California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

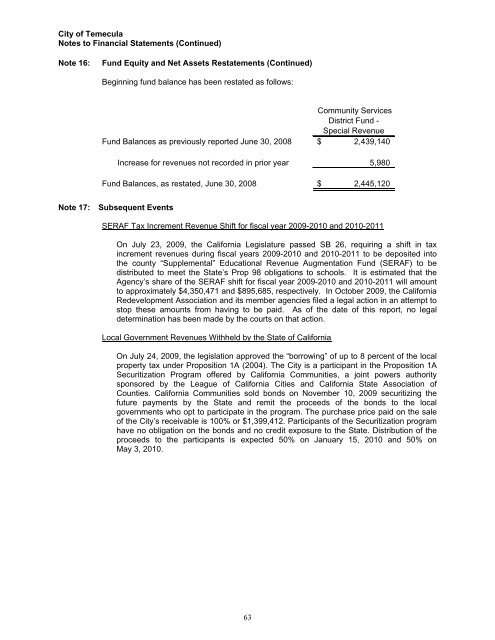

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 16:<br />

Fund Equity and Net Assets Restatements (Continued)<br />

Beginning fund balance has been restated as follows:<br />

Community Services<br />

District Fund -<br />

Special Revenue<br />

Fund Balances as previously reported June 30, 2008 $ 2,439,140<br />

Increase for revenues not recorded in prior year 5,980<br />

Fund Balances, as restated, June 30, 2008 $ 2,445,120<br />

Note 17: Subsequent Events<br />

SERAF Tax Increment Revenue Shift for fiscal year 2009-2010 and 2010-2011<br />

On July 23, 2009, the <strong>California</strong> Legislature passed SB 26, requiring a shift in tax<br />

increment revenues during fiscal years 2009-2010 and 2010-2011 to be deposited into<br />

the county “Supplemental” Educational Revenue Augmentation Fund (SERAF) to be<br />

distributed to meet the State’s Prop 98 obligations to schools. It is estimated that the<br />

Agency’s share <strong>of</strong> the SERAF shift for fiscal year 2009-2010 and 2010-2011 will amount<br />

to approximately $4,350,471 and $895,685, respectively. In October 2009, the <strong>California</strong><br />

Redevelopment Association and its member agencies filed a legal action in an attempt to<br />

stop these amounts from having to be paid. As <strong>of</strong> the date <strong>of</strong> this report, no legal<br />

determination has been made by the courts on that action.<br />

Local Government Revenues Withheld by the State <strong>of</strong> <strong>California</strong><br />

On July 24, 2009, the legislation approved the “borrowing” <strong>of</strong> up to 8 percent <strong>of</strong> the local<br />

property tax under Proposition 1A (2004). The <strong>City</strong> is a participant in the Proposition 1A<br />

Securitization Program <strong>of</strong>fered by <strong>California</strong> Communities, a joint powers authority<br />

sponsored by the League <strong>of</strong> <strong>California</strong> Cities and <strong>California</strong> State Association <strong>of</strong><br />

Counties. <strong>California</strong> Communities sold bonds on November 10, 2009 securitizing the<br />

future payments by the State and remit the proceeds <strong>of</strong> the bonds to the local<br />

governments who opt to participate in the program. The purchase price paid on the sale<br />

<strong>of</strong> the <strong>City</strong>’s receivable is 100% or $1,399,412. Participants <strong>of</strong> the Securitization program<br />

have no obligation on the bonds and no credit exposure to the State. Distribution <strong>of</strong> the<br />

proceeds to the participants is expected 50% on January 15, 2010 and 50% on<br />

May 3, 2010.<br />

63