THE INTERNATIONAL - International Indian

THE INTERNATIONAL - International Indian

THE INTERNATIONAL - International Indian

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

[ MICRO FINANCE ]<br />

The Dark Horse of the<br />

Meltdown<br />

“It is interesting to note that while the whole<br />

world can talk of little besides the global financial<br />

meltdown and even as the IMF is working<br />

overtime to come up with ways to alleviate<br />

the effect of the financial crisis on developing<br />

countries, there is one sector that is poised to be<br />

unaffected by the crisis.<br />

Micro-credit – which has proved to be a major<br />

liberating force catering to neglected groups<br />

of humanity including women, the urban<br />

and rural poor and the deprived – is thriving<br />

like never before. There may be a minor<br />

crimp in the upcoming short term by a lack<br />

of monetary infusion from banks, but that is<br />

being rapidly countered by the rush of healthy<br />

investment into micro-finance companies. In<br />

the development paradigm, micro-finance has<br />

become an irrepressible need-based policy and<br />

program that is being protectively embraced by<br />

all developing countries for empowerment of the<br />

poor and the reduction of poverty.<br />

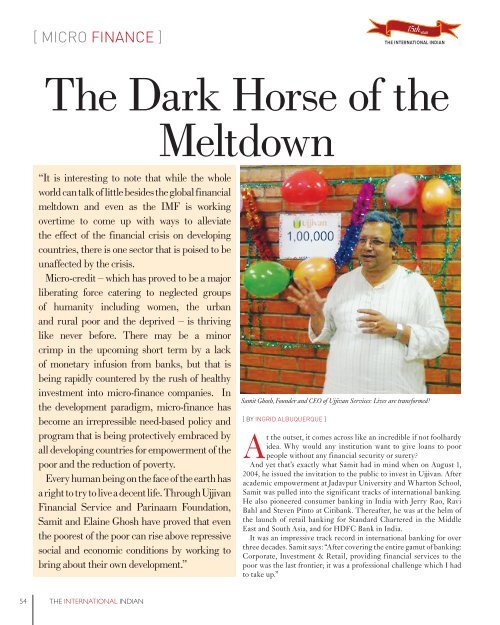

Every human being on the face of the earth has<br />

a right to try to live a decent life. Through Ujjivan<br />

Financial Service and Parinaam Foundation,<br />

Samit and Elaine Ghosh have proved that even<br />

the poorest of the poor can rise above repressive<br />

social and economic conditions by working to<br />

bring about their own development.”<br />

Samit Ghosh, Founder and CEO of Ujjivan Services: Lives are transformed!<br />

[ By INgRId AlBuquERquE ]<br />

At the outset, it comes across like an incredible if not foolhardy<br />

idea. Why would any institution want to give loans to poor<br />

people without any financial security or surety?<br />

And yet that’s exactly what Samit had in mind when on August 1,<br />

2004, he issued the invitation to the public to invest in Ujjivan. After<br />

academic empowerment at Jadavpur University and Wharton School,<br />

Samit was pulled into the significant tracks of international banking.<br />

He also pioneered consumer banking in India with Jerry Rao, Ravi<br />

Bahl and Steven Pinto at Citibank. Thereafter, he was at the helm of<br />

the launch of retail banking for Standard Chartered in the Middle<br />

East and South Asia, and for HDFC Bank in India.<br />

It was an impressive track record in international banking for over<br />

three decades. Samit says: “After covering the entire gamut of banking:<br />

Corporate, Investment & Retail, providing financial services to the<br />

poor was the last frontier; it was a professional challenge which I had<br />

to take up.”<br />

54<br />

<strong>THE</strong> <strong>INTERNATIONAL</strong> INDIAN