California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 3:<br />

Cash and Investments (Continued)<br />

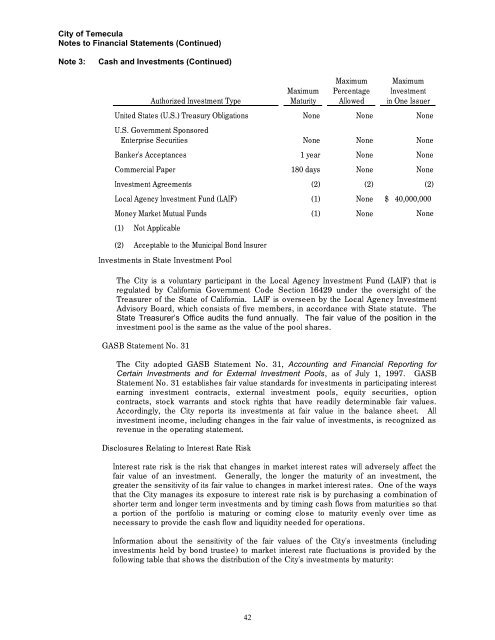

Maximum Maximum<br />

Maximum Percentage Investment<br />

Authorized Investment Type Maturity Allowed in One Issuer<br />

United States (U.S.) Treasury Obligations None None None<br />

U.S. Government Sponsored<br />

Enterprise Securities None None None<br />

Banker's Acceptances 1 year None None<br />

Commercial Paper 180 days None None<br />

Investment Agreements (2) (2) (2)<br />

Local Agency Investment Fund (LAIF) (1) None $ 40,000,000<br />

Money Market Mutual Funds (1) None None<br />

(1) Not Applicable<br />

(2) Acceptable to the Municipal Bond Insurer<br />

Investments in State Investment Pool<br />

The <strong>City</strong> is a voluntary participant in the Local Agency Investment Fund (LAIF) that is<br />

regulated by <strong>California</strong> Government Code Section 16429 under the oversight <strong>of</strong> the<br />

Treasurer <strong>of</strong> the State <strong>of</strong> <strong>California</strong>. LAIF is overseen by the Local Agency Investment<br />

Advisory Board, which consists <strong>of</strong> five members, in accordance with State statute. The<br />

State Treasurer’s Office audits the fund annually. The fair value <strong>of</strong> the position in the<br />

investment pool is the same as the value <strong>of</strong> the pool shares.<br />

GASB Statement No. 31<br />

The <strong>City</strong> adopted GASB Statement No. 31, Accounting and <strong>Financial</strong> <strong>Report</strong>ing for<br />

Certain Investments and for External Investment Pools, as <strong>of</strong> July 1, 1997. GASB<br />

Statement No. 31 establishes fair value standards for investments in participating interest<br />

earning investment contracts, external investment pools, equity securities, option<br />

contracts, stock warrants and stock rights that have readily determinable fair values.<br />

Accordingly, the <strong>City</strong> reports its investments at fair value in the balance sheet. All<br />

investment income, including changes in the fair value <strong>of</strong> investments, is recognized as<br />

revenue in the operating statement.<br />

Disclosures Relating to Interest Rate Risk<br />

Interest rate risk is the risk that changes in market interest rates will adversely affect the<br />

fair value <strong>of</strong> an investment. Generally, the longer the maturity <strong>of</strong> an investment, the<br />

greater the sensitivity <strong>of</strong> its fair value to changes in market interest rates. One <strong>of</strong> the ways<br />

that the <strong>City</strong> manages its exposure to interest rate risk is by purchasing a combination <strong>of</strong><br />

shorter term and longer term investments and by timing cash flows from maturities so that<br />

a portion <strong>of</strong> the portfolio is maturing or coming close to maturity evenly over time as<br />

necessary to provide the cash flow and liquidity needed for operations.<br />

Information about the sensitivity <strong>of</strong> the fair values <strong>of</strong> the <strong>City</strong>'s investments (including<br />

investments held by bond trustee) to market interest rate fluctuations is provided by the<br />

following table that shows the distribution <strong>of</strong> the <strong>City</strong>'s investments by maturity:<br />

42