bank-r-and-a

bank-r-and-a

bank-r-and-a

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview Strategic report Corporate governance Risk management Financial statements Other information<br />

Notes to the Bank financial statements continued<br />

For the year ended 31 December 2013<br />

All amounts are stated in £m unless otherwise indicated<br />

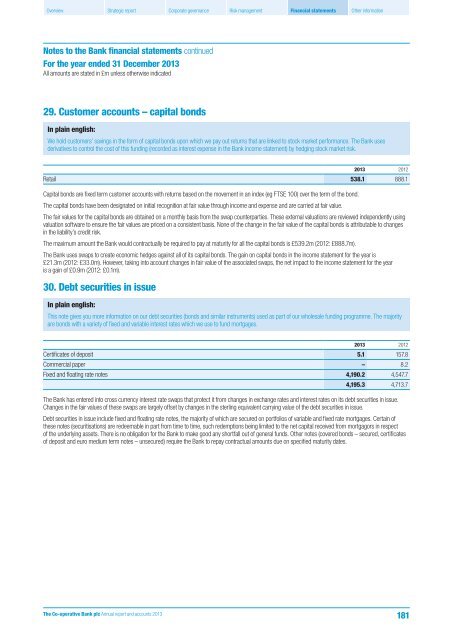

29. Customer accounts – capital bonds<br />

In plain english:<br />

We hold customers’ savings in the form of capital bonds upon which we pay out returns that are linked to stock market performance. The Bank uses<br />

derivatives to control the cost of this funding (recorded as interest expense in the Bank income statement) by hedging stock market risk.<br />

2013 2012<br />

Retail 538.1 888.1<br />

Capital bonds are fixed term customer accounts with returns based on the movement in an index (eg FTSE 100) over the term of the bond.<br />

The capital bonds have been designated on initial recognition at fair value through income <strong>and</strong> expense <strong>and</strong> are carried at fair value.<br />

The fair values for the capital bonds are obtained on a monthly basis from the swap counterparties. These external valuations are reviewed independently using<br />

valuation software to ensure the fair values are priced on a consistent basis. None of the change in the fair value of the capital bonds is attributable to changes<br />

in the liability’s credit risk.<br />

The maximum amount the Bank would contractually be required to pay at maturity for all the capital bonds is £539.2m (2012: £888.7m).<br />

The Bank uses swaps to create economic hedges against all of its capital bonds. The gain on capital bonds in the income statement for the year is<br />

£21.3m (2012: £33.0m). However, taking into account changes in fair value of the associated swaps, the net impact to the income statement for the year<br />

is a gain of £0.9m (2012: £0.1m).<br />

30. Debt securities in issue<br />

In plain english:<br />

This note gives you more information on our debt securities (bonds <strong>and</strong> similar instruments) used as part of our wholesale funding programme. The majority<br />

are bonds with a variety of fixed <strong>and</strong> variable interest rates which we use to fund mortgages.<br />

2013 2012<br />

Certificates of deposit 5.1 157.8<br />

Commercial paper – 8.2<br />

Fixed <strong>and</strong> floating rate notes 4,190.2 4,547.7<br />

4,195.3 4,713.7<br />

The Bank has entered into cross currency interest rate swaps that protect it from changes in exchange rates <strong>and</strong> interest rates on its debt securities in issue.<br />

Changes in the fair values of these swaps are largely offset by changes in the sterling equivalent carrying value of the debt securities in issue.<br />

Debt securities in issue include fixed <strong>and</strong> floating rate notes, the majority of which are secured on portfolios of variable <strong>and</strong> fixed rate mortgages. Certain of<br />

these notes (securitisations) are redeemable in part from time to time, such redemptions being limited to the net capital received from mortgagors in respect<br />

of the underlying assets. There is no obligation for the Bank to make good any shortfall out of general funds. Other notes (covered bonds – secured, certificates<br />

of deposit <strong>and</strong> euro medium term notes – unsecured) require the Bank to repay contractual amounts due on specified maturity dates.<br />

The Co-operative Bank plc Annual report <strong>and</strong> accounts 2013<br />

181