California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Notes to <strong>Financial</strong> Statements (Continued)<br />

Note 3:<br />

Cash and Investments (Continued)<br />

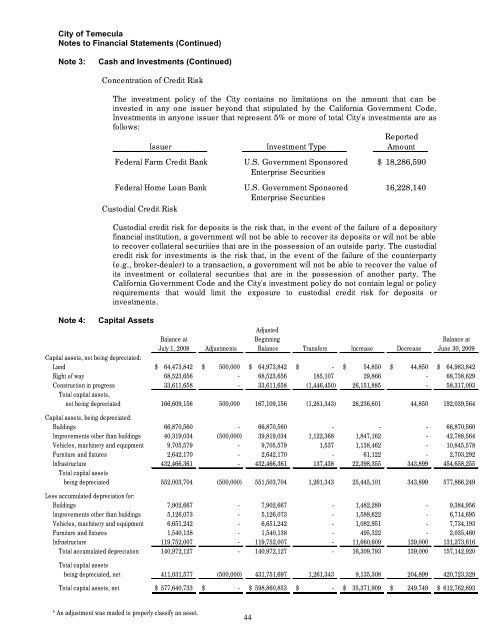

Concentration <strong>of</strong> Credit Risk<br />

The investment policy <strong>of</strong> the <strong>City</strong> contains no limitations on the amount that can be<br />

invested in any one issuer beyond that stipulated by the <strong>California</strong> Government Code.<br />

Investments in anyone issuer that represent 5% or more <strong>of</strong> total <strong>City</strong>'s investments are as<br />

follows:<br />

<strong>Report</strong>ed<br />

Issuer Investment Type Amount<br />

Federal Farm Credit Bank U.S. Government Sponsored $ 18,286,590<br />

Enterprise Securities<br />

Federal Home Loan Bank U.S. Government Sponsored 16,228,140<br />

Enterprise Securities<br />

Custodial Credit Risk<br />

Custodial credit risk for deposits is the risk that, in the event <strong>of</strong> the failure <strong>of</strong> a depository<br />

financial institution, a government will not be able to recover its deposits or will not be able<br />

to recover collateral securities that are in the possession <strong>of</strong> an outside party. The custodial<br />

credit risk for investments is the risk that, in the event <strong>of</strong> the failure <strong>of</strong> the counterparty<br />

(e.g., broker-dealer) to a transaction, a government will not be able to recover the value <strong>of</strong><br />

its investment or collateral securities that are in the possession <strong>of</strong> another party. The<br />

<strong>California</strong> Government Code and the <strong>City</strong>'s investment policy do not contain legal or policy<br />

requirements that would limit the exposure to custodial credit risk for deposits or<br />

investments.<br />

Note 4: Capital Assets<br />

Adjusted<br />

Balance at Beginning Balance at<br />

July 1, 2008 Adjustments Balance Transfers Increase Decrease June 30, 2009<br />

Capital assets, not being depreciated:<br />

Land $ 64,473,842 $ 500,000 $ 64,973,842 $ - $ 54,850 $ 44,850 $ 64,983,842<br />

Right <strong>of</strong> way 68,523,656 - 68,523,656 185,107 29,866 - 68,738,629<br />

Construction in progress 33,611,658 - 33,611,658 (1,446,450) 26,151,885 - 58,317,093<br />

Total capital assets,<br />

not being depreciated 166,609,156 500,000 167,109,156 (1,261,343) 26,236,601 44,850 192,039,564<br />

Capital assets, being depreciated:<br />

Buildings 66,870,560 - 66,870,560 - - - 66,870,560<br />

Improvements other than buildings 40,319,034 (500,000) 39,819,034 1,122,368 1,847,162 - 42,788,564<br />

Vehicles, machinery and equipment 9,705,579 - 9,705,579 1,537 1,138,462 - 10,845,578<br />

Furniture and fixtures 2,642,170 - 2,642,170 - 61,122 - 2,703,292<br />

Infrastructure 432,466,361 - 432,466,361 137,438 22,398,355 343,899 454,658,255<br />

Total capital assets<br />

being depreciated 552,003,704 (500,000) 551,503,704 1,261,343 25,445,101 343,899 577,866,249<br />

Less accumulated depreciation for:<br />

Buildings 7,902,667 - 7,902,667 - 1,482,289 - 9,384,956<br />

Improvements other than buildings 5,126,073 - 5,126,073 - 1,588,622 - 6,714,695<br />

Vehicles, machinery and equipment 6,651,242 - 6,651,242 - 1,082,951 - 7,734,193<br />

Furniture and fixtures 1,540,138 - 1,540,138 - 495,322 - 2,035,460<br />

Infrastructure 119,752,007 - 119,752,007 - 11,660,609 139,000 131,273,616<br />

Total accumulated depreciation 140,972,127 - 140,972,127 - 16,309,793 139,000 157,142,920<br />

Total capital assets<br />

being depreciated, net 411,031,577 (500,000) 431,751,697 1,261,343 9,135,308 204,899 420,723,329<br />

Total capital assets, net $ 577,640,733 $ - $ 598,860,853 $ - $ 35,371,909 $ 249,749 $ 612,762,893<br />

* An adjustment was maded to properly classify an asset.<br />

44