Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

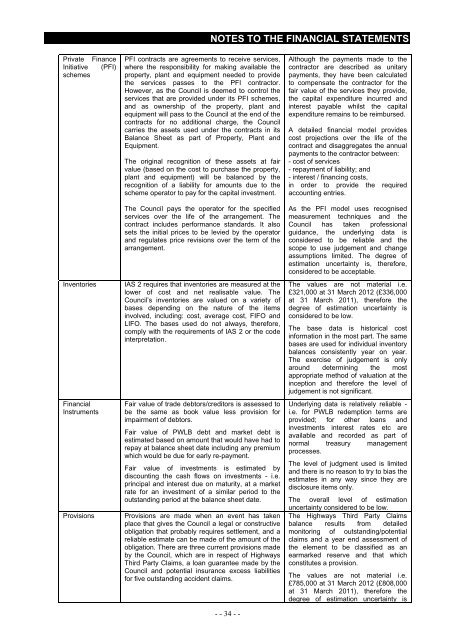

NOTES TO THE FINANCIAL STATEMENTS<br />

Private Finance<br />

Initiative (PFI)<br />

schemes<br />

Inventories<br />

Financial<br />

Instruments<br />

Provisions<br />

PFI contracts are agreements to receive services,<br />

where the responsibility for making available the<br />

property, plant and equipment needed to provide<br />

the services passes to the PFI contractor.<br />

However, as the Council is deemed to control the<br />

services that are provided under its PFI schemes,<br />

and as ownership <strong>of</strong> the property, plant and<br />

equipment will pass to the Council at the end <strong>of</strong> the<br />

contracts for no additional charge, the Council<br />

carries the assets used under the contracts in its<br />

Balance Sheet as part <strong>of</strong> Property, Plant and<br />

Equipment.<br />

The original recognition <strong>of</strong> these assets at fair<br />

value (based on the cost to purchase the property,<br />

plant and equipment) will be balanced by the<br />

recognition <strong>of</strong> a liability for amounts due to the<br />

scheme operator to pay for the capital investment.<br />

The Council pays the operator for the specified<br />

services over the life <strong>of</strong> the arrangement. The<br />

contract includes performance standards. It also<br />

sets the initial prices to be levied by the operator<br />

and regulates price revisions over the term <strong>of</strong> the<br />

arrangement.<br />

IAS 2 requires that inventories are measured at the<br />

lower <strong>of</strong> cost and net realisable value. The<br />

Council’s inventories are valued on a variety <strong>of</strong><br />

bases depending on the nature <strong>of</strong> the items<br />

involved, including: cost, average cost, FIFO and<br />

LIFO. The bases used do not always, therefore,<br />

comply <strong>with</strong> the requirements <strong>of</strong> IAS 2 or the code<br />

interpretation.<br />

Fair value <strong>of</strong> trade debtors/creditors is assessed to<br />

be the same as book value less provision for<br />

impairment <strong>of</strong> debtors.<br />

Fair value <strong>of</strong> PWLB debt and market debt is<br />

estimated based on amount that would have had to<br />

repay at balance sheet date including any premium<br />

which would be due for early re-payment.<br />

Fair value <strong>of</strong> investments is estimated by<br />

discounting the cash flows on investments - i.e.<br />

principal and interest due on maturity, at a market<br />

rate for an investment <strong>of</strong> a similar period to the<br />

outstanding period at the balance sheet date.<br />

Provisions are made when an event has taken<br />

place that gives the Council a legal or constructive<br />

obligation that probably requires settlement, and a<br />

reliable estimate can be made <strong>of</strong> the amount <strong>of</strong> the<br />

obligation. There are three current provisions made<br />

by the Council, which are in respect <strong>of</strong> Highways<br />

Third Party Claims, a loan guarantee made by the<br />

Council and potential insurance excess liabilities<br />

for five outstanding accident claims.<br />

- - 34 - -<br />

Although the payments made to the<br />

contractor are described as unitary<br />

payments, they have been calculated<br />

to compensate the contractor for the<br />

fair value <strong>of</strong> the services they provide,<br />

the capital expenditure incurred and<br />

interest payable whilst the capital<br />

expenditure remains to be reimbursed.<br />

A detailed financial model provides<br />

cost projections over the life <strong>of</strong> the<br />

contract and disaggregates the annual<br />

payments to the contractor between:<br />

- cost <strong>of</strong> services<br />

- repayment <strong>of</strong> liability; and<br />

- interest / financing costs,<br />

in order to provide the required<br />

accounting entries.<br />

As the PFI model uses recognised<br />

measurement techniques and the<br />

Council has taken pr<strong>of</strong>essional<br />

guidance, the underlying data is<br />

considered to be reliable and the<br />

scope to use judgement and change<br />

assumptions limited. The degree <strong>of</strong><br />

estimation uncertainty is, therefore,<br />

considered to be acceptable.<br />

The values are not material i.e.<br />

£321,000 at 31 March <strong>2012</strong> (£336,000<br />

at 31 March <strong>2011</strong>), therefore the<br />

degree <strong>of</strong> estimation uncertainty is<br />

considered to be low.<br />

The base data is historical cost<br />

information in the most part. The same<br />

bases are used for individual inventory<br />

balances consistently year on year.<br />

The exercise <strong>of</strong> judgement is only<br />

around determining the most<br />

appropriate method <strong>of</strong> valuation at the<br />

inception and therefore the level <strong>of</strong><br />

judgement is not significant.<br />

Underlying data is relatively reliable -<br />

i.e. for PWLB redemption terms are<br />

provided; for other loans and<br />

investments interest rates etc are<br />

available and recorded as part <strong>of</strong><br />

normal treasury management<br />

processes.<br />

The level <strong>of</strong> judgment used is limited<br />

and there is no reason to try to bias the<br />

estimates in any way since they are<br />

disclosure items only.<br />

The overall level <strong>of</strong> estimation<br />

uncertainty considered to be low.<br />

The Highways Third Party Claims<br />

balance results from detailed<br />

monitoring <strong>of</strong> outstanding/potential<br />

claims and a year end assessment <strong>of</strong><br />

the element to be classified as an<br />

earmarked reserve and that which<br />

constitutes a provision.<br />

The values are not material i.e.<br />

£785,000 at 31 March <strong>2012</strong> (£808,000<br />

at 31 March <strong>2011</strong>), therefore the<br />

degree <strong>of</strong> estimation uncertainty is