California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 1:<br />

Summary <strong>of</strong> Significant Accounting Policies (Continued)<br />

Capital assets include additions to public domain (infrastructure), certain improvements<br />

including pavement, curb and gutter, sidewalks, traffic control devices, streetlights,<br />

sewers, storm drains, bridges and right-<strong>of</strong>-way corridors within the <strong>City</strong>. The <strong>City</strong> has<br />

valued and recorded all infrastructure asset data in its entirety as <strong>of</strong> June 30, 2009.<br />

Capital assets used in operations are depreciated over their estimated useful lives using<br />

the straight-line method in the Government-wide <strong>Financial</strong> Statements and in the Fund<br />

<strong>Financial</strong> Statements <strong>of</strong> the Proprietary Funds. Depreciation is charged as an expense<br />

against operations and accumulated depreciation is reported on the respective Statement<br />

<strong>of</strong> Net Assets.<br />

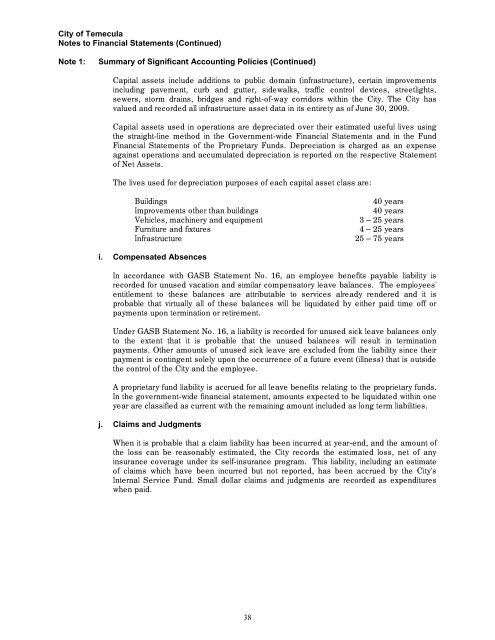

The lives used for depreciation purposes <strong>of</strong> each capital asset class are:<br />

Buildings<br />

Improvements other than buildings<br />

Vehicles, machinery and equipment<br />

Furniture and fixtures<br />

Infrastructure<br />

40 years<br />

40 years<br />

3 – 25 years<br />

4 – 25 years<br />

25 – 75 years<br />

i. Compensated Absences<br />

In accordance with GASB Statement No. 16, an employee benefits payable liability is<br />

recorded for unused vacation and similar compensatory leave balances. The employees'<br />

entitlement to these balances are attributable to services already rendered and it is<br />

probable that virtually all <strong>of</strong> these balances will be liquidated by either paid time <strong>of</strong>f or<br />

payments upon termination or retirement.<br />

Under GASB Statement No. 16, a liability is recorded for unused sick leave balances only<br />

to the extent that it is probable that the unused balances will result in termination<br />

payments. Other amounts <strong>of</strong> unused sick leave are excluded from the liability since their<br />

payment is contingent solely upon the occurrence <strong>of</strong> a future event (illness) that is outside<br />

the control <strong>of</strong> the <strong>City</strong> and the employee.<br />

A proprietary fund liability is accrued for all leave benefits relating to the proprietary funds.<br />

In the government-wide financial statement, amounts expected to be liquidated within one<br />

year are classified as current with the remaining amount included as long term liabilities.<br />

j. Claims and Judgments<br />

When it is probable that a claim liability has been incurred at year-end, and the amount <strong>of</strong><br />

the loss can be reasonably estimated, the <strong>City</strong> records the estimated loss, net <strong>of</strong> any<br />

insurance coverage under its self-insurance program. This liability, including an estimate<br />

<strong>of</strong> claims which have been incurred but not reported, has been accrued by the <strong>City</strong>'s<br />

Internal Service Fund. Small dollar claims and judgments are recorded as expenditures<br />

when paid.<br />

38