Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

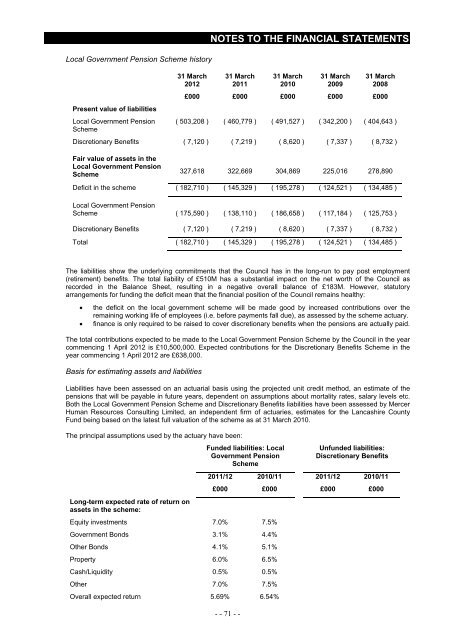

Local Government Pension Scheme history<br />

31 March<br />

<strong>2012</strong><br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March<br />

<strong>2011</strong><br />

31 March<br />

2010<br />

31 March<br />

2009<br />

31 March<br />

2008<br />

£000 £000 £000 £000 £000<br />

Present value <strong>of</strong> liabilities<br />

Local Government Pension ( 503,208 ) ( 460,779 ) ( 491,527 ) ( 342,200 ) ( 404,643 )<br />

Scheme<br />

Discretionary Benefits ( 7,120 ) ( 7,219 ) ( 8,620 ) ( 7,337 ) ( 8,732 )<br />

Fair value <strong>of</strong> assets in the<br />

Local Government Pension<br />

Scheme<br />

327,618 322,669 304,869 225,016 278,890<br />

Deficit in the scheme ( 182,710 ) ( 145,329 ) ( 195,278 ) ( 124,521 ) ( 134,485 )<br />

Local Government Pension<br />

Scheme ( 175,590 ) ( 138,110 ) ( 186,658 ) ( 117,184 ) ( 125,753 )<br />

Discretionary Benefits ( 7,120 ) ( 7,219 ) ( 8,620 ) ( 7,337 ) ( 8,732 )<br />

Total ( 182,710 ) ( 145,329 ) ( 195,278 ) ( 124,521 ) ( 134,485 )<br />

The liabilities show the underlying commitments that the Council has in the long-run to pay post employment<br />

(retirement) benefits. The total liability <strong>of</strong> £510M has a substantial impact on the net worth <strong>of</strong> the Council as<br />

recorded in the Balance Sheet, resulting in a negative overall balance <strong>of</strong> £183M. However, statutory<br />

arrangements for funding the deficit mean that the financial position <strong>of</strong> the Council remains healthy:<br />

• the deficit on the local government scheme will be made good by increased contributions over the<br />

remaining working life <strong>of</strong> employees (i.e. before payments fall due), as assessed by the scheme actuary.<br />

• finance is only required to be raised to cover discretionary benefits when the pensions are actually paid.<br />

The total contributions expected to be made to the Local Government Pension Scheme by the Council in the year<br />

commencing 1 April <strong>2012</strong> is £10,500,000. Expected contributions for the Discretionary Benefits Scheme in the<br />

year commencing 1 April <strong>2012</strong> are £638,000.<br />

Basis for estimating assets and liabilities<br />

Liabilities have been assessed on an actuarial basis using the projected unit credit method, an estimate <strong>of</strong> the<br />

pensions that will be payable in future years, dependent on assumptions about mortality rates, salary levels etc.<br />

Both the Local Government Pension Scheme and Discretionary Benefits liabilities have been assessed by Mercer<br />

Human Resources Consulting Limited, an independent firm <strong>of</strong> actuaries, estimates for the Lancashire County<br />

Fund being based on the latest full valuation <strong>of</strong> the scheme as at 31 March 2010.<br />

The principal assumptions used by the actuary have been:<br />

Long-term expected rate <strong>of</strong> return on<br />

assets in the scheme:<br />

Funded liabilities: Local<br />

Government Pension<br />

Scheme<br />

Equity investments 7.0% 7.5%<br />

Government Bonds 3.1% 4.4%<br />

Other Bonds 4.1% 5.1%<br />

Property 6.0% 6.5%<br />

Cash/Liquidity 0.5% 0.5%<br />

Other 7.0% 7.5%<br />

Overall expected return 5.69% 6.54%<br />

- - 71 - -<br />

Unfunded liabilities:<br />

Discretionary Benefits<br />

<strong>2011</strong>/12 2010/11 <strong>2011</strong>/12 2010/11<br />

£000 £000 £000 £000