California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

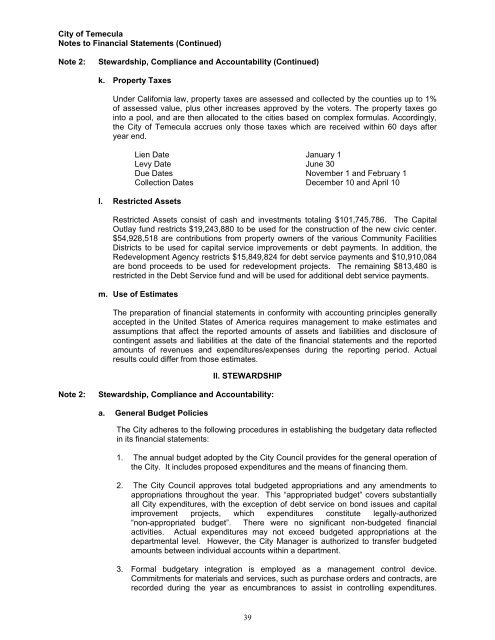

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 2:<br />

Stewardship, Compliance and Accountability (Continued)<br />

k. Property Taxes<br />

Under <strong>California</strong> law, property taxes are assessed and collected by the counties up to 1%<br />

<strong>of</strong> assessed value, plus other increases approved by the voters. The property taxes go<br />

into a pool, and are then allocated to the cities based on complex formulas. Accordingly,<br />

the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> accrues only those taxes which are received within 60 days after<br />

year end.<br />

Lien Date January 1<br />

Levy Date June 30<br />

Due Dates November 1 and February 1<br />

Collection Dates December 10 and April 10<br />

l. Restricted Assets<br />

Restricted Assets consist <strong>of</strong> cash and investments totaling $101,745,786. The Capital<br />

Outlay fund restricts $19,243,880 to be used for the construction <strong>of</strong> the new civic center.<br />

$54,928,518 are contributions from property owners <strong>of</strong> the various Community Facilities<br />

Districts to be used for capital service improvements or debt payments. In addition, the<br />

Redevelopment Agency restricts $15,849,824 for debt service payments and $10,910,084<br />

are bond proceeds to be used for redevelopment projects. The remaining $813,480 is<br />

restricted in the Debt Service fund and will be used for additional debt service payments.<br />

m. Use <strong>of</strong> Estimates<br />

The preparation <strong>of</strong> financial statements in conformity with accounting principles generally<br />

accepted in the United States <strong>of</strong> America requires management to make estimates and<br />

assumptions that affect the reported amounts <strong>of</strong> assets and liabilities and disclosure <strong>of</strong><br />

contingent assets and liabilities at the date <strong>of</strong> the financial statements and the reported<br />

amounts <strong>of</strong> revenues and expenditures/expenses during the reporting period. Actual<br />

results could differ from those estimates.<br />

II. STEWARDSHIP<br />

Note 2:<br />

Stewardship, Compliance and Accountability:<br />

a. General Budget Policies<br />

The <strong>City</strong> adheres to the following procedures in establishing the budgetary data reflected<br />

in its financial statements:<br />

1. The annual budget adopted by the <strong>City</strong> Council provides for the general operation <strong>of</strong><br />

the <strong>City</strong>. It includes proposed expenditures and the means <strong>of</strong> financing them.<br />

2. The <strong>City</strong> Council approves total budgeted appropriations and any amendments to<br />

appropriations throughout the year. This “appropriated budget” covers substantially<br />

all <strong>City</strong> expenditures, with the exception <strong>of</strong> debt service on bond issues and capital<br />

improvement projects, which expenditures constitute legally-authorized<br />

“non-appropriated budget”. There were no significant non-budgeted financial<br />

activities. Actual expenditures may not exceed budgeted appropriations at the<br />

departmental level. However, the <strong>City</strong> Manager is authorized to transfer budgeted<br />

amounts between individual accounts within a department.<br />

3. Formal budgetary integration is employed as a management control device.<br />

Commitments for materials and services, such as purchase orders and contracts, are<br />

recorded during the year as encumbrances to assist in controlling expenditures.<br />

39