California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Management’s Discussion and Analysis - continued<br />

Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

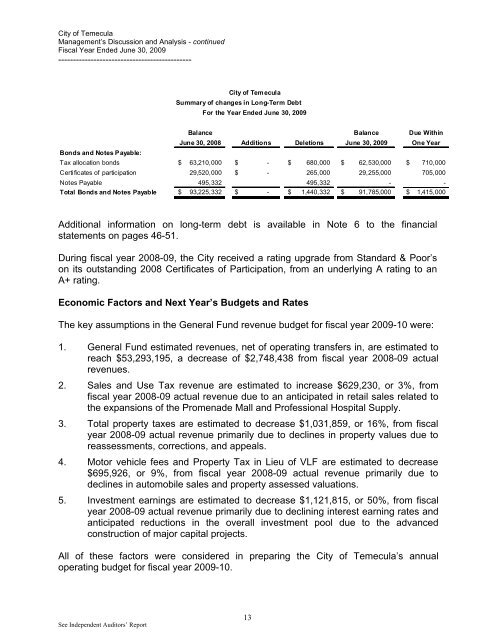

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Summary <strong>of</strong> changes in Long-Term Debt<br />

For the Year Ended June 30, 2009<br />

Balance Balance Due Within<br />

June 30, 2008 Additions Deletions June 30, 2009 One Year<br />

Bonds and Notes Payable:<br />

Tax allocation bonds $ 63,210,000 $ - $ 680,000 $ 62,530,000 $ 710,000<br />

Certificates <strong>of</strong> participation 29,520,000 $ -<br />

265,000 29,255,000 705,000<br />

Notes Payable 495,332 495,332 - -<br />

Total Bonds and Notes Payable $ 93,225,332 $ - $ 1,440,332 $ 91,785,000 $ 1,415,000<br />

Capital leases 8,799 83,600 11,393 81,006 20,983<br />

Additional information on long-term debt is available in Note 6 to the financial<br />

statements on pages 46-51.<br />

During fiscal year 2008-09, the <strong>City</strong> received a rating upgrade from Standard & Poor’s<br />

on its outstanding 2008 Certificates <strong>of</strong> Participation, from an underlying A rating to an<br />

A+ rating.<br />

Economic Factors and Next Year’s Budgets and Rates<br />

The key assumptions in the General Fund revenue budget for fiscal year 2009-10 were:<br />

1. General Fund estimated revenues, net <strong>of</strong> operating transfers in, are estimated to<br />

reach $53,293,195, a decrease <strong>of</strong> $2,748,438 from fiscal year 2008-09 actual<br />

revenues.<br />

2. Sales and Use Tax revenue are estimated to increase $629,230, or 3%, from<br />

fiscal year 2008-09 actual revenue due to an anticipated in retail sales related to<br />

the expansions <strong>of</strong> the Promenade Mall and Pr<strong>of</strong>essional Hospital Supply.<br />

3. Total property taxes are estimated to decrease $1,031,859, or 16%, from fiscal<br />

year 2008-09 actual revenue primarily due to declines in property values due to<br />

reassessments, corrections, and appeals.<br />

4. Motor vehicle fees and Property Tax in Lieu <strong>of</strong> VLF are estimated to decrease<br />

$695,926, or 9%, from fiscal year 2008-09 actual revenue primarily due to<br />

declines in automobile sales and property assessed valuations.<br />

5. Investment earnings are estimated to decrease $1,121,815, or 50%, from fiscal<br />

year 2008-09 actual revenue primarily due to declining interest earning rates and<br />

anticipated reductions in the overall investment pool due to the advanced<br />

construction <strong>of</strong> major capital projects.<br />

All <strong>of</strong> these factors were considered in preparing the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s annual<br />

operating budget for fiscal year 2009-10.<br />

See Independent Auditors’ <strong>Report</strong><br />

13