California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

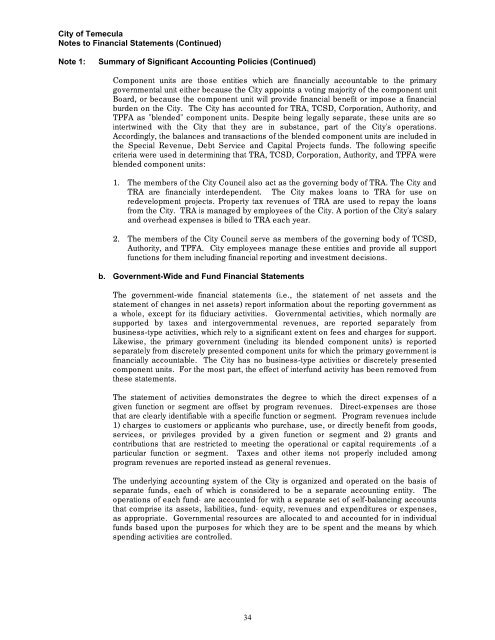

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 1:<br />

Summary <strong>of</strong> Significant Accounting Policies (Continued)<br />

Component units are those entities which are financially accountable to the primary<br />

governmental unit either because the <strong>City</strong> appoints a voting majority <strong>of</strong> the component unit<br />

Board, or because the component unit will provide financial benefit or impose a financial<br />

burden on the <strong>City</strong>. The <strong>City</strong> has accounted for TRA, TCSD, Corporation, Authority, and<br />

TPFA as "blended" component units. Despite being legally separate, these units are so<br />

intertwined with the <strong>City</strong> that they are in substance, part <strong>of</strong> the <strong>City</strong>'s operations.<br />

Accordingly, the balances and transactions <strong>of</strong> the blended component units are included in<br />

the Special Revenue, Debt Service and Capital Projects funds. The following specific<br />

criteria were used in determining that TRA, TCSD, Corporation, Authority, and TPFA were<br />

blended component units:<br />

1. The members <strong>of</strong> the <strong>City</strong> Council also act as the governing body <strong>of</strong> TRA. The <strong>City</strong> and<br />

TRA are financially interdependent. The <strong>City</strong> makes loans to TRA for use on<br />

redevelopment projects. Property tax revenues <strong>of</strong> TRA are used to repay the loans<br />

from the <strong>City</strong>. TRA is managed by employees <strong>of</strong> the <strong>City</strong>. A portion <strong>of</strong> the <strong>City</strong>'s salary<br />

and overhead expenses is billed to TRA each year.<br />

2. The members <strong>of</strong> the <strong>City</strong> Council serve as members <strong>of</strong> the governing body <strong>of</strong> TCSD,<br />

Authority, and TPFA. <strong>City</strong> employees manage these entities and provide all support<br />

functions for them including financial reporting and investment decisions.<br />

b. Government-Wide and Fund <strong>Financial</strong> Statements<br />

The government-wide financial statements (i.e., the statement <strong>of</strong> net assets and the<br />

statement <strong>of</strong> changes in net assets) report information about the reporting government as<br />

a whole, except for its fiduciary activities. Governmental activities, which normally are<br />

supported by taxes and intergovernmental revenues, are reported separately from<br />

business-type activities, which rely to a significant extent on fees and charges for support.<br />

Likewise, the primary government (including its blended component units) is reported<br />

separately from discretely presented component units for which the primary government is<br />

financially accountable. The <strong>City</strong> has no business-type activities or discretely presented<br />

component units. For the most part, the effect <strong>of</strong> interfund activity has been removed from<br />

these statements.<br />

The statement <strong>of</strong> activities demonstrates the degree to which the direct expenses <strong>of</strong> a<br />

given function or segment are <strong>of</strong>fset by program revenues. Direct-expenses are those<br />

that are clearly identifiable with a specific function or segment. Program revenues include<br />

1) charges to customers or applicants who purchase, use, or directly benefit from goods,<br />

services, or privileges provided by a given function or segment and 2) grants and<br />

contributions that are restricted to meeting the operational or capital requirements .<strong>of</strong> a<br />

particular function or segment. Taxes and other items not properly included among<br />

program revenues are reported instead as general revenues.<br />

The underlying accounting system <strong>of</strong> the <strong>City</strong> is organized and operated on the basis <strong>of</strong><br />

separate funds, each <strong>of</strong> which is considered to be a separate accounting entity. The<br />

operations <strong>of</strong> each fund· are accounted for with a separate set <strong>of</strong> self-balancing accounts<br />

that comprise its assets, liabilities, fund· equity, revenues and expenditures or expenses,<br />

as appropriate. Governmental resources are allocated to and accounted for in individual<br />

funds based upon the purposes for which they are to be spent and the means by which<br />

spending activities are controlled.<br />

34