California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 8:<br />

Public Employees Retirement System (Continued)<br />

ranging from 3.25% to 14.45% for miscellaneous members, (c) inflation <strong>of</strong> 3.0%,<br />

(d) payroll growth <strong>of</strong> 3.25%, and (e) an individual salary growth based on merit scale<br />

varying by duration <strong>of</strong> employment, coupled with an assumed annual inflation component<br />

<strong>of</strong> 3.0%, and an annual production growth <strong>of</strong> 0.25%.<br />

The actuarial value <strong>of</strong> the Plan's assets were determined using a technique that smoothes<br />

the effect <strong>of</strong> short-term volatility in the market value <strong>of</strong> investments over a three year<br />

period. The Plans' initial unfunded liabilities are amortized over a closed period that<br />

depends on the Plans' date <strong>of</strong> entry into CalPERS. Subsequent plan amendments are<br />

amortized as a level percentage <strong>of</strong> pay over a closed 20 year period. Gains and losses<br />

that occur in the operation <strong>of</strong> the plan are amortized over an open 30 year period, which<br />

results in an amortization <strong>of</strong> 6% <strong>of</strong> unamortized gains and losses each year. If the Plans<br />

accrued liability exceeds the actuarial value <strong>of</strong> plan assets, then the amortization payment<br />

on the total unfunded liability may not be lower than the payment calculated over a 30 year<br />

amortization period.<br />

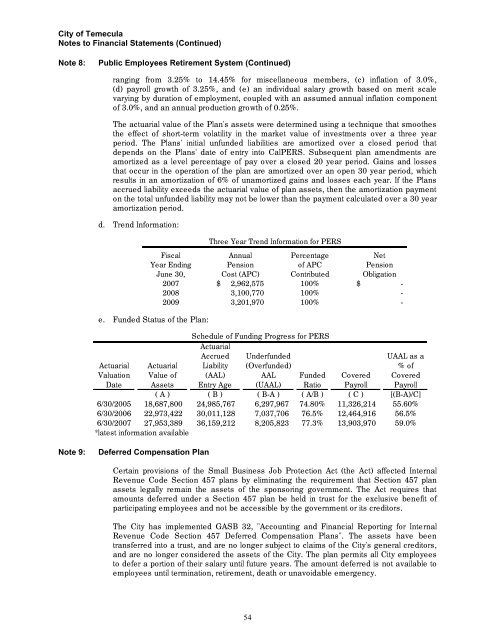

d. Trend Information:<br />

Three Year Trend Information for PERS<br />

Fiscal <strong>Annual</strong> Percentage Net<br />

Year Ending Pension <strong>of</strong> APC Pension<br />

June 30, Cost (APC) Contributed Obligation<br />

2007 $ 2,962,575 100% $<br />

-<br />

2008 3,100,770 100% -<br />

2009 3,201,970 100% -<br />

e. Funded Status <strong>of</strong> the Plan:<br />

Schedule <strong>of</strong> Funding Progress for PERS<br />

Actuarial<br />

Accrued Underfunded UAAL as a<br />

Actuarial Actuarial Liability (Overfunded) % <strong>of</strong><br />

Valuation Value <strong>of</strong> (AAL) AAL Funded Covered Covered<br />

Date Assets Entry Age (UAAL) Ratio Payroll Payroll<br />

( A ) ( B ) ( B-A ) ( A/B ) ( C ) [(B-A)/C]<br />

6/30/2005 18,687,800 24,985,767 6,297,967 74.80% 11,326,214 55.60%<br />

6/30/2006 22,973,422 30,011,128 7,037,706 76.5% 12,464,916 56.5%<br />

6/30/2007 27,953,389 36,159,212 8,205,823 77.3% 13,903,970 59.0%<br />

*latest information available<br />

Note 9:<br />

Deferred Compensation Plan<br />

Certain provisions <strong>of</strong> the Small Business Job Protection Act (the Act) affected Internal<br />

Revenue Code Section 457 plans by eliminating the requirement that Section 457 plan<br />

assets legally remain the assets <strong>of</strong> the sponsoring government. The Act requires that<br />

amounts deferred under a Section 457 plan be held in trust for the exclusive benefit <strong>of</strong><br />

participating employees and not be accessible by the government or its creditors.<br />

The <strong>City</strong> has implemented GASB 32, "Accounting and <strong>Financial</strong> <strong>Report</strong>ing for Internal<br />

Revenue Code Section 457 Deferred Compensation Plans". The assets have been<br />

transferred into a trust, and are no longer subject to claims <strong>of</strong> the <strong>City</strong>'s general creditors,<br />

and are no longer considered the assets <strong>of</strong> the <strong>City</strong>. The plan permits all <strong>City</strong> employees<br />

to defer a portion <strong>of</strong> their salary until future years. The amount deferred is not available to<br />

employees until termination, retirement, death or unavoidable emergency.<br />

54