California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

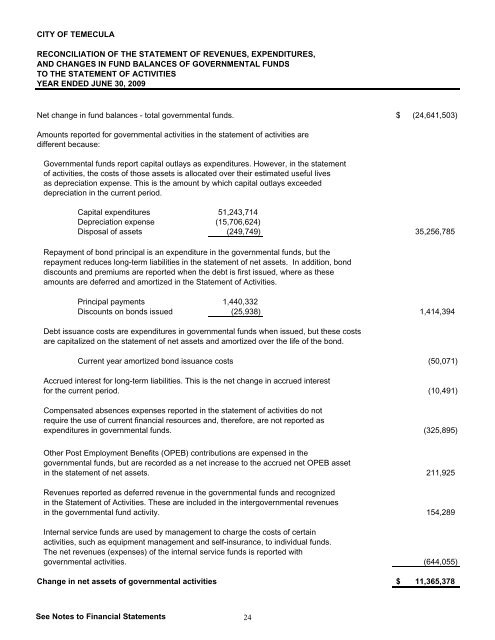

CITY OF TEMECULA<br />

RECONCILIATION OF THE STATEMENT OF REVENUES, EXPENDITURES,<br />

AND CHANGES IN FUND BALANCES OF GOVERNMENTAL FUNDS<br />

TO THE STATEMENT OF ACTIVITIES<br />

YEAR ENDED JUNE 30, 2009<br />

Net change in fund balances - total governmental funds. $ (24,641,503)<br />

Amounts reported for governmental activities in the statement <strong>of</strong> activities are<br />

different because:<br />

Governmental funds report capital outlays as expenditures. However, in the statement<br />

<strong>of</strong> activities, the costs <strong>of</strong> those assets is allocated over their estimated useful lives<br />

as depreciation expense. This is the amount by which capital outlays exceeded<br />

depreciation in the current period.<br />

Capital expenditures 51,243,714<br />

Depreciation expense (15,706,624)<br />

Disposal <strong>of</strong> assets (249,749) 35,256,785<br />

Repayment <strong>of</strong> bond principal is an expenditure in the governmental funds, but the<br />

repayment reduces long-term liabilities in the statement <strong>of</strong> net assets. In addition, bond<br />

discounts and premiums are reported when the debt is first issued, where as these<br />

amounts are deferred and amortized in the Statement <strong>of</strong> Activities.<br />

Principal payments 1,440,332<br />

Discounts on bonds issued (25,938) 1,414,394<br />

Debt issuance costs are expenditures in governmental funds when issued, but these costs<br />

are capitalized on the statement <strong>of</strong> net assets and amortized over the life <strong>of</strong> the bond.<br />

Current year amortized bond issuance costs (50,071)<br />

Accrued interest for long-term liabilities. This is the net change in accrued interest<br />

for the current period. (10,491)<br />

Compensated absences expenses reported in the statement <strong>of</strong> activities do not<br />

require the use <strong>of</strong> current financial resources and, therefore, are not reported as<br />

expenditures in governmental funds. (325,895)<br />

Other Post Employment Benefits (OPEB) contributions are expensed in the<br />

governmental funds, but are recorded as a net increase to the accrued net OPEB asset<br />

in the statement <strong>of</strong> net assets.<br />

211,925<br />

Revenues reported as deferred revenue in the governmental funds and recognized<br />

in the Statement <strong>of</strong> Activities. These are included in the intergovernmental revenues<br />

in the governmental fund activity. 154,289<br />

Internal service funds are used by management to charge the costs <strong>of</strong> certain<br />

activities, such as equipment management and self-insurance, to individual funds.<br />

The net revenues (expenses) <strong>of</strong> the internal service funds is reported with<br />

governmental activities. (644,055)<br />

Change in net assets <strong>of</strong> governmental activities $ 11,365,378<br />

See Notes to <strong>Financial</strong> Statements 24