California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

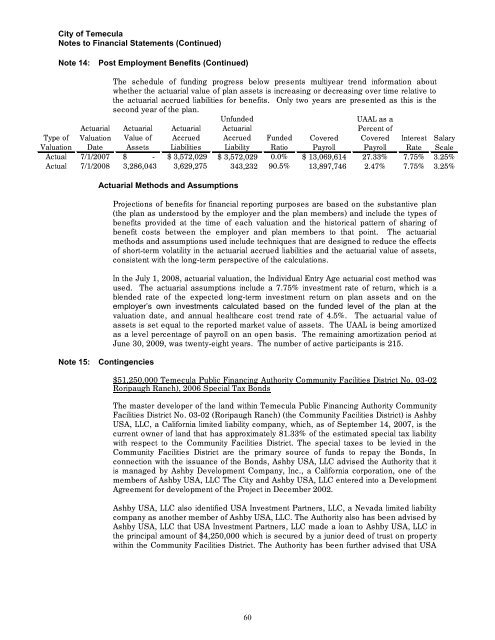

Note 14: Post Employment Benefits (Continued)<br />

The schedule <strong>of</strong> funding progress below presents multiyear trend information about<br />

whether the actuarial value <strong>of</strong> plan assets is increasing or decreasing over time relative to<br />

the actuarial accrued liabilities for benefits. Only two years are presented as this is the<br />

second year <strong>of</strong> the plan.<br />

Unfunded<br />

UAAL as a<br />

Actuarial Actuarial Actuarial Actuarial Percent <strong>of</strong><br />

Type <strong>of</strong> Valuation Value <strong>of</strong> Accrued Accrued Funded Covered Covered Interest Salary<br />

Valuation Date Assets Liabilities Liability Ratio Payroll Payroll Rate Scale<br />

Actual 7/1/2007 $ - $ 3,572,029 $ 3,572,029 0.0% $ 13,069,614 27.33% 7.75% 3.25%<br />

Actual 7/1/2008 3,286,043 3,629,275 343,232 90.5% 13,897,746 2.47% 7.75% 3.25%<br />

Actuarial Methods and Assumptions<br />

Note 15: Contingencies<br />

Projections <strong>of</strong> benefits for financial reporting purposes are based on the substantive plan<br />

(the plan as understood by the employer and the plan members) and include the types <strong>of</strong><br />

benefits provided at the time <strong>of</strong> each valuation and the historical pattern <strong>of</strong> sharing <strong>of</strong><br />

benefit costs between the employer and plan members to that point. The actuarial<br />

methods and assumptions used include techniques that are designed to reduce the effects<br />

<strong>of</strong> short-term volatility in the actuarial accrued liabilities and the actuarial value <strong>of</strong> assets,<br />

consistent with the long-term perspective <strong>of</strong> the calculations.<br />

In the July 1, 2008, actuarial valuation, the Individual Entry Age actuarial cost method was<br />

used. The actuarial assumptions include a 7.75% investment rate <strong>of</strong> return, which is a<br />

blended rate <strong>of</strong> the expected long-term investment return on plan assets and on the<br />

employer’s own investments calculated based on the funded level <strong>of</strong> the plan at the<br />

valuation date, and annual healthcare cost trend rate <strong>of</strong> 4.5%. The actuarial value <strong>of</strong><br />

assets is set equal to the reported market value <strong>of</strong> assets. The UAAL is being amortized<br />

as a level percentage <strong>of</strong> payroll on an open basis. The remaining amortization period at<br />

June 30, 2009, was twenty-eight years. The number <strong>of</strong> active participants is 215.<br />

$51,250,000 <strong>Temecula</strong> Public Financing Authority Community Facilities District No. 03-02<br />

Roripaugh Ranch), 2006 Special Tax Bonds<br />

The master developer <strong>of</strong> the land within <strong>Temecula</strong> Public Financing Authority Community<br />

Facilities District No. 03-02 (Roripaugh Ranch) (the Community Facilities District) is Ashby<br />

USA, LLC, a <strong>California</strong> limited liability company, which, as <strong>of</strong> September 14, 2007, is the<br />

current owner <strong>of</strong> land that has approximately 81.33% <strong>of</strong> the estimated special tax liability<br />

with respect to the Community Facilities District. The special taxes to be levied in the<br />

Community Facilities District are the primary source <strong>of</strong> funds to repay the Bonds, In<br />

connection with the issuance <strong>of</strong> the Bonds, Ashby USA, LLC advised the Authority that it<br />

is managed by Ashby Development Company, Inc., a <strong>California</strong> corporation, one <strong>of</strong> the<br />

members <strong>of</strong> Ashby USA, LLC The <strong>City</strong> and Ashby USA, LLC entered into a Development<br />

Agreement for development <strong>of</strong> the Project in December 2002.<br />

Ashby USA, LLC also identified USA Investment Partners, LLC, a Nevada limited liability<br />

company as another member <strong>of</strong> Ashby USA, LLC. The Authority also has been advised by<br />

Ashby USA, LLC that USA Investment Partners, LLC made a loan to Ashby USA, LLC in<br />

the principal amount <strong>of</strong> $4,250,000 which is secured by a junior deed <strong>of</strong> trust on property<br />

within the Community Facilities District. The Authority has been further advised that USA<br />

60