 137.9 137.9 – 324.4 324.4 –<br />

80% to 90% 47.9 47.9 – 148.5 148.5 –<br />

90% to 100% 22.0 22.0 – 96.4 96.4 –<br />

Greater than 100% 55.2 19.9 – 227.5 169.9 –<br />

Unsecured 30.7 – – 81.4 – –<br />

1,065.1 999.1 – 1,776.6 1,637.6 –<br />

2,833.6 2,165.3 574.4 3,869.0 3,060.6 434.5<br />

In the table, collateral is constrained to a maximum of 100% of the exposure to each customer to correctly reflect the maximum protection available to the Bank.<br />

There are two cases in the 50-60% LTV b<strong>and</strong> which have had significant impairment provisions applied against them. In one case the provision represents the<br />

loss of key rental income combined with swap break costs, in the other the anticipated final losses on completion of the sale of the property.<br />

As at 31 December 2013, £59.3m (2012: £50.0m) of the above are not held as first charge.<br />

Impairment<br />

Corporate customers are placed on a watchlist <strong>and</strong> treated as impaired when they show signs of unsatisfactory performance <strong>and</strong> require close monitoring.<br />

Strong indicators that a customer should be placed on watchlist include but are not limited to:<br />

• unsatisfactory account operation – both lending facility <strong>and</strong> current accounts;<br />

• considerable reduction in value of collateral;<br />

• deteriorating balance sheet position <strong>and</strong>/or material losses/cashflow pressures;<br />

• breach of covenants;<br />

• refinance risk at maturity;<br />

• application of forbearance strategies; <strong>and</strong><br />

• business performance is assessed to have deteriorated to the extent that there is a real risk of loss of principal, interest or fees.<br />

After a period of satisfactory performance, <strong>and</strong> dependent on the Bank’s agreement that the triggers which led to inclusion on the watchlist no longer apply,<br />

customers may be removed from the watchlist.<br />

96<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013