California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 6:<br />

Long-Term Liabilities (Continued)<br />

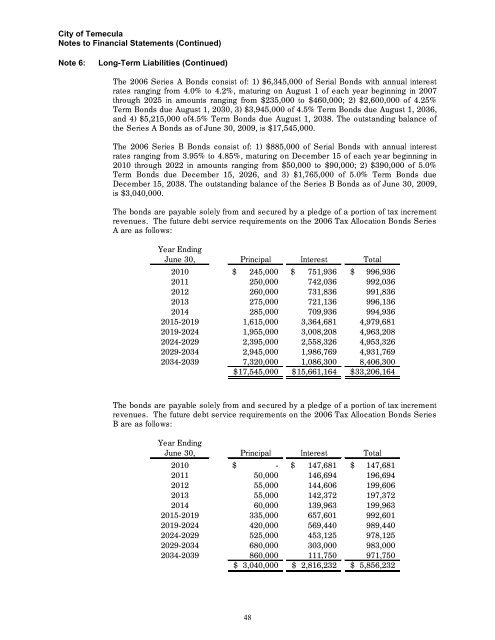

The 2006 Series A Bonds consist <strong>of</strong>: 1) $6,345,000 <strong>of</strong> Serial Bonds with annual interest<br />

rates ranging from 4.0% to 4.2%, maturing on August 1 <strong>of</strong> each year beginning in 2007<br />

through 2025 in amounts ranging from $235,000 to $460,000; 2) $2,600,000 <strong>of</strong> 4.25%<br />

Term Bonds due August 1, 2030, 3) $3,945,000 <strong>of</strong> 4.5% Term Bonds due August 1, 2036,<br />

and 4) $5,215,000 <strong>of</strong>4.5% Term Bonds due August 1, 2038. The outstanding balance <strong>of</strong><br />

the Series A Bonds as <strong>of</strong> June 30, 2009, is $17,545,000.<br />

The 2006 Series B Bonds consist <strong>of</strong>: 1) $885,000 <strong>of</strong> Serial Bonds with annual interest<br />

rates ranging from 3.95% to 4.85%, maturing on December 15 <strong>of</strong> each year beginning in<br />

2010 through 2022 in amounts ranging from $50,000 to $90,000; 2) $390,000 <strong>of</strong> 5.0%<br />

Term Bonds due December 15, 2026, and 3) $1,765,000 <strong>of</strong> 5.0% Term Bonds due<br />

December 15, 2038. The outstanding balance <strong>of</strong> the Series B Bonds as <strong>of</strong> June 30, 2009,<br />

is $3,040,000.<br />

The bonds are payable solely from and secured by a pledge <strong>of</strong> a portion <strong>of</strong> tax increment<br />

revenues. The future debt service requirements on the 2006 Tax Allocation Bonds Series<br />

A are as follows:<br />

Year Ending<br />

June 30, Principal Interest Total<br />

2010 $ 245,000 $ 751,936 $ 996,936<br />

2011 250,000 742,036 992,036<br />

2012 260,000 731,836 991,836<br />

2013 275,000 721,136 996,136<br />

2014 285,000 709,936 994,936<br />

2015-2019 1,615,000 3,364,681 4,979,681<br />

2019-2024 1,955,000 3,008,208 4,963,208<br />

2024-2029 2,395,000 2,558,326 4,953,326<br />

2029-2034 2,945,000 1,986,769 4,931,769<br />

2034-2039 7,320,000 1,086,300 8,406,300<br />

$ 17,545,000 $ 15,661,164 $ 33,206,164<br />

The bonds are payable solely from and secured by a pledge <strong>of</strong> a portion <strong>of</strong> tax increment<br />

revenues. The future debt service requirements on the 2006 Tax Allocation Bonds Series<br />

B are as follows:<br />

Year Ending<br />

June 30, Principal Interest Total<br />

2010 $ - $ 147,681 $ 147,681<br />

2011 50,000 146,694 196,694<br />

2012 55,000 144,606 199,606<br />

2013 55,000 142,372 197,372<br />

2014 60,000 139,963 199,963<br />

2015-2019 335,000 657,601 992,601<br />

2019-2024 420,000 569,440 989,440<br />

2024-2029 525,000 453,125 978,125<br />

2029-2034 680,000 303,000 983,000<br />

2034-2039 860,000 111,750 971,750<br />

$ 3,040,000 $ 2,816,232 $ 5,856,232<br />

48